Augur Doubles Down On Version 2

Augur is seeking to resolve some of the user experience issues in its second version.

Share this article

If I were a betting man, I’d wager that Augur’s newest prediction market platform will be released after the summer. Augur announced the contract changes that they’ll be implementing for Augur V2 earlier this month, and their ZenHub algorithm is targeting a mid-June launch.

Version 1 of the prediction market quickly became the Ethereum’s most popular dApp, but there were many flaws in the first edition. As Crypto Briefing reported, the system had high barriers to entry and was extremely vulnerable to “manipulation” by dishonest parties.

The main criticisms of the platform came during the strange resolution process for the highest profile market on Augur. A market predicting the winner of the US House Elections had over $2 million in open interest, but the creator of the market, who uses the persona of a “soft cat” on Twitter and in the Augur Discord channel, ambiguously phrased the market in an attempt to profit.

The controversy stemmed from the ambiguous phrasing of the question, “Which party will control the House after 2018 U.S. Midterm Election?” Although most users would interpret this as a straightforward statement on the elections’ outcome, a strict interpretation would note that the Republicans continued to control the House.

However, the market resolved as expected, and losses were minimized. The entire process pushed Augur developers to make meaningful changes to the platform.

The Augur developers didn’t expect the first version of the platform to be perfect, and Augur Co-Founder Joey Krug even predicted many of its failings. Two years ago, Krug said, “The first version of Augur will likely be somewhat slow and slightly expensive (think pennies and many seconds per trade), but it’ll certainly be a beautiful glimpse of what’s to come.”

What’s in Store For Version 2?

We got a peek at the new changes in the team’s latest update, which included:

- Dai-denominated markets ($1 peg) rather than having all markets denominated in ETH. This means users don’t need to have risk exposure to ETH while betting.

- Quicker reporting tools, including 1-day designated reporting, immediate dispute rounds, pre-emptive dispute contributions, and immediate payouts. All of these will make the reporting go more smoothly and encourage greater participation. That’s a big improvement over Version 1, in which some markets took over two months to settle an outcome.

- Traders will be able to trade “INVALID” as an outcome. In the previous version some markets could be maliciously worded so that the creator could profit by purchasing what the public might deem as “losing shares.” In reality these market would resolve as INVALID, giving the creator “free profit” at the expense of well-intentioned traders. In the new version, an invalid market pays everyone evenly rather than giving them their money back.

- Mandatory fork participation in the event of a lengthy dispute. This encourages more reporters to have active management of the platform, and ETH fees will also be removed from disputes.

- Affiliate marketing programs where the creator of markets will presumably be paid (just like on BitMEX and Binance) for bringing more bettors to their market for greater liquidity.

The changes acknowledge that reporting on events was difficult and expensive, and that amateur traders could be taken advantage of. The new features will make it easier and safer to bet while hopefully bringing in more users.

Augur Foresees A Strong Year

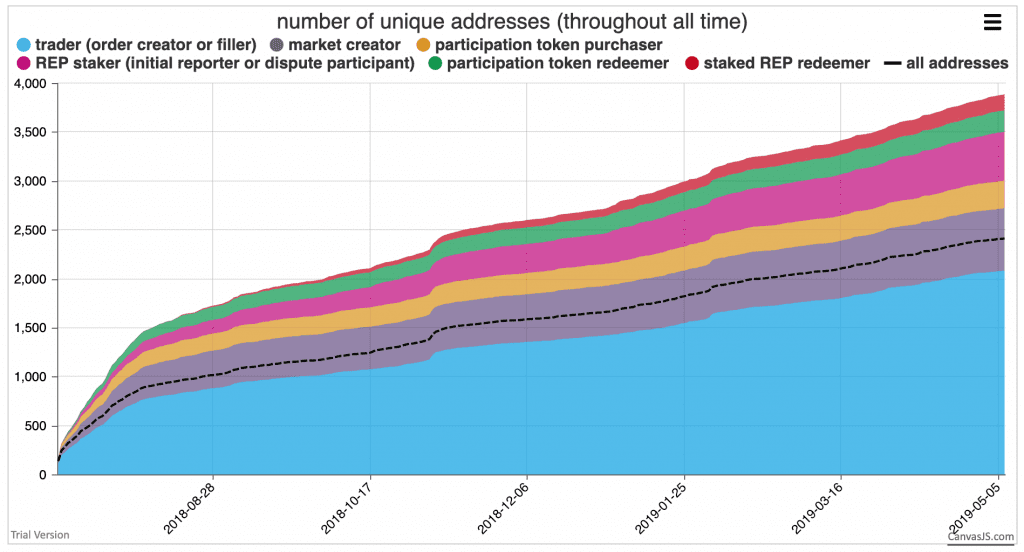

Augur hopes to improve upon a successful first year of operation with its second version. The number of unique addresses that are trading, creating, and reporting on Augur markets have all been steadily increasing since the platform launched last July.

