Bitcoin could reach $87,000 in 2024 per veterans’ average predictions

The price is the average prediction of 31 different fintech executives, which ranges from $100,000 to $1.5 million.

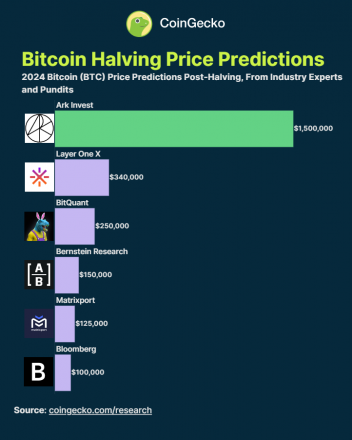

The approach of Bitcoin’s (BTC) fourth halving and the approval of its first spot ETF in the US prompted price predictions for 2024 ranging from $100,000 to $1.5 million, points out information gathered by CoinGecko from a Finder survey. The average BTC price found in 31 predictions made by different fintech executives is $87,000.

On top of representing the industry’s expectation of Bitcoin’s performance in 2024, this figure represents aggregated sentiment and understanding of asset potential post-halving value. Interestingly, nearly half of the surveyed experts believe BTC is currently underpriced, while 10% view it as overpriced.

Halving is the event in which BTC miners’ rewards paid for each successfully mined block are reduced by 50%, thus halving the daily batch of new Bitcoins. This supply shock is seen by analysts as a key event to track crypto market cycles, being the reason why crypto veterans pay attention to the halving.

However, it is crucial to acknowledge the diversity in these predictions, underscoring the complexity and uncertainty inherent in cryptocurrency markets. For instance, ARK Invest’s projection extends to a staggering $600,000 by 2030 in a worst-case scenario. In contrast, other forecasts, like those from Matrixport and BitQuant, suggest a more immediate target, with predictions ranging between $80,000 and $250,000 by the end of 2024.

These variations are indicative of the myriad factors influencing cryptocurrency prices, from market liquidity to macroeconomic trends.

This broad spectrum of predictions can also be exemplified by the recent VanEck valuation report on Solana (SOL), which offered a wide range of $10 to $3,211 by 2030. This highlights the speculative nature of the crypto market, where even the most informed predictions can encompass an extraordinarily wide range of outcomes.

Therefore, investors and enthusiasts must approach these predictions from a balanced perspective. While the average price target of $87,000 is a valuable indicator of market sentiment, it must be contextualized within the broader market dynamics and potential future developments.