Bitcoin faces key resistance ahead of FOMC meeting

The Fed's interest rate decision may influence Bitcoin's price.

Share this article

Bitcoin is confronting a pivotal resistance level at $44,000 ahead of the Federal Open Market Committee (FOMC) meeting scheduled for January 30-31. All eyes are set on the Fed’s interest rate decision tomorrow, which could affect Bitcoin’s price action.

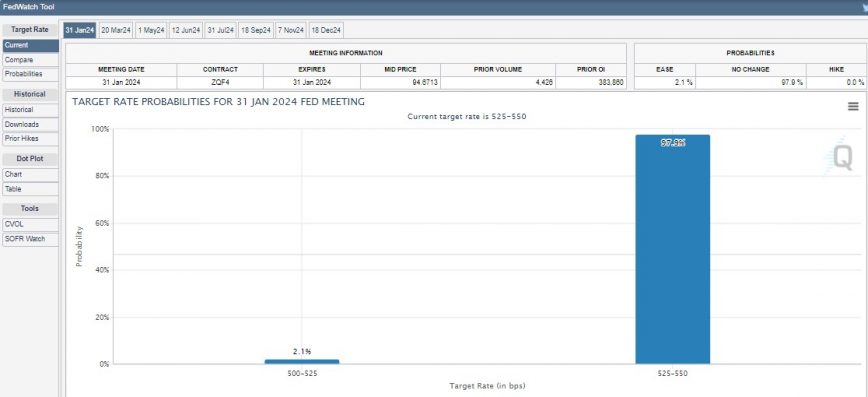

According to recent estimates from the CME FedWatch Tool, there is a 98% probability that interest rates will remain between 525-550 basis points, leaving only a 2% chance of a rate cut and effectively taking a rate hike off the table. Either way, Bitcoin could benefit from it. A pause in interest rate hikes can signal that the central bank wants to encourage economic growth, which often improves investor sentiment and risk appetite.

The Fed’s aggressive monetary policy has seen interest rates rise 11 times since March 2022 as a measure to tame inflation. However, the Fed kept the interest rate unchanged for the third consecutive time by the end of last year. Previously, Fed officials projected a gradual decline to meet the 2% target by 2026. These projections also included an anticipation of at least three rate cuts this year, assuming quarter percentage point increments.

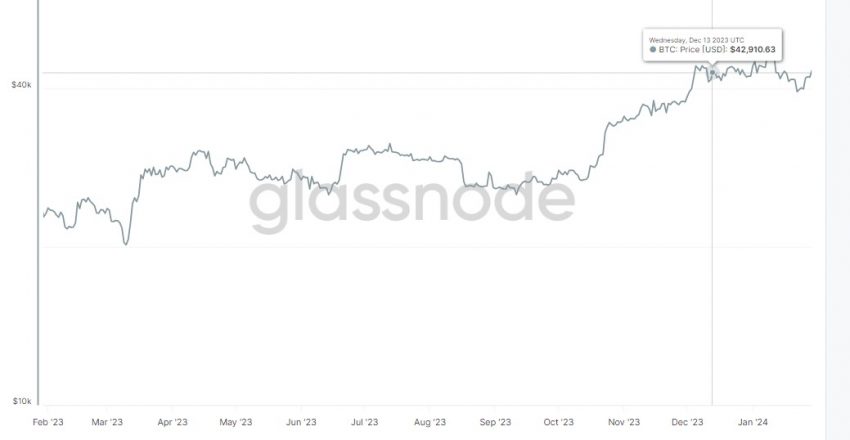

However, while macroeconomic announcements in the US, such as those from the FOMC, could act as a catalyst for Bitcoin’s price actions, data from Glassnode indicates that Bitcoin’s price has remained relatively unresponsive to such events.

After the FOMC’s last meeting on December 12-13 last year, Bitcoin’s price stayed within the range of $42,000 to $43,000 through the end of the year. Similarly, following the latest rate hike at the July meeting, Bitcoin’s price held steady at around $29,000 until mid-August, suggesting a tenuous link between Bitcoin and macro factors.

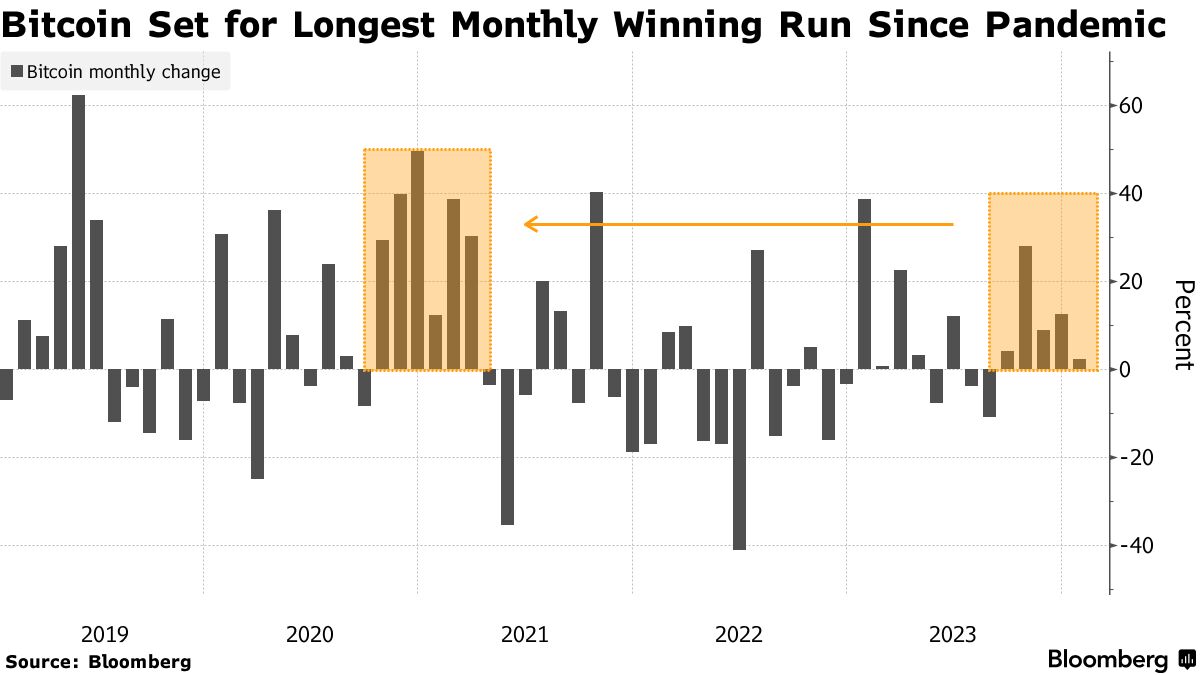

Bitcoin is trading at around $43,500, up 11% over the past week. If Bitcoin maintains this price level through the end of the month, it will secure its fifth consecutive monthly increase, representing the longest sequence of monthly gains since 2021’s bull market.

Share this article