Rising attention on PYTH staking as airdrop fever hits the market

Users flock to PYTH staking, motivated by guides on X about qualifying for airdrops.

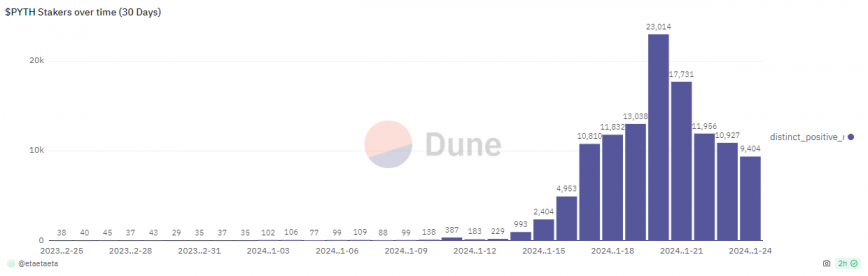

Pyth Network’s native token, named PYTH, saw a massive growth in interest. In the last 30 days, 109,614 unique users were registered staking PYTH, and 99.8% of this number was achieved in the last 10 days, according to a Dune Analytics dashboard. The sudden rise in PYTH staking might be related to the airdrop frenzy.

A growing number of users on X (formerly Twitter) started publishing guides on how to qualify for rewards by locking the token in a smart contract in mid-January. The upward trend in PYTH staking started around the same time, which might indicate a correlation.

Pyth Network is an oracle service offered to blockchain decentralized applications (dApps), making price feeds and benchmarks available for those dApps. Staking PYTH gives voting power for users to participate in Pyth’s governance. There are currently more than 200 different protocols using Pyth’s oracle services.

Guides published on X then infer that staking PYTH might qualify users for a potential airdrop by one of the oracle service consumers. This belief is fueled by how staking Celestia’s native token, TIA, granted token airdrops to protocols that use their modular infrastructure, such as Manta Network and AltLayer.

However, the majority of users staking PYTH don’t seem to be ready to lock in a significant amount of capital to follow this strategy. At the time of writing, almost 68% of users have staked 1,100 PYTH or less, which is almost $420 at the token’s current value.