US Bitcoin spot ETFs attract $2 billion in net inflows over two weeks

Meanwhile, Bitcoin’s price is 6% away from its record high, currently trading at around $69,100.

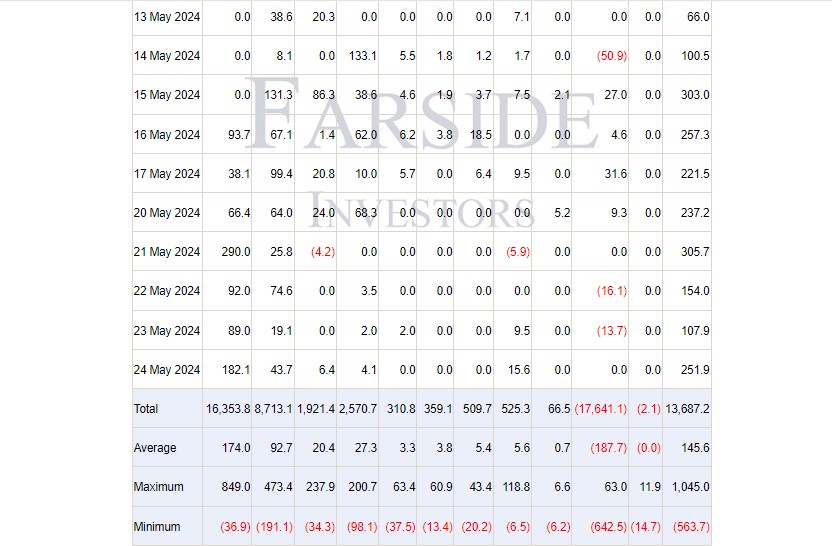

Investors have poured around $2 billion into US spot Bitcoin exchange-traded funds (ETFs) over the past two weeks, according to data from Farside. These funds also recorded a tenth consecutive day of net inflows.

This week alone, US spot Bitcoin ETFs saw over $1 billion in inflows, with Thursday recording the largest daily inflow of around $305 million.

BlackRock’s Bitcoin ETF, iShares Bitcoin Trust (IBIT), led the pack with nearly $720 million in weekly inflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) took the second spot with around $227 million.

The order was different last week when FBTC surpassed IBIT in terms of weekly inflows. Data shows that FBTC recorded around $344 million in inflows from May 13 to 17 while IBIT saw approximately $132 million.

With over 284,525 BTC in its holdings, IBIT is just $300 million away from surpassing Grayscale Bitcoin Trust, which currently holds 289,000 BTC, valued at $19.9 billion. This calculation is based on Bitcoin (BTC) being worth $69,100 as of the writing, according to CoinGecko. IBIT is well on track to become the largest Bitcoin ETF.

Meanwhile, Bitcoin’s price moved in the same direction with strong ETF inflows in the last two weeks.

On May 24, this week’s final trading day, the price soared to $69,000, up around 13% over the past two weeks. Bitcoin is now only 6% away from its record high of $73,700, established in March.

Bitcoin had stagnated after the fourth halving, which analyst Rekt Capital pointed out as the post-halving “danger zone” characterized by heightened volatility. He noted last week, however, that the selling pressure was weakening; Bitcoin was entering a phase of accumulation.

In addition to Bitcoin ETFs, the week’s spotlight was on the SEC’s approval of spot Ethereum ETF filings. These ETFs still need S-1 form approval to begin trading, which ETF experts believe will take weeks to months. However, in essence, the approval of spot Ethereum ETFs indicates that the launch of these funds is imminent.

Positive developments prior to the approval had factored into the surge in Ethereum’s price (ETH). On Monday, ETH jumped 8% on news that approval odds were raised to 75%. Rally extended during the day with a broader market upswing. At press time, ETH is trading at around $3,700, up over 20% over the past seven days.

Earn with Nexo

Earn with Nexo