Tether freezes six more Ethereum wallets amid OFAC compliance efforts

ChainArgos's report reveals links between frozen wallets and the Finiko scam.

Tether, the world’s largest stablecoin issuer of USDT, with a market cap exceeding $90 billion, has frozen six new wallets on the Ethereum blockchain, according to a report by the US-based blockchain data firm ChainArgos.

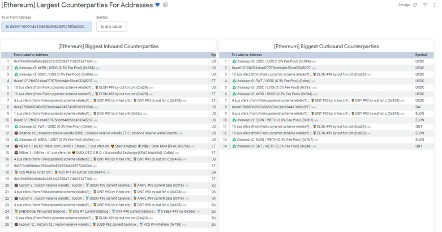

After analyzing the Ethereum addresses connected to these wallets, ChainArgos discovered specific peculiar patterns linked to an old Russian scam, Finiko, which defrauded investors with promises of up to 30% monthly returns on investments over $1,000.

Some transfers to these addresses appeared suspicious and may have connections to the Finiko Scam, as evidenced by examining a TRON address, which received a single inbound transfer of approximately $7,000 USDT from Bitfinex.

This latest restriction comes after Tether moved to freeze over 150 wallets tied to individuals and entities sanctioned by the US Treasury Department’s Office of Foreign Assets Control (OFAC). By proactively barring wallets on the Specially Designated Nationals list, Tether aims to comply with US sanctions requirements.

Last week, Paolo Ardoino, CEO of Tether, stated that:

“By executing voluntary wallet address freezing of new additions to the SDN List and freezing previously added addresses, we will be able to strengthen the positive usage of stablecoin technology further and promote a safer stablecoin ecosystem for all users.”

The move comes as regulators pressure crypto firms to bolster compliance and prevent usage by sanctioned parties like Russia and Iran. Stablecoins like USDT have faced particular scrutiny due to their extensive use on major exchanges like Binance.

Earn with Nexo

Earn with Nexo