Strategy acquires 390 Bitcoin valued at $43M

Strategy's Bitcoin-centric approach aims to redefine corporate treasury strategy and influence broader digital asset adoption in 2025.

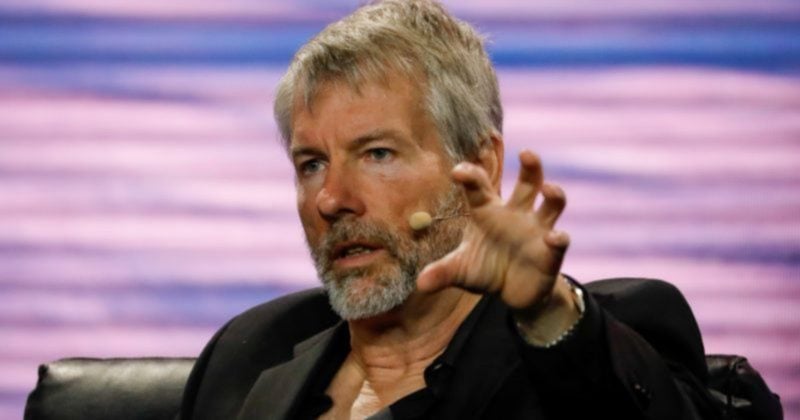

Strategy acquired 390 Bitcoin valued at approximately $43 million last week, continuing the business intelligence firm’s aggressive cryptocurrency accumulation strategy under executive chairman Michael Saylor.

The purchase aligns with Saylor’s philosophy of treating Bitcoin as a long-term hedge against economic uncertainty. Strategy has positioned itself as a Bitcoin-centric entity through ongoing cryptocurrency acquisitions regardless of market conditions.

Saylor’s approach emphasizes Bitcoin as a tool for corporate leverage, using debt and media to enhance its role in balance sheets amid broader institutional interest. The executive chairman advocates for relentless Bitcoin accumulation as a corporate treasury approach.

Strategy treats Bitcoin as inventory for sustained value growth, part of what Saylor promotes as an essential corporate asset strategy that influences other companies’ cryptocurrency adoption decisions.

Earn with Nexo

Earn with Nexo