All Eyes on Ethereum as ETH Makes New Yearly Highs, Aiming for $550

Ethereum is breaking out and even though prices seem to have taken a breather, ETH appears to have more gas in the tank.

Ethereum has stolen the crypto spotlight again after surging to new yearly highs. Now, different metrics suggest ETH isn’t done just yet.

Ethereum Makes New Yearly Highs

Since the beginning of the month, Ethereum has been consolidating within a narrow range. The smart contracts giant had been mostly contained between the $447 resistance barrier and the 78.6% Fibonacci retracement level, without providing any clear signals of where it was headed next.

Although the TD sequential index had presented a buy signal on August 26, it was uncertain whether or not it was going to be validated.

A spike in the buying pressure behind Ether that began to build up right around support seems to have confirmed the bullish formation. As a result, it led a 25% bull rally over the past week that has seen ETH break above resistance and make a new yearly high of $467.

Now, Ethereum seems poised for a further advance towards 127.2% Fibonacci retracement level.

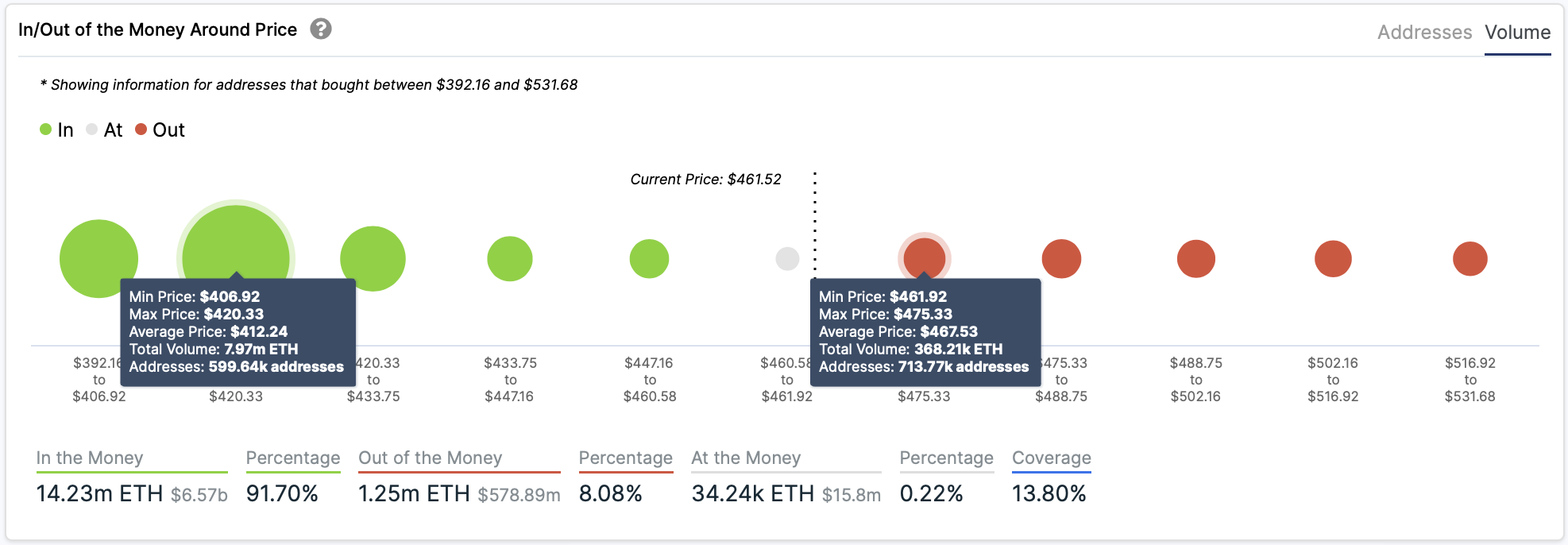

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals there is no supply barrier that will prevent the second-largest cryptocurrency by market cap from achieving its upside potential.

Based on this on-chain metric, there is only one major area of interest between $462 and $475 that is filled by a high number of investors that had previously purchased Ether around this price level. Here, roughly 715,000 addresses are holding nearly 370,000 ETH.

This area may have the ability to absorb some of the buying pressure seen recently. Holders who have been underwater may try to break even on their positions, slowing down the uptrend.

But if Ether can slice through this hurdle, it would likely climb to $545.

On the flip side, the IOMAP cohorts show that Ether sits on top of stable support.

Nearly 600,000 addresses bought roughly 8 million ETH between $407 and $420. This crucial area of interest suggests that bears will struggle to push prices down. Right now, the odds favor the bulls.

On-Chain Metrics Bullish

It is worth noting that following the recent bullish impulse, the Ethereum network also began to expand.

Data from the behavior analytics firm Santiment indicates that the number of new addresses being created daily surged alongside prices.

The recent spike in Ether’s network growth can be considered a positive signal that supports the overall uptrend. Based on historical data, network growth is regarded as one of the leading on-chain price indicators.

An increase in user adoption over time can help observers understand the health and well being of a cryptocurrency network.

Usually, a prolonged upswing in network growth leads to a price increase. The addition of newly-created addresses also tends to positively impact the regular inflow and outflow of tokens in the network, so traders beware.