Uniswap raises swap fees amid SEC legal challenges

Previously, the firm charged a flat fee of 0.15%.

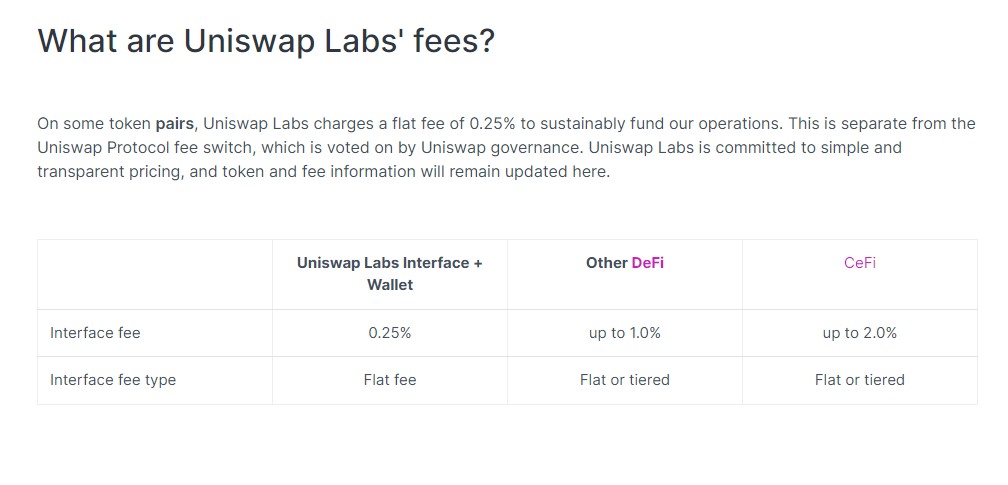

Uniswap Labs has imposed a new swap fee of 0.25%, starting on April 10, the same day the firm’s founder, Hayden Adams, disclosed that they received a Wells Notice from the US Securities and Exchange Commission (SEC).

According to Uniswap Labs’ latest update, the fee applies to a broad range of trading pairs, with some exceptions for stablecoin and wrapped token pairs, and is in effect across all networks that support Uniswap. Users have the option to bypass this fee by using alternative interfaces that are not developed by Uniswap Labs.

Uniswap rolled out the swap fees around mid-October last year. At the time, the firm charged a flat fee of 0.15%, citing that it was part of a strategy for the company’s sustainable growth.

Following the first announcement, the Uniswap community responded dividedly to the introduction of these fees. While some members supported the decision for the project’s sustainability, others were displeased with the additional cost.

Before the implementation of the interface fee, the only cost to Uniswap users was the protocol fee.

Although the noted reason for the fee is to ensure Uniswap operates sustainably, there is speculation that it could also help cover legal expenses in the event of a fight with the SEC.

Uniswap Labs also noted that the interface fee is separate from the Uniswap Protocol fee switch. Previously, in March, Uniswap issued a new proposal to distribute swap fee income to holders of its native UNI token.

According to CoinGecko’s data, the UNI token’s price dropped to around $7.4, down around 34% over the past week following the SEC’s legal threat and the overall downward trend in the crypto market last weekend.