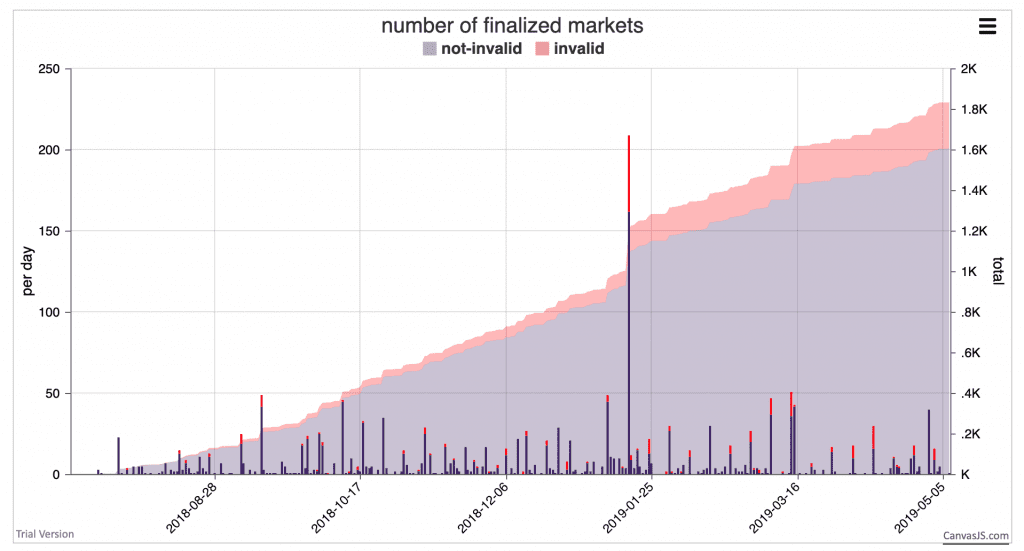

In addition, active betting has also increased, with the number of finalized markets also growing over time. It’s clear the number of invalid markets are growing as well, which makes the improvements in V2 even more important moving forward.

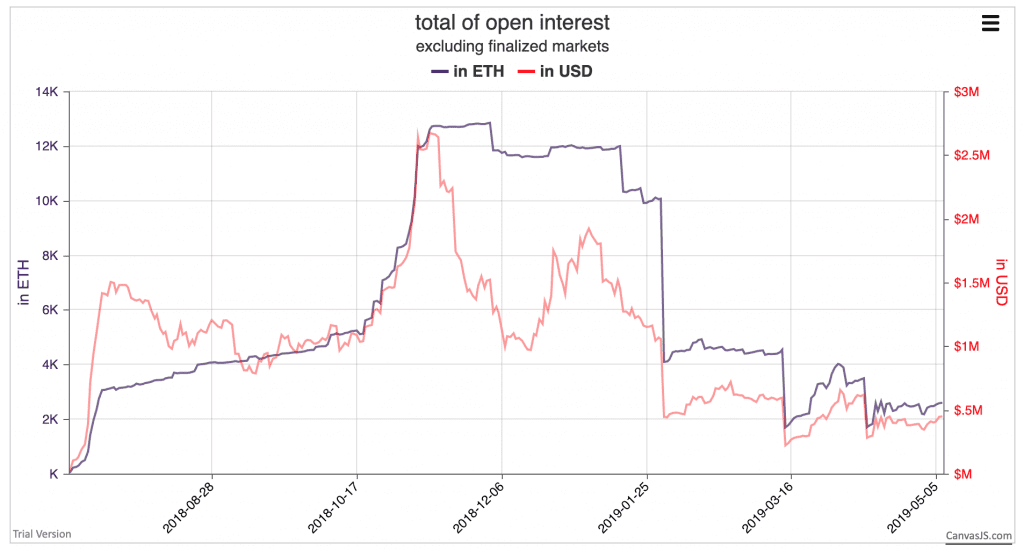

As seen in the graph below, the open interest (total ETH staked on Augur markets) fluctuates greatly, and this is because trading tends to concentrate within few highly-liquid markets. V2’s affiliate marketing program and dollar-denominated markets may encourage more traders to spread their trading activity throughout more markets.

What could Version 3 bring?

It’s a good sign that the Augur team is aware that the first version wasn’t perfect. These changes will help, but they’re not going to make Augur widely used – yet.

Augur still needs easier fiat on-ramps, a more friendly user experience, and more liquidity on the platform to encourage traders to participate. Fiat on-ramps and the learning curve required to use the Ethereum blockchain are challenges that will likely be solved outside of Augur. In addition, third-party platforms such as Veil are also making it easier for users to participate in Augur with improved user experience.

Although it’s too soon for predictions, one might hope for future versions of Augur to have direct integration with Coinbase for easy fiat on-ramps and proper KYC. We can also hope for third party integrations creating better user-experiences to use the application.

I’ll bet $5 that the platform can sustain its growth.

Share this article