Bitcoin ETFs captured over 4% of BTC supply in Q1: IntoTheBlock

Bitcoin ETFs' rapid accumulation signals a shift in crypto whale dynamics.

Share this article

Bitcoin (BTC) exchange-traded funds (ETFs) rapidly absorbed over 4% of the total BTC supply in less than three months, according to the latest “On-chain Insights” newsletter by IntoTheBlock. This development comes after the US Securities and Exchange Commission (SEC) approved the launch of several spot Bitcoin ETFs and the transformation of the Grayscale Bitcoin Trust (GBTC) into an ETF.

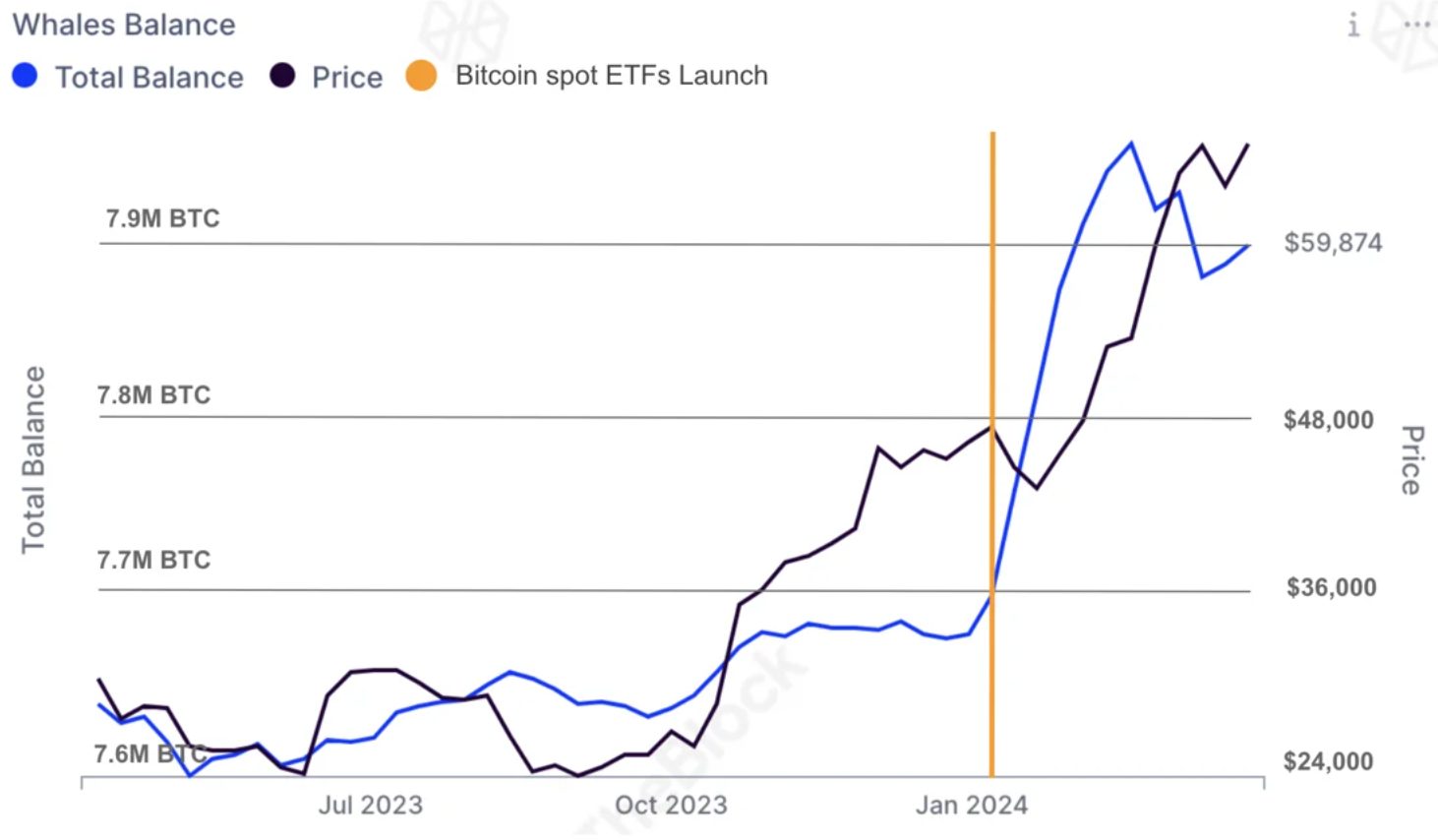

The influence of Bitcoin ETFs on the market has been profound, with addresses holding at least 1,000 BTC seeing their balances soar to the highest levels since June 2022. The total Bitcoin held by these whales has increased by 220,000 BTC, approximately $14.2 billion, with 210,000 BTC attributed to net inflows into the ETFs. This influx has not only propelled Bitcoin to new all-time highs but also spurred broader demand for crypto-assets.

