More liquidity: stablecoin market cap grows $4 billion despite Bitcoin’s pullback

Smart money increases stablecoin holdings, anticipates new investments.

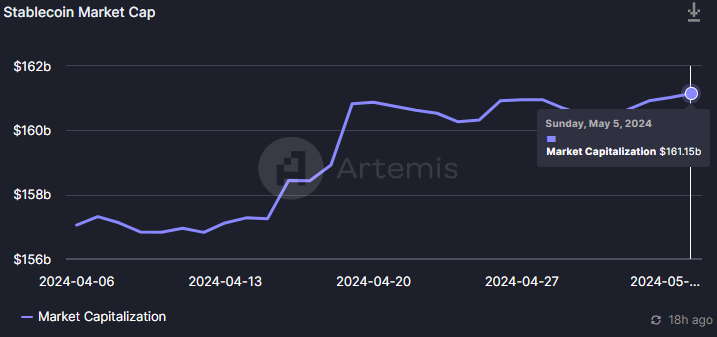

Despite the recent corrections in crypto prices, over $4 billion in stablecoins entered the market in the last 30 days, according to data aggregator Artemis. Bitcoin (BTC) closed April nearing a 15% pullback and fell below the $57,000 price level but this didn’t keep investors away.

The total market cap of stablecoins jumped from $157 billion to over $161 billion at the time of writing, a 2.5% monthly growth.

New stablecoin inflows are a commonly used metric by analysts to measure the market’s liquidity. Since most cryptos are traded against stablecoin pairs on centralized exchanges, and even more so in decentralized platforms, the growth in the market cap of these tokens is seen as a positive movement.

Rotating capital

Moreover, investors labeled as “smart money” seemed to realize profits last week and are ready to rotate their stablecoins into new tokens. According to on-chain data firm Nansen, these traders’ “stablecoins holdings” jumped from 5.54% to 8.63% between April 28 and 30.

However, after reaching 8.69% on May 1, it started going down again and is at 6.82% at the time of writing. This movement of diminishing stablecoin holdings while the crypto market receives more liquidity suggests that smarter traders are betting on their next tokens.

Earn with Nexo

Earn with Nexo