Terra, Abracadabra Stablecoins "Are Going to Zero": Maker Founder

Rune Christensen says that Terra and Abracadabra.Money's stablecoins are “solid ponzis.”

Key Takeaways

- MakerDAO founder Rune Christensen has called out rival stablecoin protocols Terra and Abracadabra.Money.

- He said that UST and MIM are "not built for resilience," adding that they are "are going to 0 once the market turns for real."

- Abracadabra.Money and Terra founders Daniele Sestagalli and Do Kwon took shots at Christensen in response.

Share this article

MakerDAO founder Rune Christensen described the UST and MIM stablecoins as “solid ponzis” in a tweet earlier this morning. Abracadabra.Money and Terra founders Daniele Sestagalli and Do Kwon immediately fired back.

MakerDAO Founder Slams Rival Stablecoins

Rune Christensen has sparked controversy by sharing his thoughts on two of DeFi’s fastest-growing stablecoins.

Look, UST and MIM are solid ponzis and I respect that. You can make good money off them for sure. But they are not built for resilience and they are going to 0 once the market turns for real

Now stop trying to scam users looking for actual stability into being ur exit liquidity

— Rune (@RuneKek) January 4, 2022

The MakerDAO founder took to Twitter earlier today to call out Terra’s TerraUSD (UST) and Abracadabra.Money’s Magic Internet Money (MIM), two rivals to MakerDAO’s DAI stablecoin. In the tweet, Christensen described them as “solid ponzis” and argued that Terra and Abracadabra.Money proponents were “trying to scam users looking for actual stability.” He wrote:

“Look, UST and MIM are solid ponzis and I respect that. You can make good money off them for sure. But they are not built for resilience and they are going to 0 once the market turns for real. Now stop trying to scam users looking for actual stability into being ur exit liquidity.”

“I thought you were ded already,” responded Terra founder Do Kwon. Abracadabra.Money founder Daniele Sestagalli also weighed in, advising Christensen to “focus on saving the world from pollution” and let them “take care of DeFi in the meantime.”

Kwon’s “ded” comment is likely a reference to Christensen’s apparent absence from the DeFi community in recent months; in November, Christensen came under fire in the MakerDAO community when a former employee accused him of returning to the project and “trying to fire someone” after taking a prolonged step back. “Rune has been away for a long period, and in that time he has decided that we are at war again,” she wrote in a post on the MakerDAO governance forum. Shortly after, the venture capital firm Dragonfly Capital enlisted Christensen as a Venture Partner.

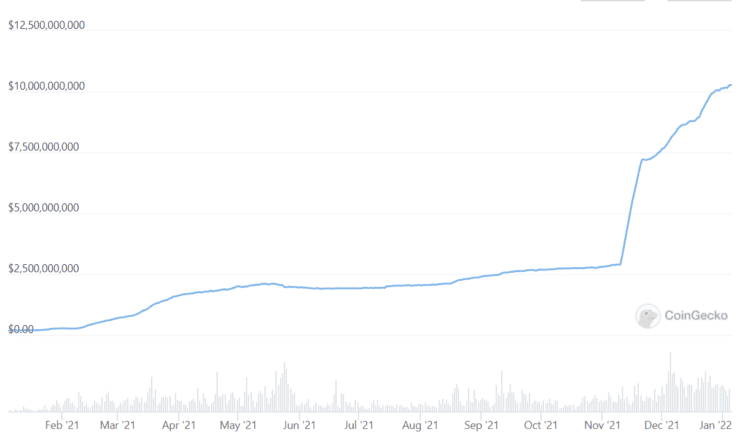

The debates also centered on Christensen’s divisive October essay that discussed how MakerDAO should focus on “Clean Money” by ensuring that it uses “sustainable and climate-aligned assets that consider the long-term impacts of financial activity on the environment” as its collateral. Christensen argued that MakerDAO should invest its collateral into sustainable real-world assets, but the post led to debates over MakerDAO’s lack of direction. MakerDAO’s DAI is currently one of DeFi’s most widely used decentralized stablecoins with a market cap of $9.1 billion. However, it’s partly collateralized by USDC, a centralized stablecoin issued by Circle.

In October, Terra and Abracadabra.Money announced a partnership that aims to “beat the centralized counterparts” by leveraging their UST and MIM stablecoins. Both projects have seen immense success since; UST overtook DAI’s long-held position as the largest decentralized stablecoin on the market amid the rise.

Both Kwon and Sestagalli have been vocal against DAI in the past, arguing that the stablecoin is not sufficiently decentralized because it’s partly backed by USDC.

Terra’s UST is an algorithmically governed, seigniorage-based stablecoin that relies on an elastic monetary policy to ensure price stability and growth. Unlike MakerDAO’s DAI, it’s not collateralized and leverages the LUNA token to ensure price stability and maintain its peg. Abracadabra.Money’s MIM, meanwhile, is an overcollateralized stablecoin similar to DAI, except the collateral backing consists of yield-bearing assets.

According to Christensen, the two DAI rivals rely on unsound stability mechanisms that could crumble under the pressure of extreme market forces. The theoretical argument against UST and MIM is that the former relies on sustained demand for LUNA, while the latter is overcollateralized by “low quality” or rehypothecated assets. Notably, both stablecoins have maintained their peg during several significant market pullbacks.

Neither Rune Christensen nor Do Kwon immediately responded to Crypto Briefing’s request for comment.

Disclosure: At the time of writing, the author of this piece held ETH, UST, and several other cryptocurrencies.

Share this article