US Bitcoin ETFs face setbacks as Bitcoin retreats amid rising Middle East conflicts

Bitcoin's role as a safe haven is questioned as geopolitical conflicts mount.

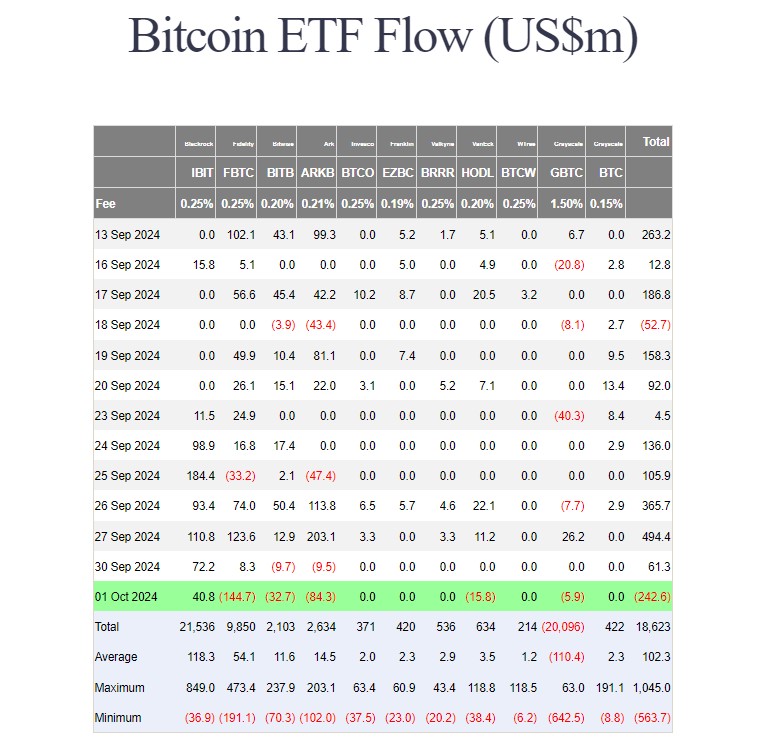

Net flows into the group of US spot Bitcoin ETFs turned negative on Tuesday as Bitcoin retreated below $62,000 amid intensified tensions between Israel and Iran.

According to data tracked by Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) was the sole gainer, taking in over $40 million yesterday. IBIT’s net buying has topped $2.1 billion since its trading launch in January, with its holdings now exceeding 366,400 BTC, valued at around $23.2 billion.

However, IBIT’s gains were insufficient to counterbalance the outflows from other funds. On Tuesday, investors pulled over $283 million from Fidelity’s FBTC, ARK Invest’s ARKB, Bitwise’s BITB, VanEck’s HODL, and Grayscale’s GBTC.

GBTC was no longer the outflow star as the fund only bled approximately $6 million in Tuesday trading while FBTC led with $144 million worth of redemptions.

Overall, the US spot Bitcoin ETFs ended Tuesday with over $242 million in net outflows. This marked a reversal from an eight-day streak of net inflows that began on September 19.

Bitcoin ETF demand turned red on a day marked by Iran’s launch of missile attacks on Israel, an event that escalated tensions in the Middle East.

As soon as news of Iran’s missile strikes broke, Bitcoin’s value started shedding. CoinGecko data shows that BTC experienced a decline of over 3% in the last 24 hours, with a sharp drop of nearly $4,000, bottoming out at around $60,300.

BTC has slightly recovered to $61,800, but its contrasting movement with gold and oil has sparked debate about its role as a safe haven asset.

On October 1, gold prices increased by 1.4% to $2,665 per ounce, nearing a record high, while crude oil prices surged by 7% to $72 per barrel. The US dollar and bonds also saw gains in response to an airstrike on Israel.

Historically, geopolitical tensions have led to volatility in Bitcoin prices. The Israeli attack on Iran earlier this year, for example, led to Bitcoin price corrections.

The current situation could continue to influence investor behavior, potentially leading to further sell-offs if the conflict escalates.

Israeli Prime Minister Benjamin Netanyahu has vowed retaliation against Iran following yesterday’s missile attack.

“Iran made a big mistake tonight, and it will pay for it,” Netanyahu stated during a Security Cabinet meeting.

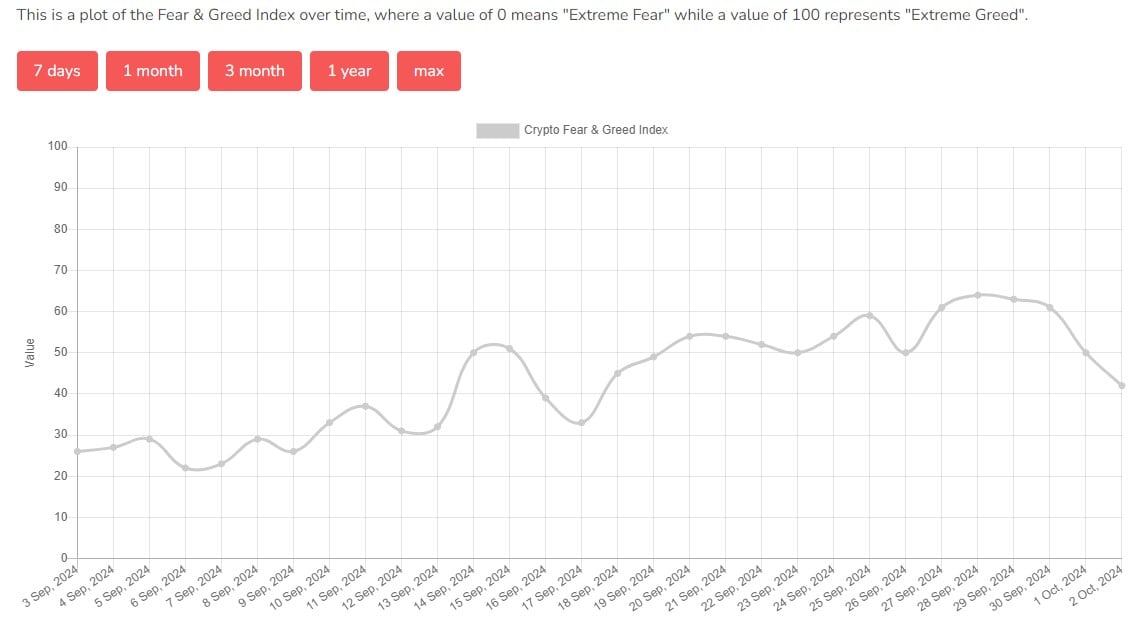

The Crypto Fear and Greed Index dropped from a neutral zone of 50 points to fear at 42 points. That suggests increased caution among investors as geopolitical risks are heightened.