yEarn Finance Becomes the Ultimate Yield Farming Machine, Reaching 1,000% APY

With returns of over 1,000% APY, yEarn Finance is unmatched in DeFi.

iEarn Finance rebranded to yEarn Finance and launched a governance token with no pre-mine and over 1,000% APY for investors, earning it the title of the most lucrative pool in DeFi.

The Most Lucrative Pool in DeFi

Before the DeFi boom in June 2020, the then-iEarn Finance launched as a yield aggregator that maximized interest rate earnings by redirecting tokens to the best lending markets.

This week it joined DeFi’s yield farming movement with returns that trounce every other protocol.

The protocol’s product suite now includes tools to short DAI and restore its peg when it trades at a premium, liquidate Aave loans that become undercollateralized, and its latest release, a new type of automated market maker (AMM).

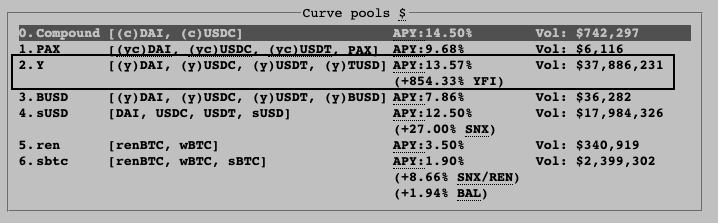

Consider first the farming dynamics on Compound, the sector’s most valuable project.

When yield farmers deposit a token into Compound, they earn interest on their holdings along with COMP rewards. To maximize this yield, these investors have been depositing their cTokens (Compound deposit token) into Balancer to earn liquidity provision fees and BAL mining rewards.

However, it’s the pool – not the investors – that earn the corresponding COMP, BAL, and interest from Compound. The way to fix this is with a “yield aware” liquidity pool that doesn’t differentiate between, say, cBAT and BAT.

yEarn’s new AMM, ySwap.exchange, is yield aware and introduces a transfer token that represents all liquidity for an asset, regardless if it is aBAT, cBAT, or BAT.

Unlike Uniswap, where all pools are between one ERC-20 token and ETH, all ySwap pools will be linked to the transfer token. This allows yield farmers to overcome pain points with other AMMs.

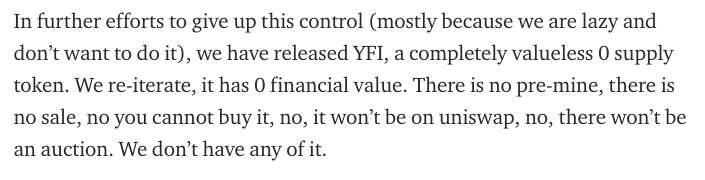

yEarn Finance launched a governance token to democratize decision making in the ecosystem, too.

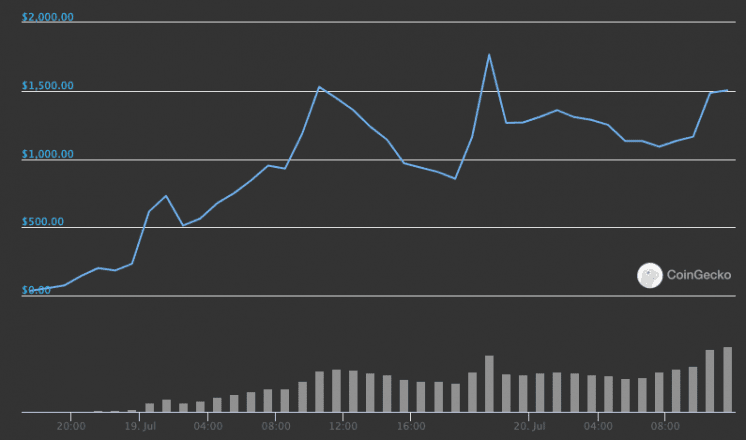

Despite explicitly stating the token has no value, and its sole purpose is to facilitate governance, DeFi did what it does best – pump tokens.

YFI’s price went from $0 to over $1,700 at one point, giving yield farmers a return upwards of 1,200% APY. However, the token continues to sustain above $1,500, earning the continued attention of yield farmers.

YFI holders can introduce any proposal within reasonable means to change any aspect of the protocol. There is currently a supply cap at 30,000 tokens, hence YFI’s high price. But insofar as the token facilitates governance of the project, a majority of YFI holders could increase this supply cap.

This is the first iteration of a governance token where even distribution was done in a meritocratic manner with no allocation to founders or any existing investors.

Andre Cronje, the creator of yEarn Finance, is an investor in Crypto Briefing.

Earn with Nexo

Earn with Nexo