Shutterstock photo by one photo

Bitcoin Traders Expect Volatility as Options Expire

BTC is preparing for another round of volatility ahead of large-scale options contract expirations.

Bitcoin traders are preparing for an extended short-term correction, as options contracts of 118,000 BTC ($3.5 billion) expire on Jan. 29.

Bitcoin Price Volatility Ahead

Bitcoin’s price fell by a record percentage of 13.1% on Thursday. The price carnage led the coin’s value to fall to $28,800.

According to options market data, volatility is expected to remain high until next Friday, with the largest volume of options of $3.5 billion notional volume expiring that day.

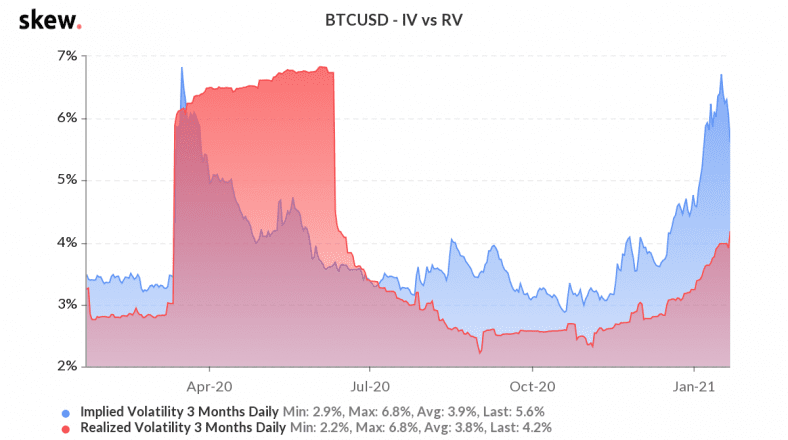

The implied volatility of Bitcoin, which represents the market’s expectations for volatility, is near record highs of 6.2%—levels not seen since the COVID-19-related crash in March.

Higher levels of implied volatility also correspond to costly premiums for options contracts.

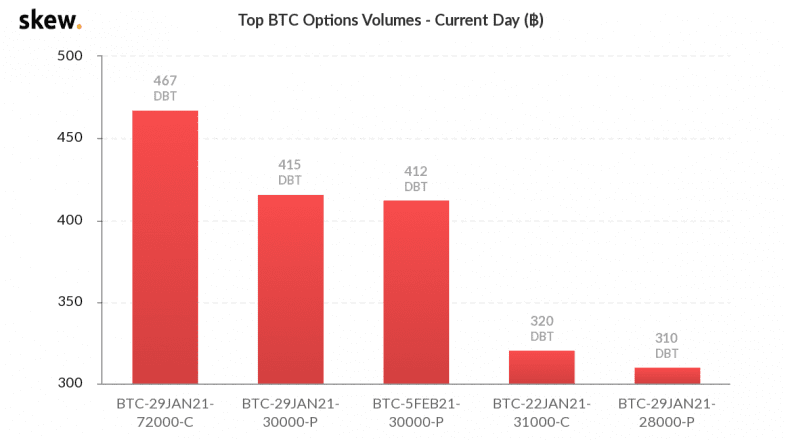

Deribit, which is responsible for 85% of options trading, has seen a high volume of put orders at strike prices of $31,000 and $28,000, expiring on Jan. 19, since BTC plummeted yesterday. This suggests that traders are reducing their short-term risk against further downfall.

Notably, 467 contracts for call options were also picked up at a strike price of $72,000. The above trade may represent a hedging order against short exposure. More likely, it represents the opening of long interest after spot liquidation.

The maximum pain level, where both call and put buyers incur maximum loss, is at $28,000.

Disclosure: The author held Bitcoin at the time of publication.