Shutterstock cover by Inked Pixels

Bitcoin, Ethereum Dip as U.S. Inflation Hits 40-Year High

Crypto assets and stock futures fell in tandem on the news that U.S. inflation has come in at 7.5%, even higher than projected.

The market is reacting negatively to the consumer price index’s report on U.S. inflation.

Bitcoin, Ethereum Dip on Inflation Update

U.S. inflation has hit a 40-year year-on-year high, and crypto assets are sliding in response.

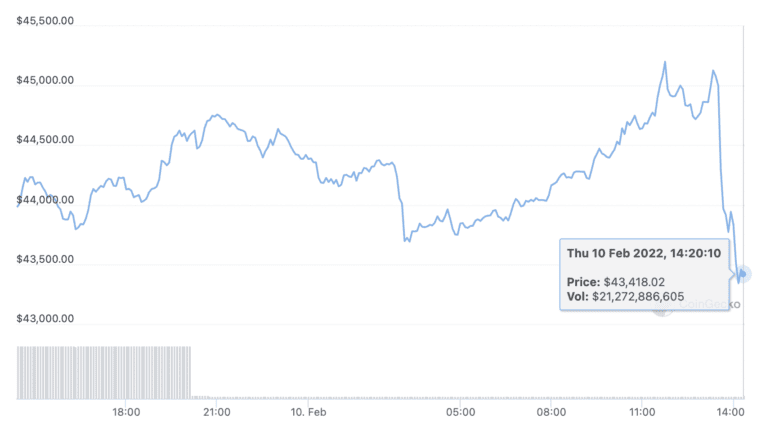

Bitcoin and Ethereum both dipped Thursday immediately after the Labor Department reported that the consumer price index had jumped 7.5% since last year. Price hikes in January contributed to the yearly rise as the cost of all items increased by 0.6%.

The 7.5% figure is the highest U.S. inflation rate the CPI has recorded since 1982. The Dow Jones had estimated that the figure would come in at 7.2%. Markets quickly reacted as the news that the rate had surpassed predictions broke, with futures on the S&P 500 and Nasdaq-100 respectively falling 0.8% and 1.3%.

Bitcoin took a 3.5% dip from around $45,000 to $43,400, while Ethereum fell from around $3,250 to $3,100. Many other lower cap assets, including the alternative Layer 1 coins Solana, Avalanche, and Terra, were harder hit.

The slump across global markets marks a stark contrast to the reaction to the news that U.S. inflation had hit record levels in November, when Bitcoin and Ethereum both rallied to all-time highs on the same day. The difference this time around is that the 7.5% jump indicates that the Federal Reserve is likely to push ahead with significant interest rate hikes in 2022 as planned (when interest rates increase, risk-on assets tend to tumble as the cost of borrowing money jumps).

The Fed first signaled that interest rate hikes would be coming in December, and crypto assets dipped on the news. Markets then dipped when Jerome Powell confirmed the rate increases in January. The market has looked shaky since, with both Bitcoin and Ethereum maintain momentum. They’re respectively down 37.5% and 36.2% from their highs recorded in November.

With interest rate hikes looking increasingly likely this year, crypto believers will be hoping that the market can make a recovery without spilling too much more blood.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.