Shutterstock image by Momentum Fotograh

Bitcoin Primed for New All-Time Highs as Retail Interest Returns

Bitcoin looks unstoppable as retail investors are taking advantage of every dip to get in the market.

Bitcoin reclaimed the $50,000 level as increased demand from institutional and retail investors continues to rise.

Demand Skyrockets, Supply Plunges

Bitcoin continues trending up with few signs of slowing down. Some of the most prominent analysts in the industry have warned of a steep correction, but the pioneer cryptocurrency remains fundamentally strong.

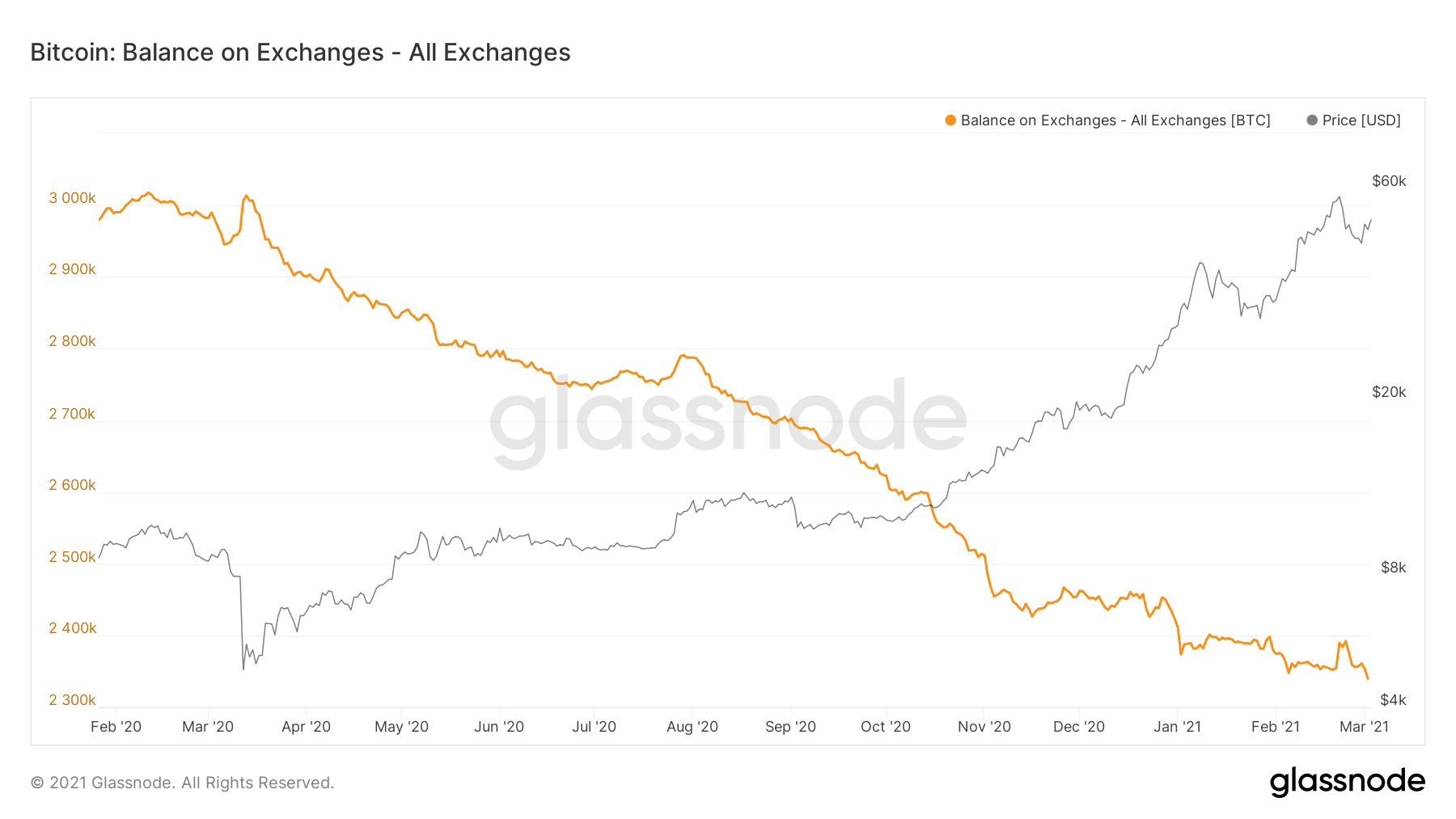

Indeed, the number of Bitcoin available on trading platforms is declining at an exponential rate. More than 30,000 BTC have been withdrawn from known cryptocurrency exchange wallets, representing a 1.20% drop.

Such market behavior represents a positive signal for further price growth as the selling pressure behind Bitcoin is technically reducing, consequently capping its downside potential.

According to Arcane Research, investors opt to hold BTC for a longer period because of its store of value characteristics. But the positive growth in the lending markets could also be affecting the available supply on cryptocurrency exchanges.

The analytics firm maintains that if the DeFi space continues expanding at the current rate, the number of Bitcoin used as collateral in the lending markets will likely reach 1 million by 2023.

