Coinbase’s cbETH Staking Generates 4% of Exchange’s Revenue

Coinbase expands into staking and layer-2s amid low trading volumes.

Coinbase, the largest US-based crypto exchange, is diversifying its revenue streams beyond trading fees amid the ongoing crypto winter, according to a new report by blockchain analytics firm Coin Metrics. A key area of growth is the company’s Ethereum staking service.

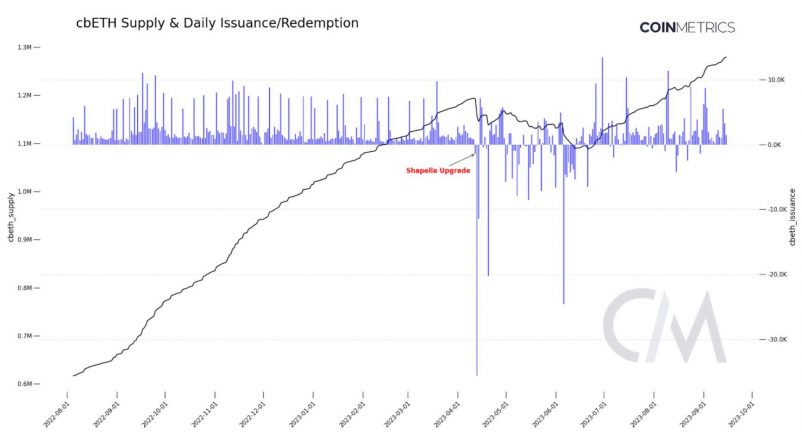

Coinbase’s staking service allows customers to stake their ETH by converting it into a token called cbETH. Despite facing scrutiny from the SEC, cbETH has seen its supply rise to 1.3 million as staking demand increases after the Merge.

The 25% commission that Coinbase charges on cbETH staking generated 4% of the company’s revenue in Q2 2022, the report revealed. While trading volumes remain Coinbase’s primary revenue driver, staking and other services are starting to make up a more material portion of revenues.

“The adoption of cbETH and Base are evidence of a commitment to an on-chain future beyond the exchange,” said Kyle Waters, analyst at Coin Metrics.

Last month, Coinbase also launched its own layer-2 network called Base. While still early, Base aims to provide a low-cost environment for Ethereum developers and easy integration with the Coinbase exchange.

However, operating a layer 2 (L2) comes with expenses like posting transaction data to Ethereum, which can consume significant gas fees. As an EVM L2 Base has to write batches of transactions to Ethereum as part of its operations. On some days, the gas fees consumed by these L1 data batches have reached over 1% of the total fees paid on Ethereum.