Lucas Outumuro, Head of Research at IntoTheBlock, states that these financial instruments have simplified the process of investing in Bitcoin, attracting both institutional and retail investors by eliminating the complexities of centralized exchanges and private key management.

Meme coins and liquid staking played an important role in Q1

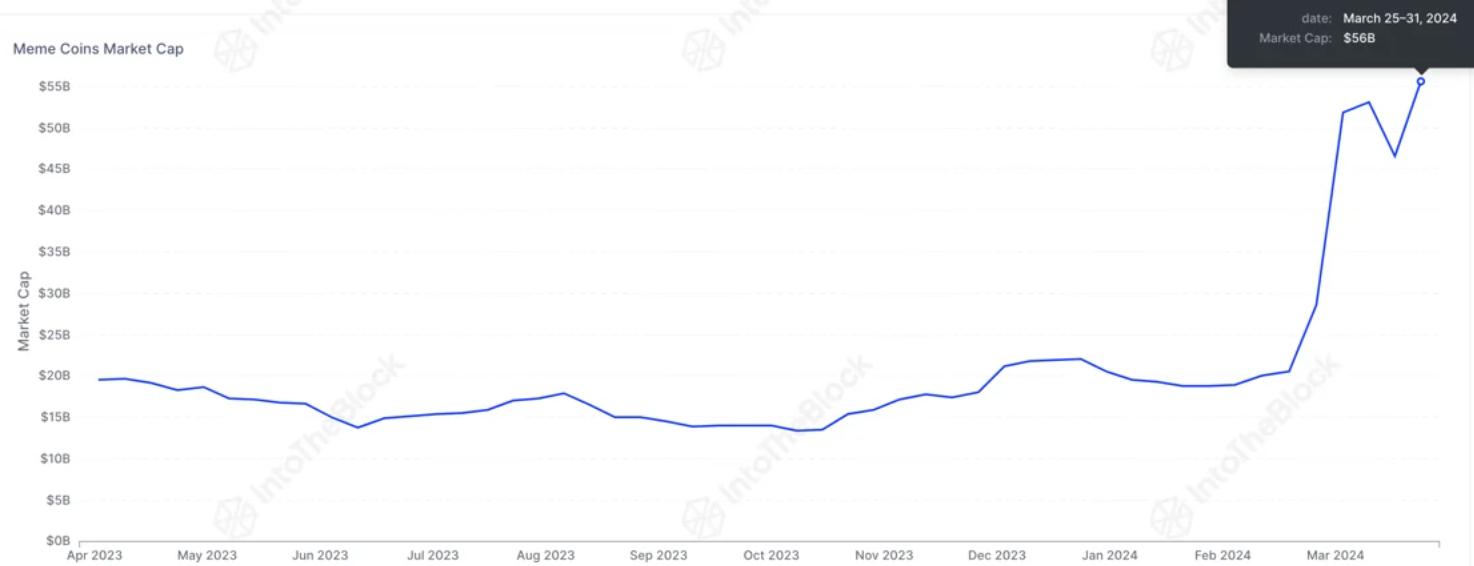

As the market momentum shifts towards a bull run, traders are increasingly seeking higher-risk assets, with meme coins emerging as a prime target. Despite high-interest rates and the absence of stimulus checks, the demand for meme coins has reached its peak since 2021.

The market capitalization for this category has nearly tripled in 2024, with Dogecoin, Shiba Inu, and other meme coins experiencing significant price increases. The meme coin craze has also benefited from lower transaction fees on networks like Solana, which has seen days with trading volumes surpassing those on Ethereum.

The resurgence of meme coins on the Ethereum ecosystem can be partly attributed to the successful implementation of the Dencun upgrade, which has led to a drastic reduction in gas fees, particularly on Coinbase’s Base layer-2 network. This upgrade has facilitated the transfer of the meme coin frenzy back to Ethereum, indicating a dynamic shift in the crypto landscape.

Share this article