Shutterstock cover by surassawadee

Cardano Must Break Crucial Resistance to Head to $2

Cardano must slice through a massive supply barrier to achieve its upside potential.

Cardano has broken out of a consolidation pattern, but it’s lacking the volume it needs for a trend reversal.

Cardano Faces Stiff Resistance

Cardano has not had the strength to advance further after breaking out of a descending triangle on Jul. 24. The $1.33 resistance zone has prevented ADA from achieving its upside potential.

Although the technical formation forecasts a 54.55% upswing toward $1.91, trading volume remains almost flat.

Amazon’s negative stance on supporting cryptocurrency payments may have contributed to Cardano’s stagnant price action. Now, time is running out for the fifth-largest cryptocurrency by market capitalization to make its final move.

Buy orders need to increase at the current levels for ADA to target higher highs and avoid a steep correction.

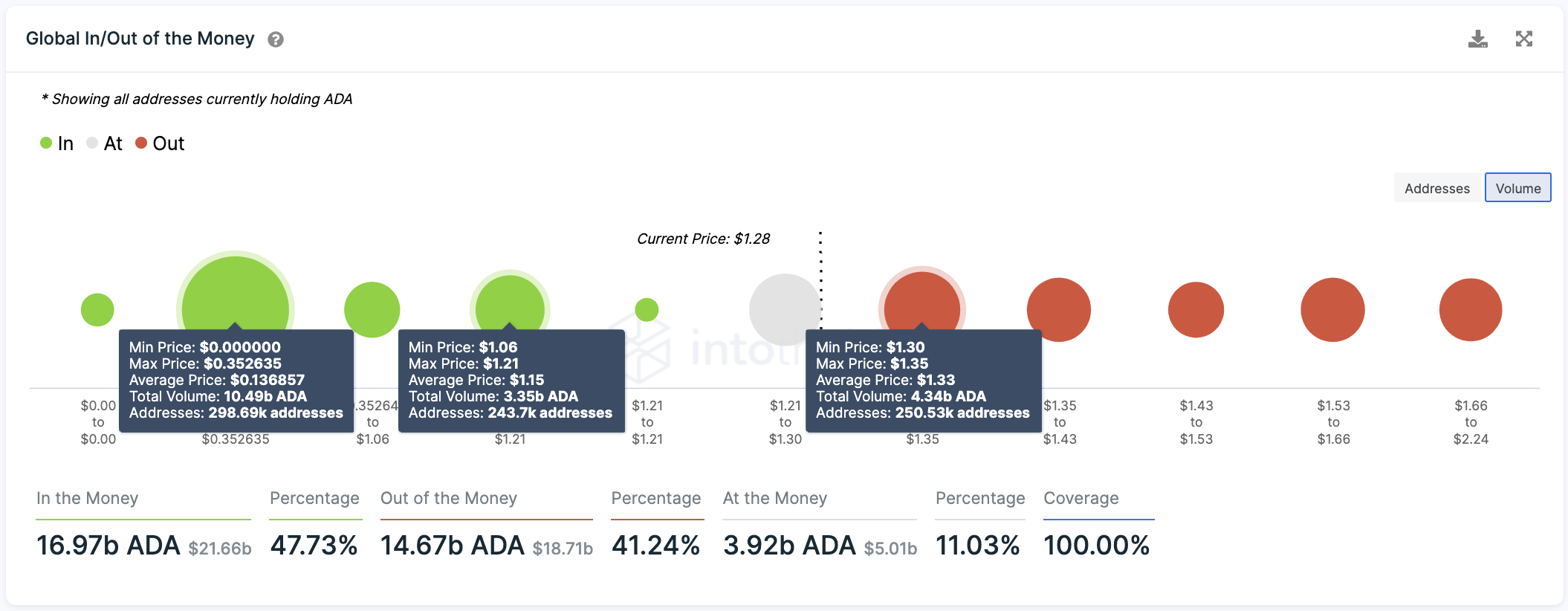

IntoTheBlock’s In/Out of The Money Around Price (IOMAP) model shows that 250,530 addresses have previously purchased over 4.34 billion ADA between $1.30 and $1.35. Holders within this price range could be trying to break even on their underwater positions, which would hold the asset back.

A spike in buying pressure that allows Cardano to move past $1.33 might be all that is needed for prices to rise toward the $1.91 target presented by the descending triangle as the IOMAP model shows no other significant supply wall ahead.

On the other hand, transaction history reveals that the most critical support level underneath Cardano sits between $1.06 and $1.21. Here, 243,700 addresses bought 3.35 billion ADA.

This demand barrier must hold in the event of a sell-off since the next support level sits at $0.35, according to the IOMAP model.