Bitcoin Mining Activity Surges Amid High Difficulty: Bitfinex

The record high in Bitcoin mining difficulty reveals a surge in miner confidence and robustness of the network amid a new landscape of Bitcoin ownership and trading.

Share this article

Bitcoin miners’ activities continue to pique global interest, showing a rise in BTC mining activity, according to a report from Bitfinex.

One particular development is the Bitcoin mining difficulty hitting an all-time high, which signals a more robust network and a heightened miner optimism.

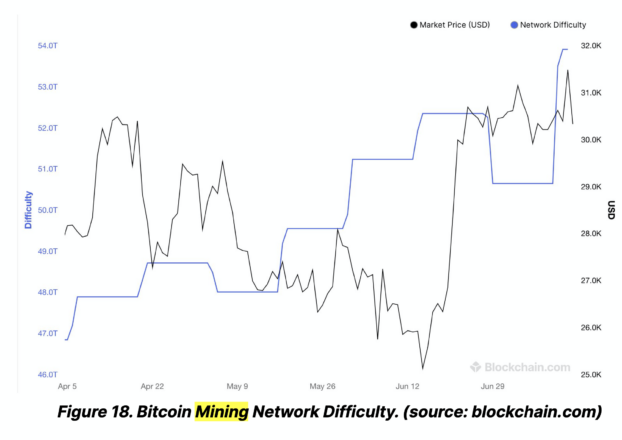

The BTC network difficulty has surged to 6.45, meaning that there is an increased amount of power going to the miners to solve the computational equation to make a newborn Bitcoin. This also means that miners need to use more resources to power and cool the machines:

“An increase in mining difficulty implies more computational power has been committed to securing the Bitcoin network, which is often seen as a sign of increased network health. It could indicate more miner confidence in the profitability of mining, possibly due to a higher Bitcoin price or more efficient mining hardware.”

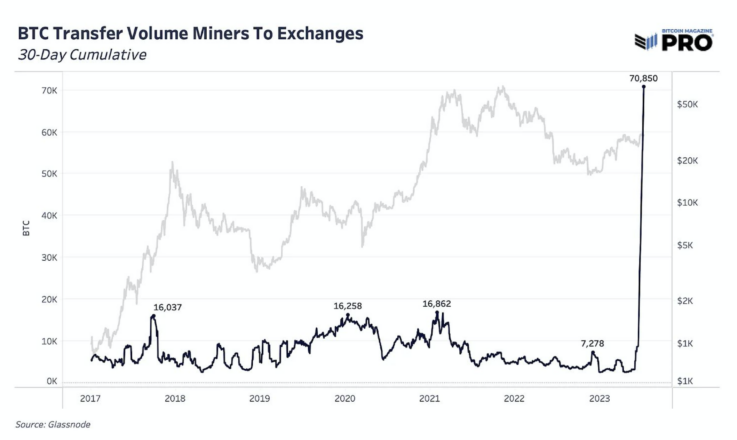

While miners are committing additional resources to mining, increasing the difficulty in the process, they also appear to be cautiously offloading Bitcoin onto exchanges.

One particular mining pool, Poolin, has been making waves, leading the transfer of large BTC volumes onto exchanges. Some observers posit this move as an attempt at risk mitigation or hedging, while others perceive it as a response to an upsurge in institutional interest in Bitcoin and its mining derivatives.

Patterns in investor behavior mirror miners’ bullish outlook. On-chain activities demonstrate a shift of Bitcoin ownership from long-term to short-term holders, typically a hallmark of bullish markets.

The trend suggests an influx of new entrants aiming for quick gains and long-term holders monetizing on advantageous prices. This transfer of ownership often signifies the onset of a bull market phase.

Additionally, long-term holders seem content with their positions and are reluctant to sell at a loss, as indicated by the Spent Output Profit Ratio (SOPR). Meanwhile, short-term holders are the main sellers at current prices, contributing to market balance.

In the recent week, Bitcoin’s price fluctuated within a limited range, mostly driven by short-term holders. A brief price surge, prompted by positive news from Ripple and bullish inflation data, resulted in record short liquidations.

And, as the Bitcoin halving moment is slated for April 2024, some concerns arise. Especially as the network difficulty seems to rise, it could be a problem once the BTC reward cuts in half.

Bitcoin mining already demands substantial resources and will become even more challenging with the dwindling rewards. A Bloomberg report interviewed Jaran Mellerud, a crypto-mining analyst at Hashrate Index, who predicted:

“Nearly half of the miners will suffer given they have less efficient mining operations with higher costs.”

Share this article