Wisconsin doubles down on BlackRock’s Bitcoin ETF with $321 million investment

Wisconsin pivots from Grayscale's GBTC to embrace IBIT amid surging demand for digital assets.

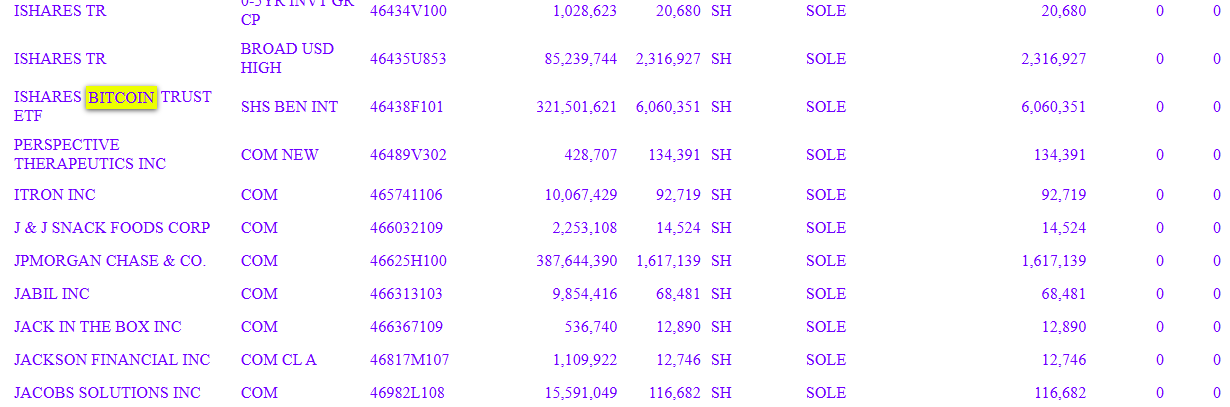

The State of Wisconsin Investment Board (SWIB) has doubled its holdings in BlackRock’s iShares Bitcoin Trust (IBIT), adding over 3 million shares to reach 6 million shares valued at over $321 million as of December 31, 2024, according to a recent SEC filing.

The increase marks a remarkable expansion from around 2,8 million shares the state pension fund held at the end of September 2024. The board divested its position of 1,013,000 shares in the Grayscale Bitcoin Trust (GBTC) during the second quarter of 2024, before expanding its IBIT investment.

IBIT has emerged as the fastest-growing spot Bitcoin fund, accumulating approximately $41 billion in net inflows since its launch. The fund’s assets under management reached $56 billion as of Feb. 14.

The Wisconsin board has diversified its crypto-related investments beyond IBIT, with stakes in Coinbase, MARA Holdings, Robinhood, and Block Inc.

Earlier this week, Goldman Sachs disclosed its holdings of over $1.5 billion in US spot Bitcoin exchange-traded funds (ETFs), including around $1.2 billion in IBIT and $288 million in Fidelity’s Bitcoin fund (FBTC).