When considering the rising interest among retail investors, the supply shock that Bitcoin is going through will likely have serious implications on prices.

On-chain analyst Willy Woo believes that BTC has more room to go up as the number of new daily addresses joining the network is going parabolic.

“Until we approach the inflection point of [billions of people using BTC], the numbers joining the network per day keeps climbing. BTC is barely past 2% of the world population, so lots more to climb,” said Woo.

Chart: The increase in Bitcoin users visible on its blockchain per day.

Retail investors arrived in Jan.

Like prior cycles, I expect this peak to top out higher than the ones before it.

Gives you an idea how this bull market is just warming up.

Data: @glassnode pic.twitter.com/csGLp9sLze

— Willy Woo (@woonomic) March 3, 2021

Bitcoin Sits on Top of Stable Support

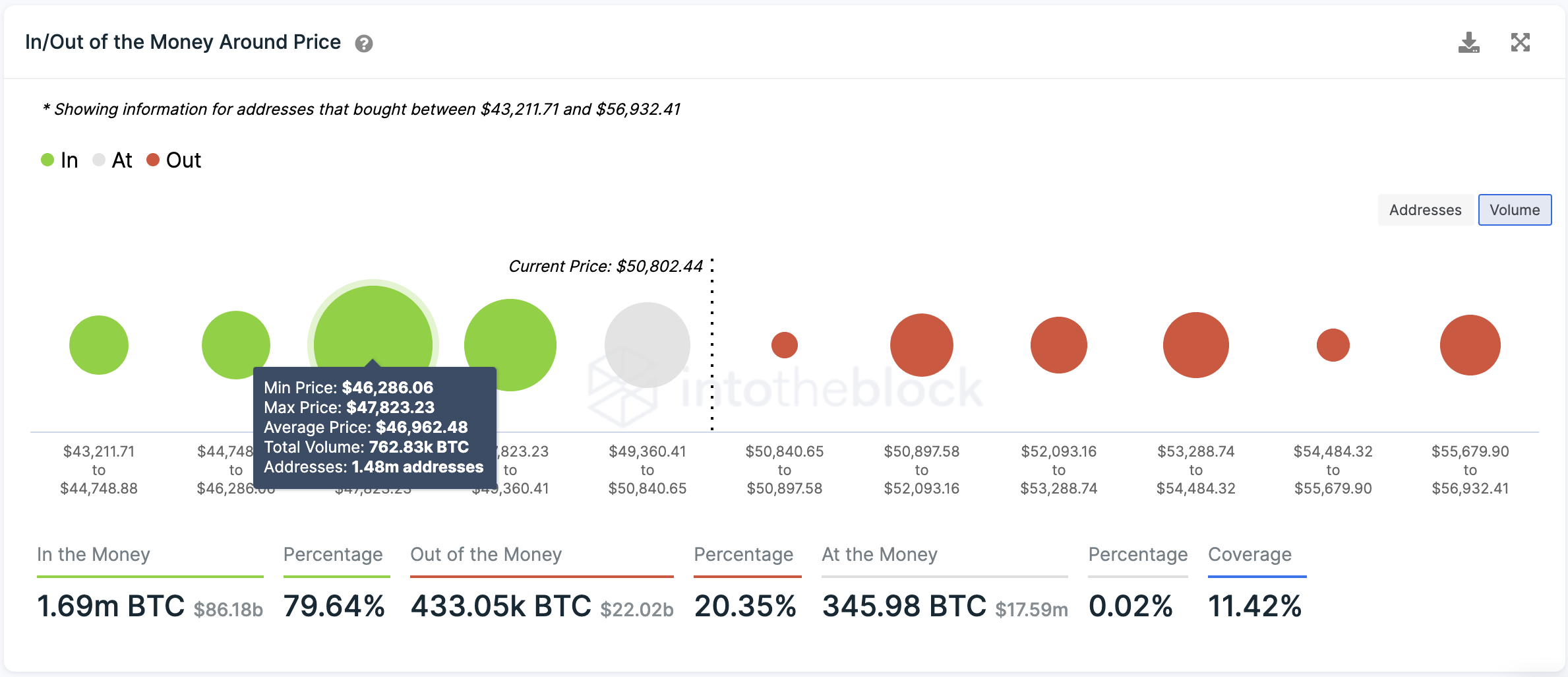

Transaction history shows that as long as Bitcoin remains trading above the $46,000 support zone, it will likely continue trending upward.

Based on IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that nearly 1.50 million addresses had previously purchased over 760,000 BTC around this price level. This massive demand wall could absorb some of the selling pressure in the event of a correction, preventing Bitcoin from falling further.

Holders within this price range will likely do anything to keep their investments “In the Money.” They may even buy more tokens to allow prices to rebound.

That said, a sudden spike in selling pressure that pushes Bitcoin below the $46,000 support area could be catastrophic for those betting on the upside. The IOMAP cohorts show that the next significant level reinforcing BTC’s uptrend sits around $40,000.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.