ChainLink Mainnet Launch In Nine Days: LINK Investment Analysis

ChainLink is going strong in the lead-up to its mainnet launch.

The ChainLink (LINK) mainnet is launching on May 30th. Using our previous mainnet analysis, we can examine the trading patterns that have characterized similar events in the past.

These data are only based on historical mainnet returns, and in no way guarantee that LINK will perform in a similar manner. They do not account for the fundamental strength of the project, nor its suitability for its stated purpose.

LINK announced that they’d be launching their mainnet on May 14th:

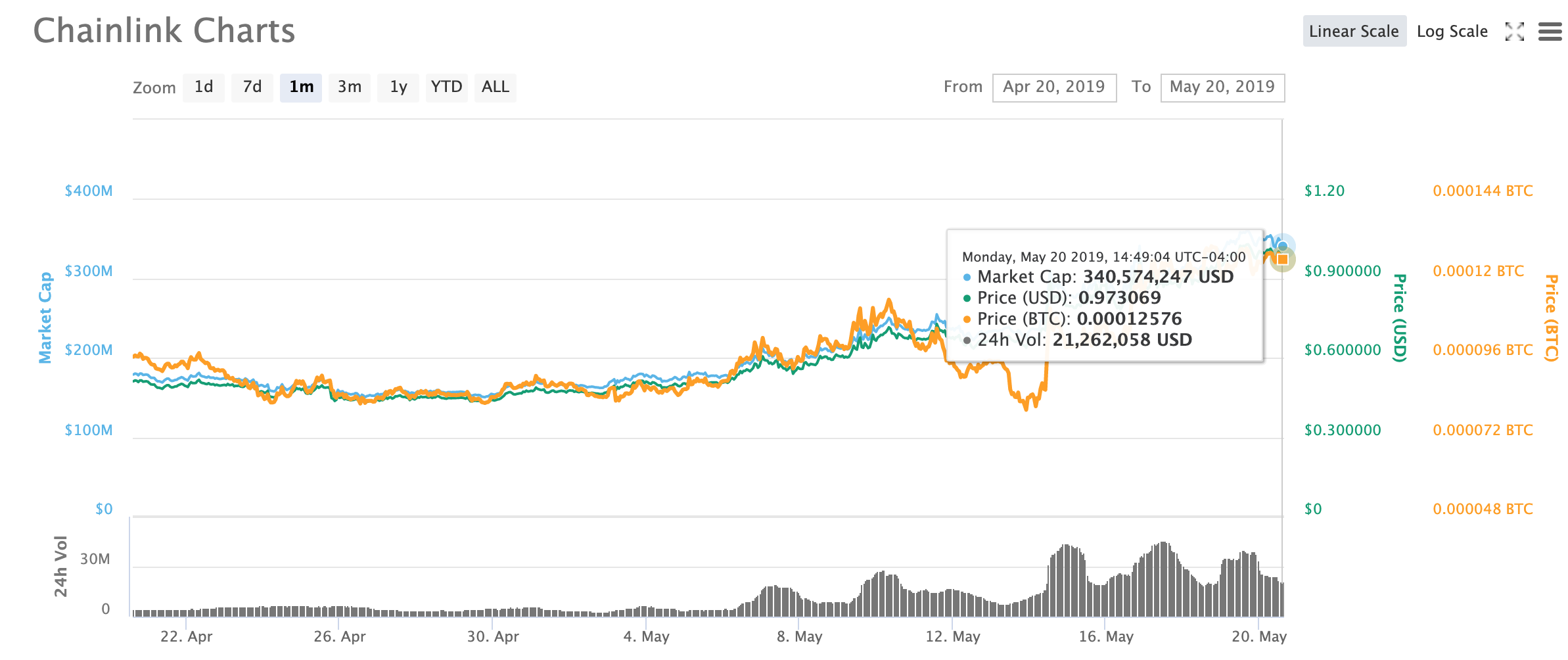

Since then, the price of LINK has increased by 50% relative to BTC in just six days:

It’s worth noting that the 50% jump in price may have also been influenced by a cryptocurrency investment analysis company, which issued a buy-signal on LINK on May 16th at 4pm EST. The signal pumped the coin an additional 18% in a few hours.

Three weeks ago, our team aggregated a data set to analyze the price changes of 28 popular cryptocurrencies which launched mainnets between 2017 and 2019. We concluded that the most profitable strategy was a variation in which the investor buys the coin 30 days prior to the mainnet launch, sells one day prior, and then buys the coin back 30 days later.

How can we apply this to LINK?

LINK’s mainnet launch will likely play out a bit differently. We won’t be able to apply that concrete strategy since the announcement was only made two weeks prior to the actual launch.

Based on data from previous mainnets, coins tend to appreciate an average of 15% in the 30 days prior to a mainnet launch, and depreciate an average of 10% in the 30 days following their launch.

LINK is performing exceptionally well after the announcement of its mainnet launch. This could be due to the market’s excitement in the price of BTC, coupled with the fact that their announcement was made at Consensus.

Armed with this information, it could be argued that LINK is currently overvalued for a coin that has yet to demonstrate significant tangible adoption. The market may exercise caution knowing that historically, coins tend to lose value after the excitement of their mainnet launch has worn off.

FOMO is a powerful force, and it can lead to buying the top. In LINK’s case, we’ll be watching in the next month to see if the pricing mimics the data we’ve examined for previous mainnets.

You know what they say: the harder they pump… the harder they can fall!