Bitcoin eyes all-time high with 4% gap as ETFs attract massive inflows

Spot Bitcoin ETFs defy skeptics with a surge in demand.

Bitcoin’s price soared to $71,200 on Tuesday, only 4% away from its all-time high of $73,700 established earlier in March, according to data from TradingView. The rally comes on the heels of massive inflows into US spot Bitcoin exchange-traded funds (ETFs).

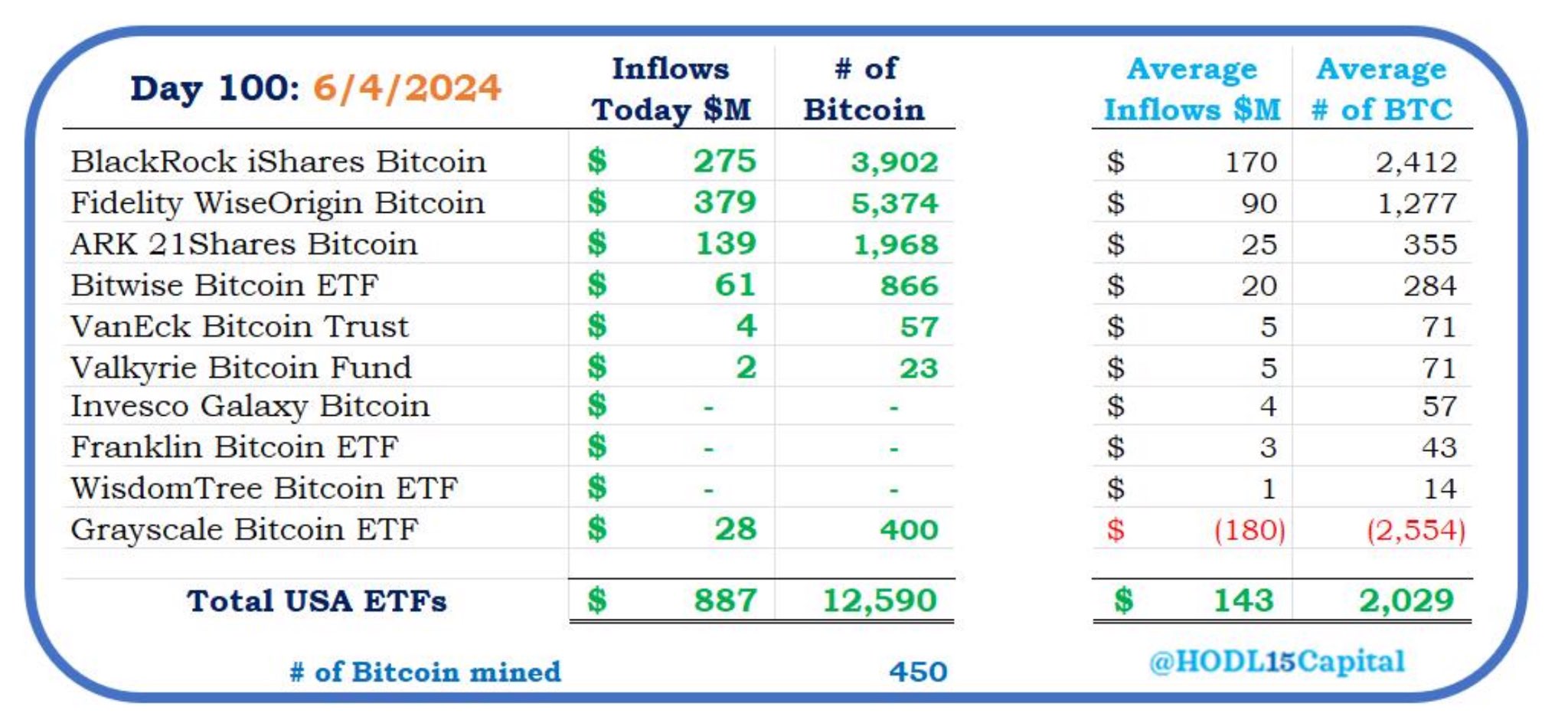

Data from HODL15Capital shows that US Bitcoin funds collectively witnessed $887 million in net inflows on June 4, marking the second-highest such inflow ever recorded.

Leading the charge, the Fidelity Wise Origin Bitcoin Fund amassed an impressive $378 million, while BlackRock’s iShares Bitcoin Trust followed with $275 million, according to insights from Farside Investors and HODL15Capital. The ARK 21Shares Bitcoin ETF claimed the third spot with over $138 million in net inflows.

These inflows marked a significant milestone, being the most substantial since March 12, which saw a record-setting $1.04 billion influx. The following day, Bitcoin reached a peak of $73,700.

At press time, BTC is trading close to $71,000, up almost 3% in the last 24 hours. The recent surge signals a positive turn for Bitcoin after several weeks of moving sideways. Industry experts suggest that the crypto market is set for a “bright June” due to anticipated spot Ethereum ETF developments.

With Bitcoin ETFs scoring big on their 100th trading day, Nate Geraci, president of ETF Store, addressed the skepticism surrounding Bitcoin ETFs and their demand, particularly from critics who doubted their appeal to retail investors.

Earn with Nexo

Earn with Nexo