Chainlink, Kyber Network Prices Surge with Strong Developer Activity

The development communities behind Chainlink and Kyber Network continue to make strides in expanding the utility of their respective tokens.

Chainlink and Kyber Network demonstrated astonishing price growth this month. Software development activity from these two projects is one indicator that could help predict where LINK and KNC are moving next.

Chainlink Expands Its Utility

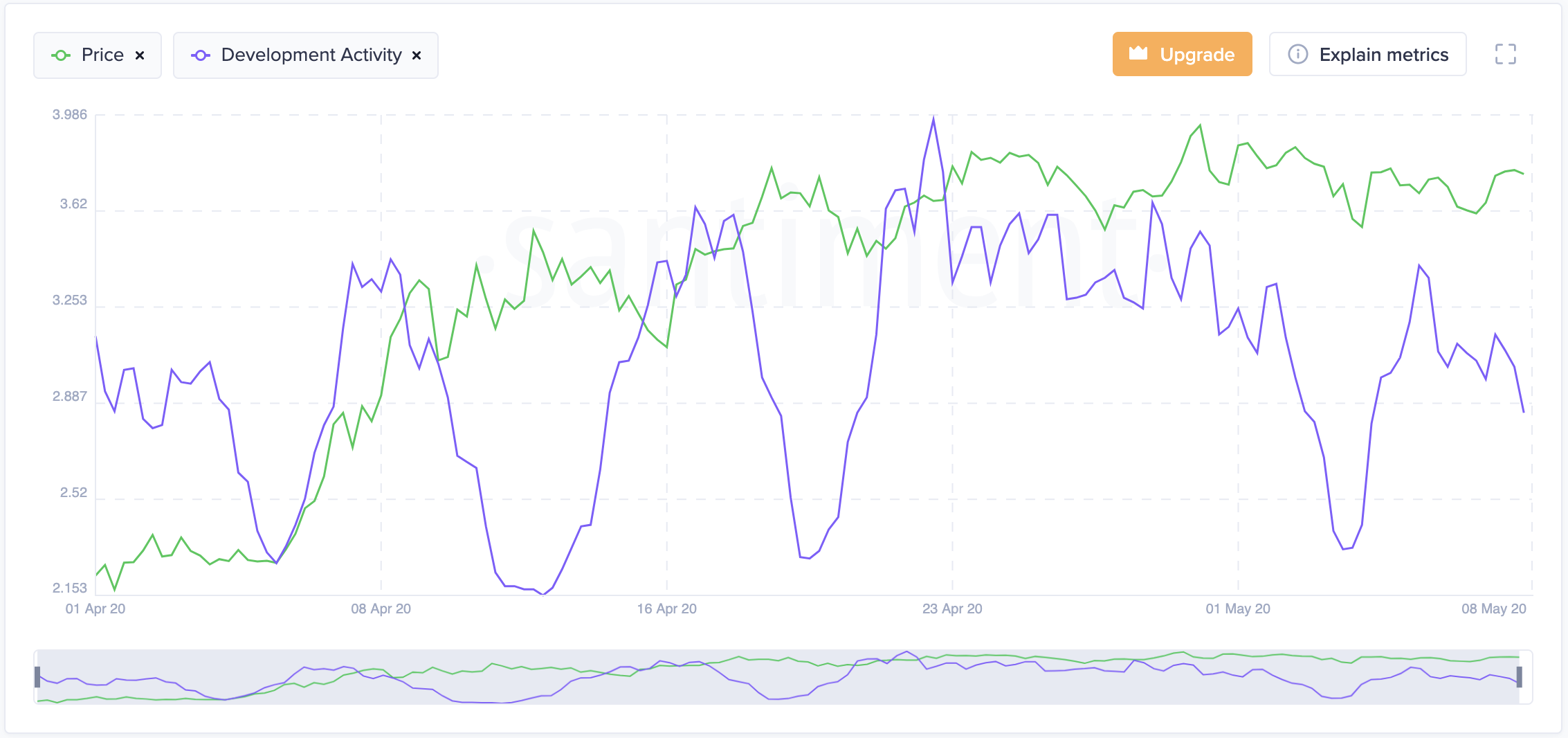

Chainlink has been staying true to its long-term roadmap, and it shows. Chainlink has shown robust development activity over the past month, according to Santiment.

