Shutterstock cover by Tinawut Krapanpongsakul

Bitcoin Bulls to Correct Before Reaching for Higher Highs

The bullish momentum behind Bitcoin could be slowly fading, suggesting that a correction is underway.

Investors are growing overwhelmingly bullish about Bitcoin thanks to the recent price action. However, multiple technical and on-chain metrics suggest that a brief correction is underway.

Bitcoin Flashes Sell Signals at Critical Support

Bitcoin made headlines on Oct. 21 after breaking out of an ascending parallel channel containing its price action since the market crash in early September.

The 12% upswing that followed saw the top cryptocurrency surge to new yearly highs. BTC rose to $13,360 for the first time since June 2019, meeting the target presented by the channel.

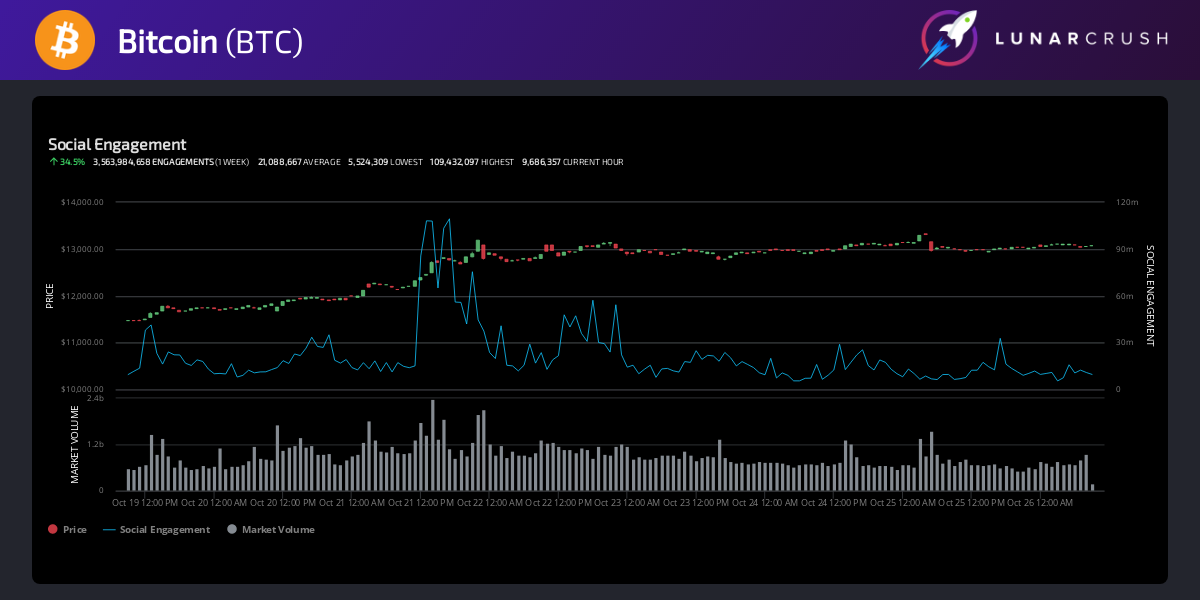

As the flagship cryptocurrency breached the infamous $12,000 mark, social media exploded with activity. Community insights provider LunarCRUSH recorded more than 1 billion engagements on Oct. 21 alone.

Unfortunately, high volumes of social mentions during a price pump often leads to short-term consolidations or even steep corrections.

When looking at the TD sequential indicator on the daily chart, the pessimistic thesis holds. This technical index is currently presenting a sell signal in the form of a green nine candlestick.

If validated, the bearish formation forecasts a one to four daily candlesticks correction before the uptrend resumes.

An increase in selling pressure around the current price levels could see Bitcoin drop to $12,350. But first, the pioneer cryptocurrency would have to break through a stiff support barrier between $12,700 and $13,000.

Here, approximately 750,000 addresses had previously purchased nearly 700,000 BTC, according to IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model.

Although the odds seem to favor the bears, a sudden spike in buy orders may have the strength to jeopardize the bearish outlook.

Moving past the recent high of $13,360 and turning this area into support could see Bitcoin rise to $15,000 or higher. The IOMAP cohorts show little to no resistance ahead of the $13,100-$13,500 hurdle.

The Crypto Market Moves Forward

A new wave of developments has brought a lot of attention to the cryptocurrency market lately. Alongside the publicly-traded companies buying up Bitcoin, PayPal is opening the gates for its 350 million users to buy and sell cryptocurrencies.

This positive news aligns with the supply shock that this year’s Bitcoin halving has yet to have on prices.

On-chain analyst Willy Woo believes that the effects of the block rewards reduction event may be just around the corner and would likely “teleport [BTC] upwards into a full-on, FOMO induced, bull run.” However, the high levels of greed among market participants are a concern, especially for the short-term price action.

While the bellwether cryptocurrency continues to hover around the $13,000 zone, there are two crucial price levels to pay attention to.

The underlying support at $12,700 and the overhead resistance at $13,360 will help determine where prices are headed next.

Moving above this zone will signal a jump towards $15,000, while breaking below it may see Bitcoin drop to $12,350.