Cardano Poised to Retrace Before 30% Breakout

Cardano is primed to pull back as critical resistance has rejected further upward price action.

Cardano has traded sideways for the past month while Bitcoin stole the crypto spotlight after rising to a new all-time high of more than $23,000. Though investors expect ADA to catch the rest of the market, technicals point to a retracement before a massive breakout.

Cardano Plays Catch Up

The so-called “Ethereum killer” has endured a month-long stagnation period that began in late November. Since then, ADA has made a series of higher lows, while the $0.175 resistance barrier has prevented the token from achieving its upside potential.

Such price action appears to have led to the formation of an ascending triangle on the 4-hour chart. A horizontal trendline developed along with the swing highs, while a rising trendline was created along with the swing lows.

A spike in demand for Cardano around the current price levels could be significant enough to allow it to slice through the overhead resistance. If ADA moves past the $0.175 hurdle, FOMO will likely kick in, pushing prices up by more than 30%.

The $0.232 level may serve as a potential target when considering the distance between the ascending triangle’s two highest points.

Given the overwhelmingly bullish sentiment among investors, there is a high probability that the cryptocurrency market is bound for a steep correction before the uptrend resumes.

A Short-Lived Correction Before Higher Highs

Trading veteran Peter Brandt has publicly stated that he exited 20% of his Bitcoin position because bull rallies are often accompanied by “short-term blow-offs.”

If this were to happen, the ninth-largest cryptocurrency might retest the ascending triangle’s hypotenuse at $0.153 before a breakout occurs.

This short-term bearish scenario holds when looking at Cardano’s transaction history.

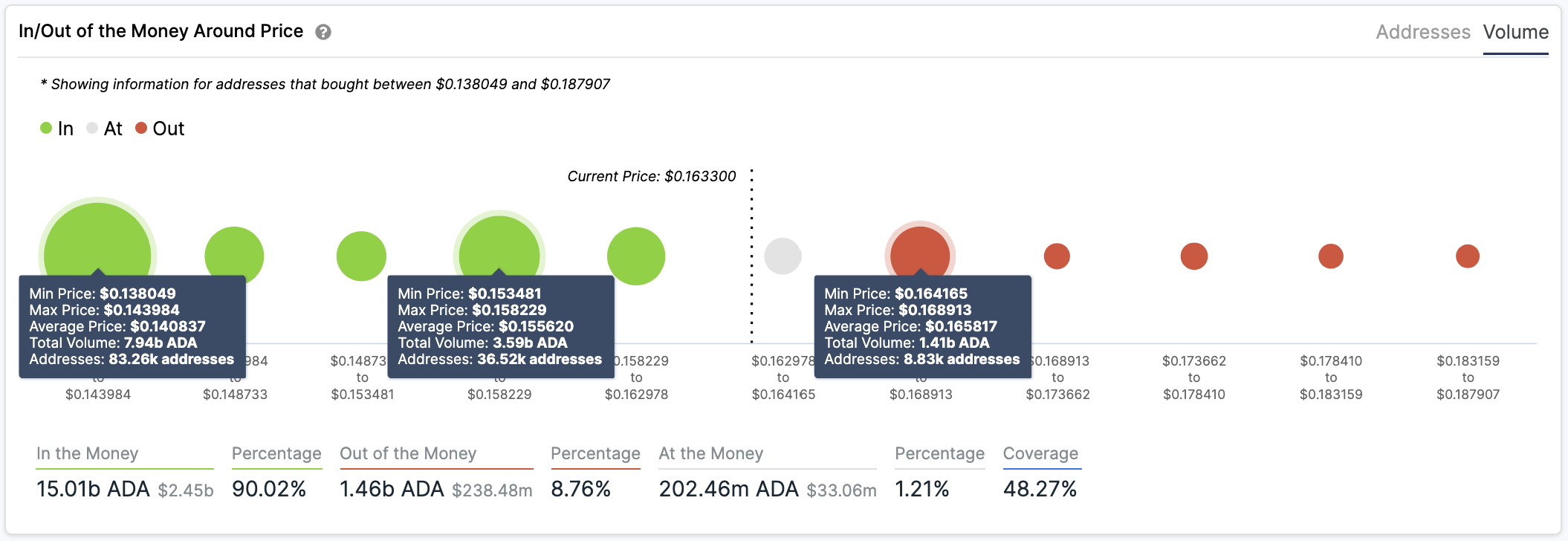

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that this altcoin sits underneath a significant supply barrier. More than 8,800 addresses had previously purchased over 1.4 billion ADA around $0.168.

This resistance wall will likely continue to hold and absorb some of the buying pressure seen recently. As holders who have been waiting to break even on their positions, they may slow down the uptrend and trigger a correction.

On its way down, the IOMAP cohorts show that Cardano might find stable support at $0.153 around the ascending triangle’s hypotenuse. Here, roughly 36,500 addresses bought nearly 3.6 billion ADA.

Such a crucial area of interest could keep falling prices at bay and serve as a rebound zone.

Earn with Nexo

Earn with Nexo