Indeed, the decentralized oracles firm kicked off April by announcing a partnership with Cypherium, an enterprise-focused blockchain platform, to give them “access to fully integrated smart contracts that are secure end-to-end.”

Then, Acala Network revealed it will use Chainlink to supply robust and reliable price feeds to DeFi applications running on Polkadot. Another firm, IRISnet, integrated Chainlink to support interchain interoperability.

As Chainlink expands its use throughout the entire cryptocurrency industry, it fortifies its use cases and value for developers building smart contract applications. This could be one of the reasons why many investors have given LINK their vote of confidence, which is clear from its recent price growth.

The oracles token saw its price rise by nearly 90% in April. It went from trading at a low of $2.1 to a high of $4 by the end of the month. Despite the significant bullish momentum, it seems that LINK could be bound for a correction in the short-term.

The TD sequential indicator recently presented a sell signal in the form of a green nine candlestick on LINK’s 3-day chart. This bearish formation estimates a one to four candlestick correction before Chainlink continues its uptrend.

An increase in the selling pressure behind this altcoin that allows it to break below the 78.6% Fibonacci retracement level may validate the pessimistic outlook. If this were to happen, the next significant level of support to watch out for is represented by the 61.8% and 50% Fibonacci retracement levels.

These demand barriers are currently sitting at $3 and $2.75, respectively.

Since Chainlink’s price action remains highly unpredictable, as it has invalidated many of these technical signals before, the bullish outlook cannot be ignored.

Breaking above the recent high of $4 would put the pessimistic scenario in jeopardy. Under such circumstances, the next key level of resistance that LINK may test lies around $4.7, which is the location of the 127.2% Fibonacci retracement level.

