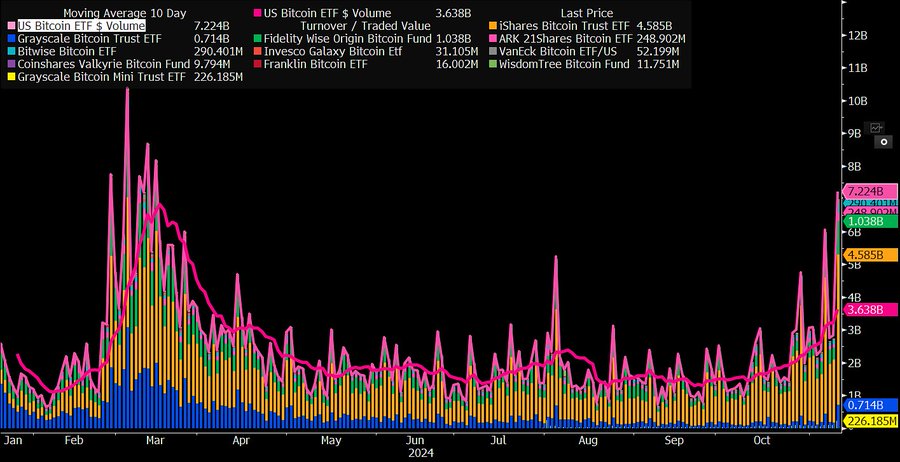

Bitcoin ETFs hit $7 billion in trading volume, highest since March

ETF trading surge ties into Bitcoin's post-election momentum.

Institutional appetite for Bitcoin continues to grow as US spot Bitcoin ETFs saw their biggest trading day in over 7 months. According to Bloomberg ETF analyst James Seyffart, total daily volume reached $7.22 billion on November 11, the 6th highest ever.

BlackRock’s IBIT accounted for half of volumes—roughly $4.6 billion worth of shares traded today, followed by FBTC which surpassed $1 billion.

The surge follows IBIT’s previous record-setting performance last Thursday when it recorded over $4 billion in traded shares, its highest daily volume since launch.

However, that day’s activity resulted in $69 million in net outflows, followed by more than $1 billion in net inflows the next day—its largest single-day capital injection since inception.

ETF expert Eric Balchunas noted that high trading volumes can indicate both buying and selling activity. Market observers may need several days to determine whether the recent volume surge translates into sustained net inflows.

The uptick in Bitcoin ETF trading volumes comes amid Bitcoin bullish momentum post-election. Following Donald Trump’s victory, which many perceive as favorable for crypto policies, there has been a wave of optimism that likely fueled both the Bitcoin price rise and the corresponding increase in ETF trading volumes.

Bitcoin has flipped silver in market capitalization, reaching a valuation of $1.736 trillion and becoming the world’s 8th largest asset, Crypto Briefing reported Monday. This achievement came hand-in-hand with a surge in Bitcoin’s price, which shot past $88,000—a 10% jump in a single day. Meanwhile, silver prices dipped by 2%.

Bitcoin now trails only giants like gold, Nvidia, Apple, Microsoft, Google, Amazon, and Saudi Aramco.

Earn with Nexo

Earn with Nexo