Photo: GuerrillaBuzz

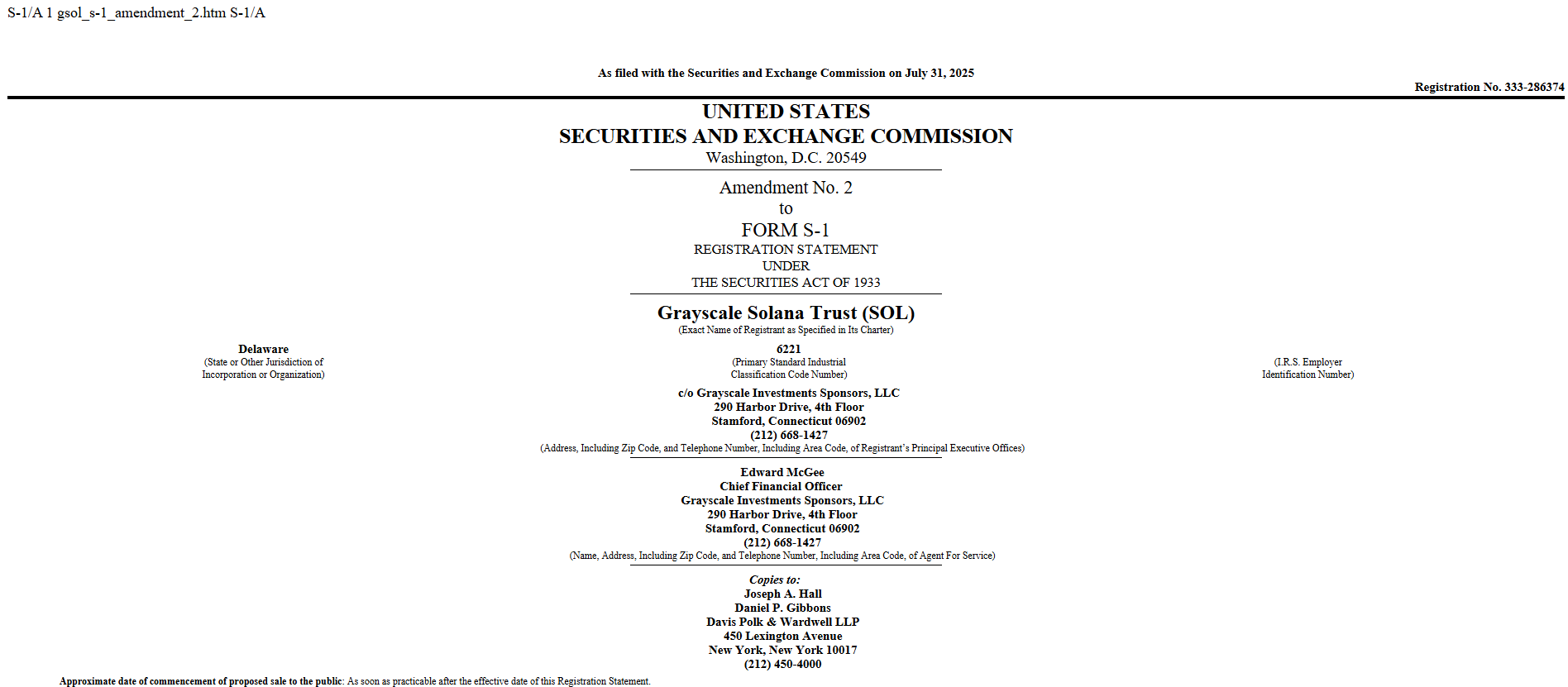

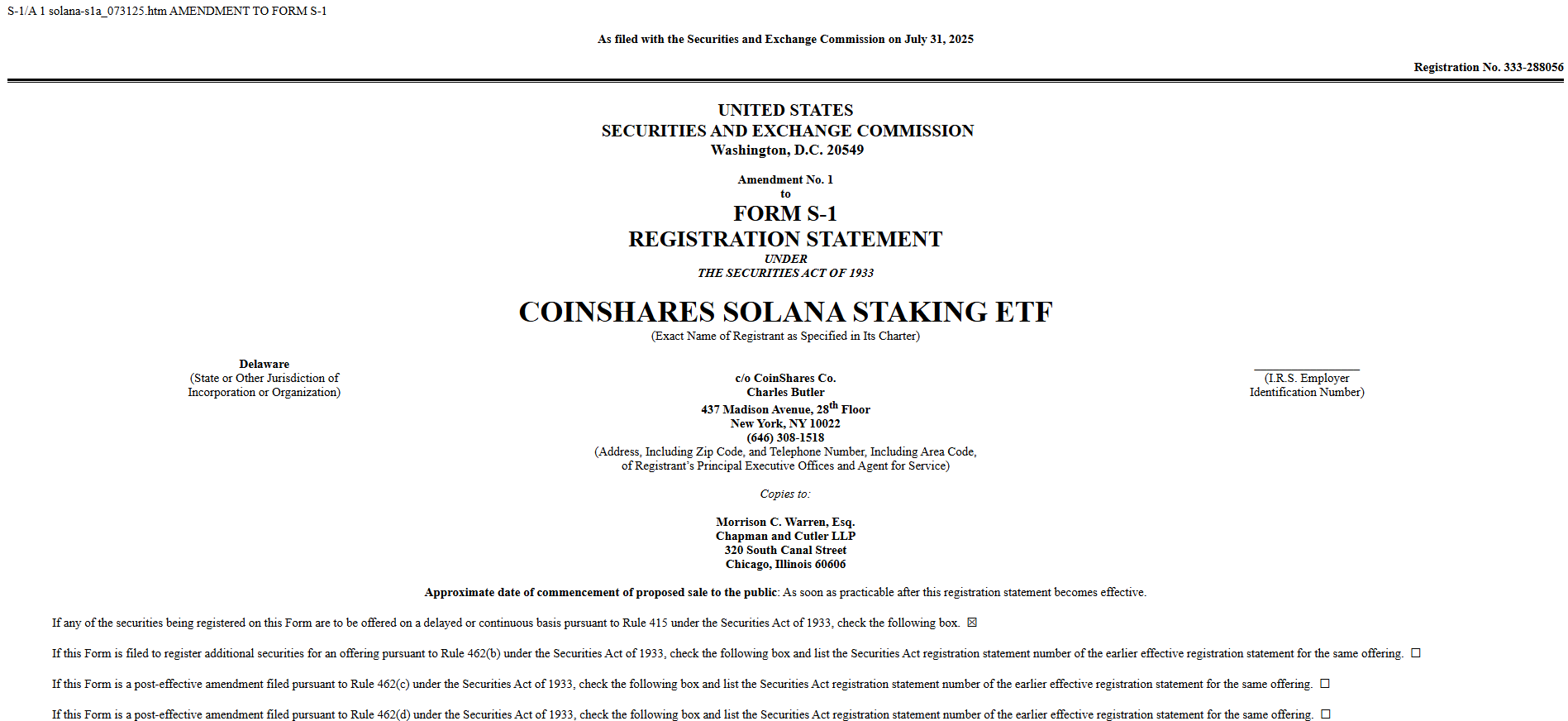

Spot Solana ETF issuers file amended S-1 applications

Meanwhile, industry leaders are pushing for liquid staking features as SEC considers next wave of digital asset ETFs beyond Bitcoin and Ether.

Seven major asset managers – Grayscale, VanEck, Bitwise, Canary, Franklin Templeton, Fidelity, and CoinShares – on Thursday submitted amended S-1 registration statements to the SEC for their proposed Solana (SOL) ETFs.

The amendments represent the firms’ continued efforts to secure regulatory nod to expand their crypto ETF offerings beyond Bitcoin and Ethereum products currently available to US investors.

Bloomberg ETF analyst Eric Balchunas and ETF Store President Nate Geraci note that the revised filings demonstrate active engagement between the SEC and ETF issuers.

Not really… but clearly dialogue w/ SEC and issuers are refining prospectus language.

Gotta think fees in neighborhood of btc & eth ETFs.

— Nate Geraci (@NateGeraci) July 31, 2025

Industry experts project a 95% probability of SEC approval for spot Solana ETFs, though prospects are unclear for products incorporating staking features.

Meanwhile, asset managers like BlackRock are seeking regulatory approval to incorporate staking into their existing spot Ethereum ETFs. Geraci suggests staked Ether ETFs could receive the next regulatory approval, following the SEC’s recent authorization of in-kind redemptions for spot Bitcoin and Ether ETFs.

Several organizations, including Jito Labs, VanEck, Bitwise, the Solana Policy Institute, and Multicoin Capital, are advocating for the SEC to permit liquid staking in Solana-based ETPs.

Liquid staking enables tokens to maintain liquidity while being staked, providing benefits such as enhanced capital efficiency, lower ETP operational costs, and expanded security and investor options.