XRP Erupts On Ripple’s Icelandic Acquisition

The Algrim acquisition will help Ripple expand its product suite.

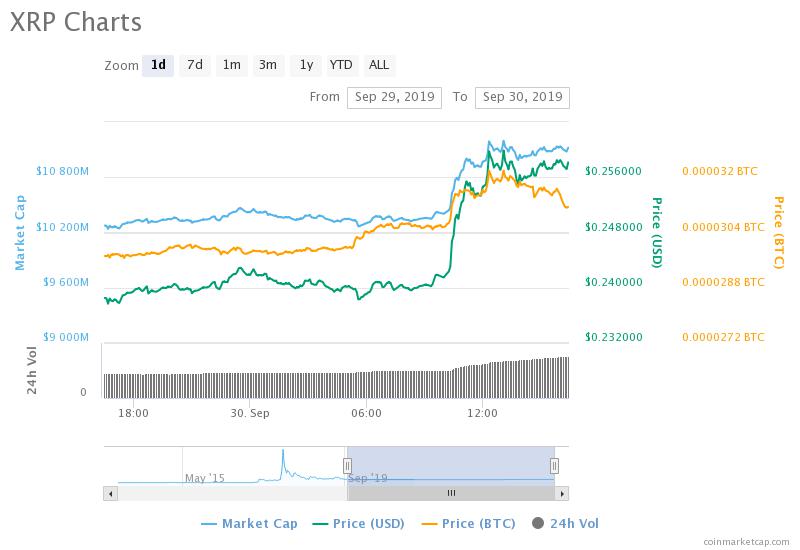

XRP prices have surged following news that Ripple has acquired Algrim, a cryptocurrency trading firm based in Iceland. The token had previously been trading near the $0.24 mark, following the the sudden sell-off early last week.

That changed at approximately 09:00 GMT Monday when XRP began to rise, peaking at nearly $0.26 per token at around 13:00. That two-cent gain amounts to nearly a billion-dollar increase in market capitalization.

At the time of writing, XRP was trading at $0.257, up 8% from this morning’s price.

The surge coincides with today’s announcement that Ripple has acquired the Icelandic cryptocurrency trading firm, Algrim Consulting. The acquisition – for an undisclosed sum – will see all six of Algrim’s engineers join Ripple to work on the company’s RippleNet product suite from their offices in Reykjavik.

According to Amir Sarhangi, Ripple’s VP of Products, the team was chosen for its proven expertise in digital assets. Today’s acquisition means the engineers can turn immediately to work on expanding RippleNet’s cross-border payment corridors and contribute to the on-demand liquidity product.

The news comes on the same day that a consortium of crypto companies, including Coinbase, Kraken and Bittrex, announced the creation of the Crypto Rating Council (CRC), a framework that applies the Howey Test to cryptocurrencies. The Council hopes to receive official recognition as a means to determine whether a digital asset is a security.

Ripple has repeatedly denied that XRP is a security – going so far as to tell journalists not to call the token ‘Ripple.’ But the CRC website identifies multiple traits, including “securities-like language” and a marketing campaign that suggested an “opportunity to earn profits,” which make XRP more similar to a security than other leading digital assets.

But while the market considers the Algrim purchase a buy-signal, concerns about XRP’s continued regulatory uncertainty are likely to remain on the sidelines.