Shutterstock cover by Maquette.pro

VET Holders Unimpressed With VeChain’s New Highs

VET looks ready to resume its uptrend after breaking out of a two-week-long consolidation pattern.

VeChain made headlines after reaching a new all-time high of $0.106 in the past few hours. Even though a spike in profit-taking seems imminent, VET has more room to go up.

VeChain Targets Higher Highs

A new Twitter poll conducted by Real Vision asked cryptocurrency enthusiasts whether Hedera Hashgraph, Ravencoin, or VeChain was the most undervalued altcoin in the market.

Roughly 66% of more than 140,000 respondents believe that VET has not realized its upside potential despite its network utility.

Although the supply management token has posted a whooping year-to-date return of over 460%, market participants believe there’s more room for growth.

📊 Follow up Poll 📊$HBAR & $RVN were too close to call. As such, both will go up against the single most popular response to this post – $VET.

Here we go 🚀

Which of these do you believe is the most undervalued asset in #crypto right now?

— Real Vision (@RealVision) March 31, 2021

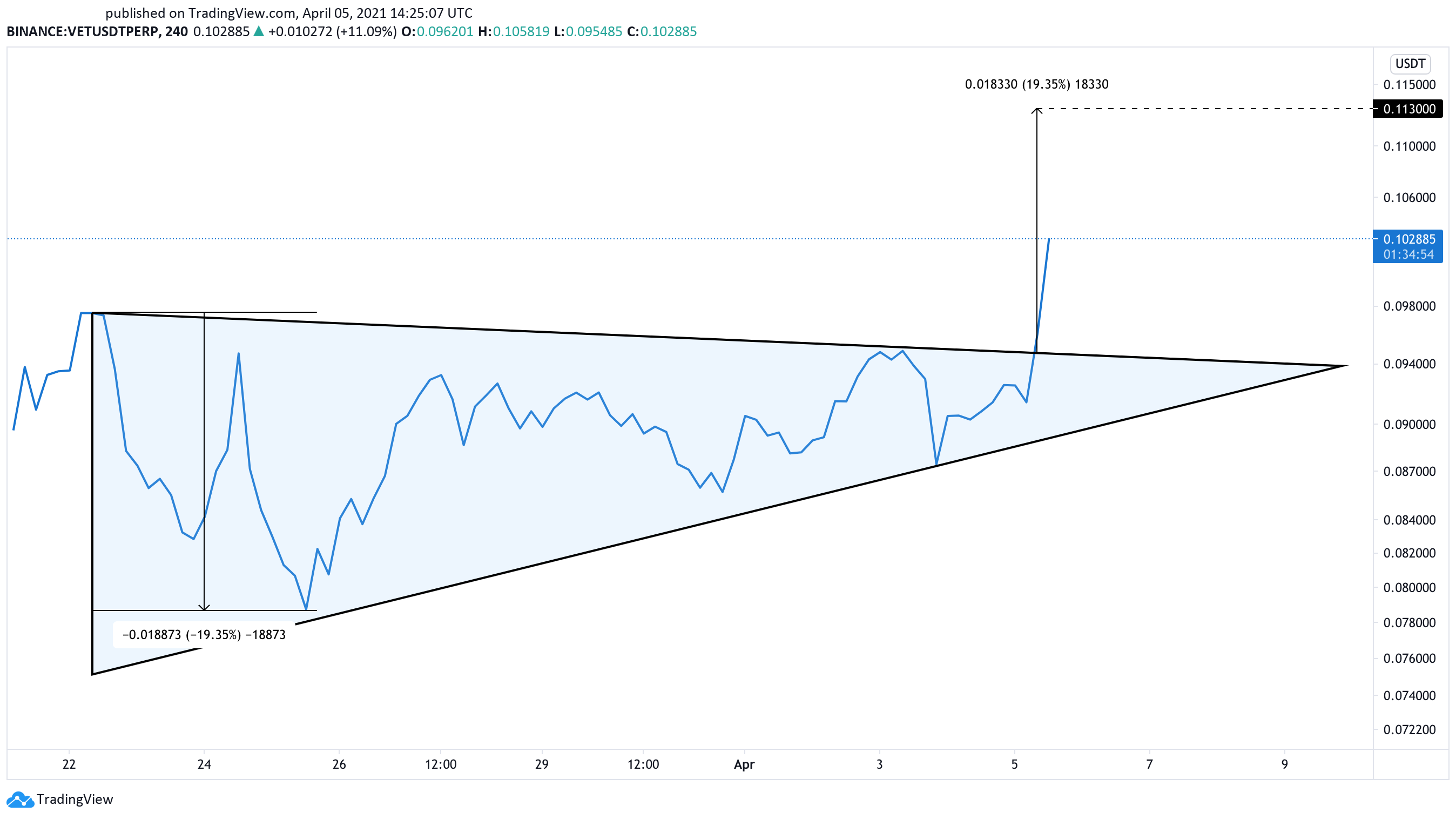

Following the bullish sentiment, VET recently broke out of a symmetrical triangle that developed on its 4-hour chart for the past two weeks.

The sudden upswing allowed VET to rise to a new all-time high of $0.106. Even though some investors could take advantage of the recent price action to book profits, this technical pattern suggests further gains on the horizon.

By measuring the height of the triangle’s y-axis and adding it to the breakout point at $0.095, it anticipates that VeChain is primed to rise another 6.30%.

Such a bullish projection puts VET’s market value at a new record high of $0.113.

Disclosure: At the time of press, the author held Ethereum and Bitcoin.