Kyber Network Prepares to Fork

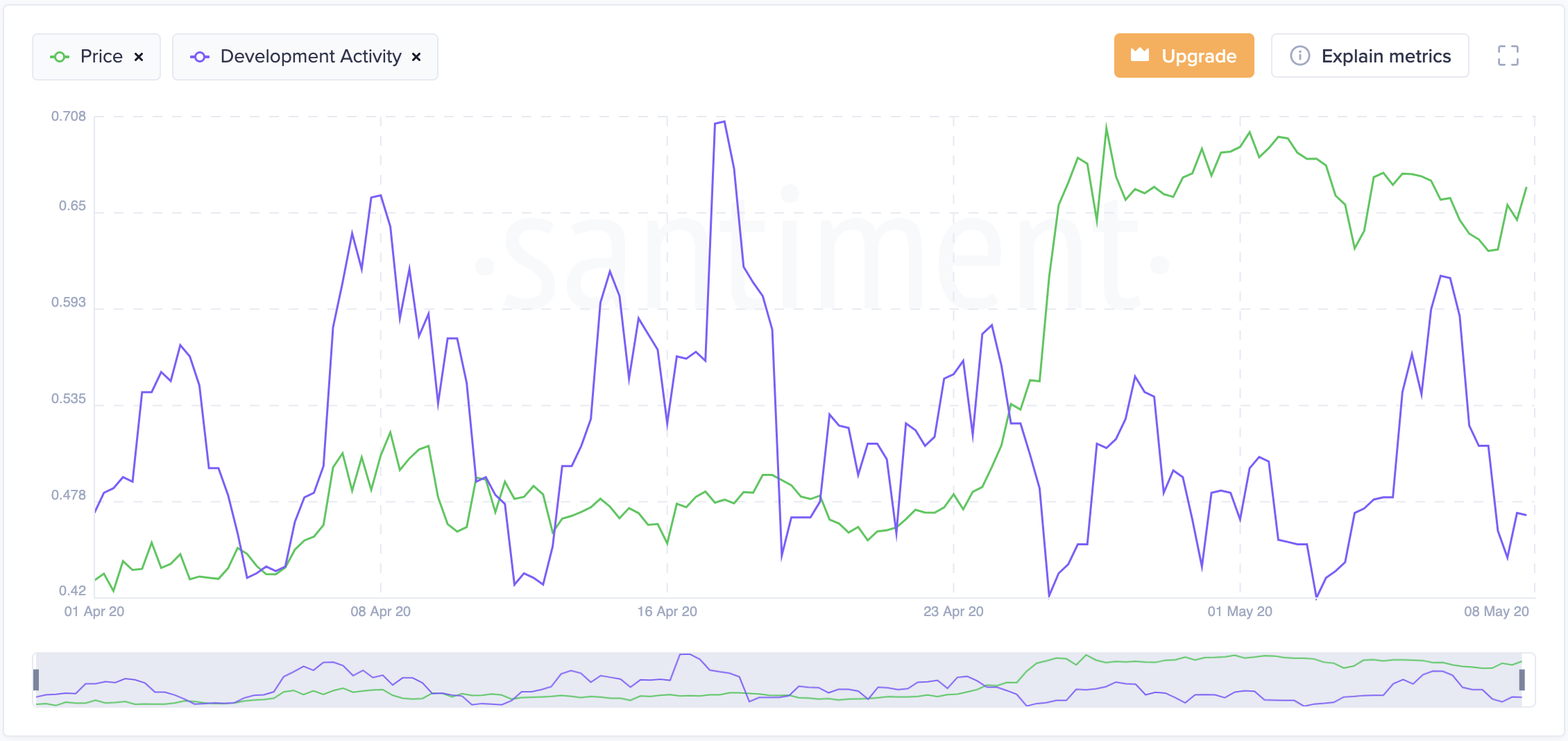

Like Chainlink, Kyber Network also saw a significant spike in its development activity last month. These were mostly related to the upcoming launch of Katalyst and KyberDAO as the development team pushes to meet deadlines, said Santiment.

One of the most important updates shared in April was an overview of how staking, voting, and delegation works. By partnering with StakeWith.US, the Kyber team will allow all KyberDAO Pool Masters to operate without the need to deploy additional smart contracts.

“Kyber staking doesn’t require any minimum amount, lockups, or slashing. KyberDAO and the governance process were designed to empower our community while ensuring the security and stability of the network. Now with StakeWith.Us, KNC holders will possess even greater flexibility in participating in network governance,” said Loi Luu, CEO of Kyber Network.

Additionally, Kyber Network was able to integrate several crypto startups into its ecosystem, including Rarible, Unstoppable Domains, Bullionix, Furucombo, and SNX.Link.

As emotions heat up in the run-up to the Katalyst fork, the price of KNC appreciated over 80% in the past month. Even though some of these developments are already priced in, it still looks like Kyber has more room to go up.

From a technical perspective, KNC has been creating a bull pennant in its 12-hour chart. The 70% rally that took place between Apr. 20 and 26 created the flagpole. Now, the descending triangle that is developing looks like it will complete the flag.

This continuation pattern estimates that upon the breakout point, Kyber may surge up to 41.5% in the same direction of the previous trend. If this technical formation is confirmed, KNC may soon be worth $0.93.

Nonetheless, the $0.63 support level will be key to determine whether or not KNC has the ability to reach its upside potential. A bearish impulse that pushes this altcoin below this demand barrier may indicate that a further retracement is underway.

Moving Forward

Although development activity is not necessarily a good leading indicator of price, it adds legitimacy to projects that are involved in an industry that has been plagued by scams. The fact that both Chainlink and the Kyber Network development communities continue working despite the uncertainty in the global financial system is a sign of strength. Moreover, it reduces the downside risk of holding these coins long term if they can maintain their pace of development.

Now, it’s a matter of how these cryptocurrencies will behave as Bitcoin’s halving approaches. This event will likely usher in high levels of volatility, which will test the support and resistance levels previously mentioned.

Now, it’s a matter of time before LINK and KNC provide a strong signal of where they are headed next.

Earn with Nexo

Earn with Nexo