Shutterstock cover by nasidastudio

Bitcoin, Ethereum Primed For Increased Volatility

Bitcoin and Ethereum look primed for volatility after prolonged consolidation.

The top two cryptocurrencies by market cap, Bitcoin and Ethereum, remain stagnant with no clear indication of where they are heading next.

Bitcoin, Ethereum Stuck Within Tight Range

Bitcoin continues to consolidate while its price action is getting narrower over time.

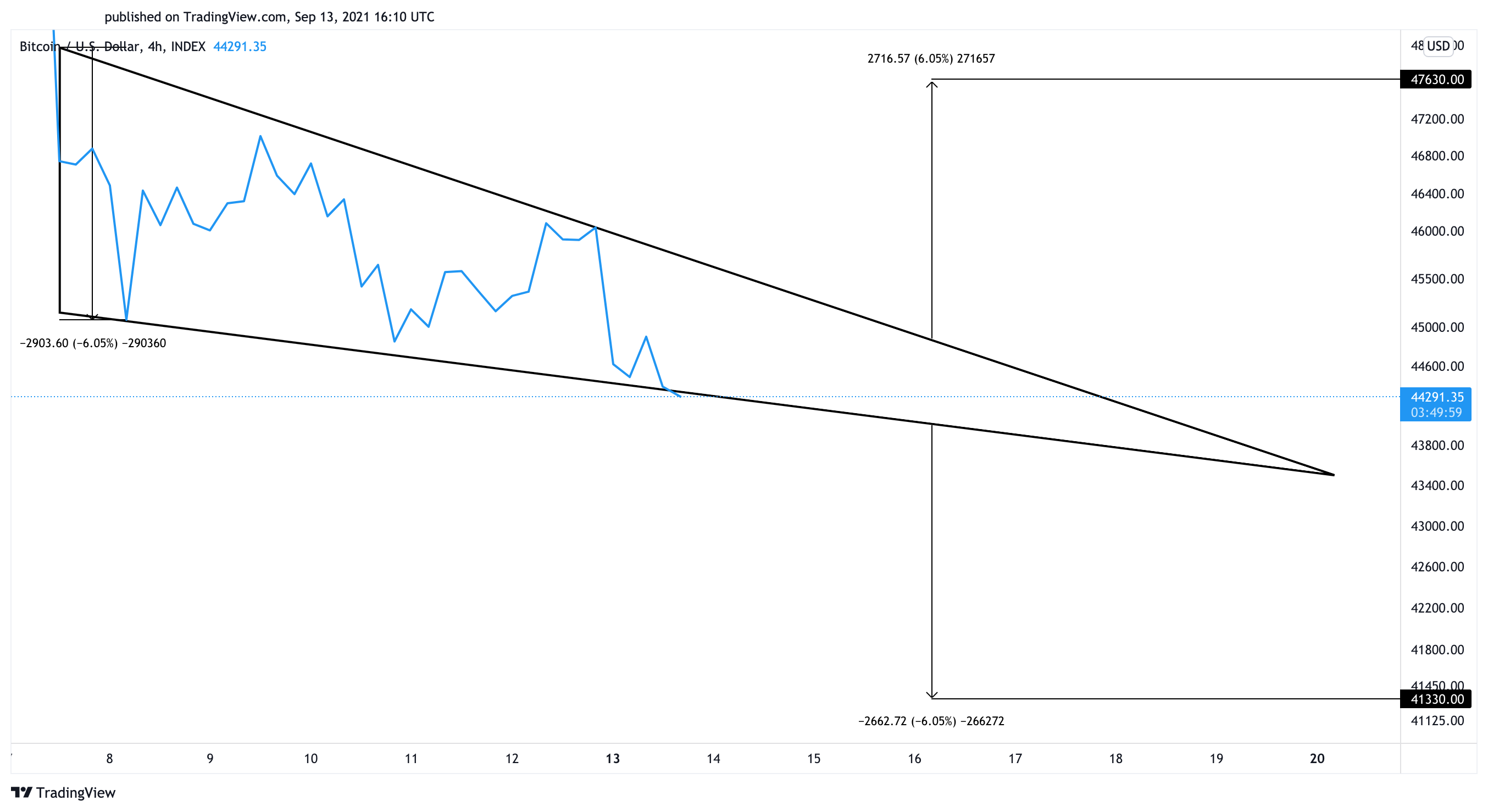

The flagship cryptocurrency has formed a series of lower lows and lower highs since last week’s flash crash. Drawing a trendline through these pivotal points results in a falling wedge pattern. This technical formation’s y-axis forecasts a 6% target in either direction.

A decisive hourly candlestick close above $44,900 could result in an upswing toward $47,630, while a downswing below $44,000 may ignite a sell-off toward $41,330.

Ethereum also presents an ambiguous outlook as its price action has been contained within a descending parallel channel over the past week.

Whenever ETH rises to this technical formation’s upper boundary, it gets rejected and retraces to the pattern’s lower edge. From this point, it tends to rebound, which is consistent with the characteristics of a parallel channel.

Ethereum recently dropped to the channel’s middle trendline and is yet to rebound to the upper trendline or fall to the lower trendline.

Slicing through the $3,330 resistance would likely lead to a bullish impulse to $3,660 while dropping below the $3,000 support could see ETH drop to $2,730.

Given the ambiguity that both Bitcoin and Ethereum present, waiting for confirmation before entering a long or short position is imperative. Patience can play a vital role in profiting from BTC and ETH’s next significant price movement.