Why Is Dash Celebrating Smaller Transactions?

Dash appeals to a broad spectrum of people who have been shut out of legacy finance.

For most traders, high-value transactions are a sign of a healthy cryptocurrency. Big Bitcoin movements frequently make waves on Twitter, and Litecoin once made headlines by moving $99M in one go. But it’s not very often that you find someone bragging that their transactions are getting smaller.

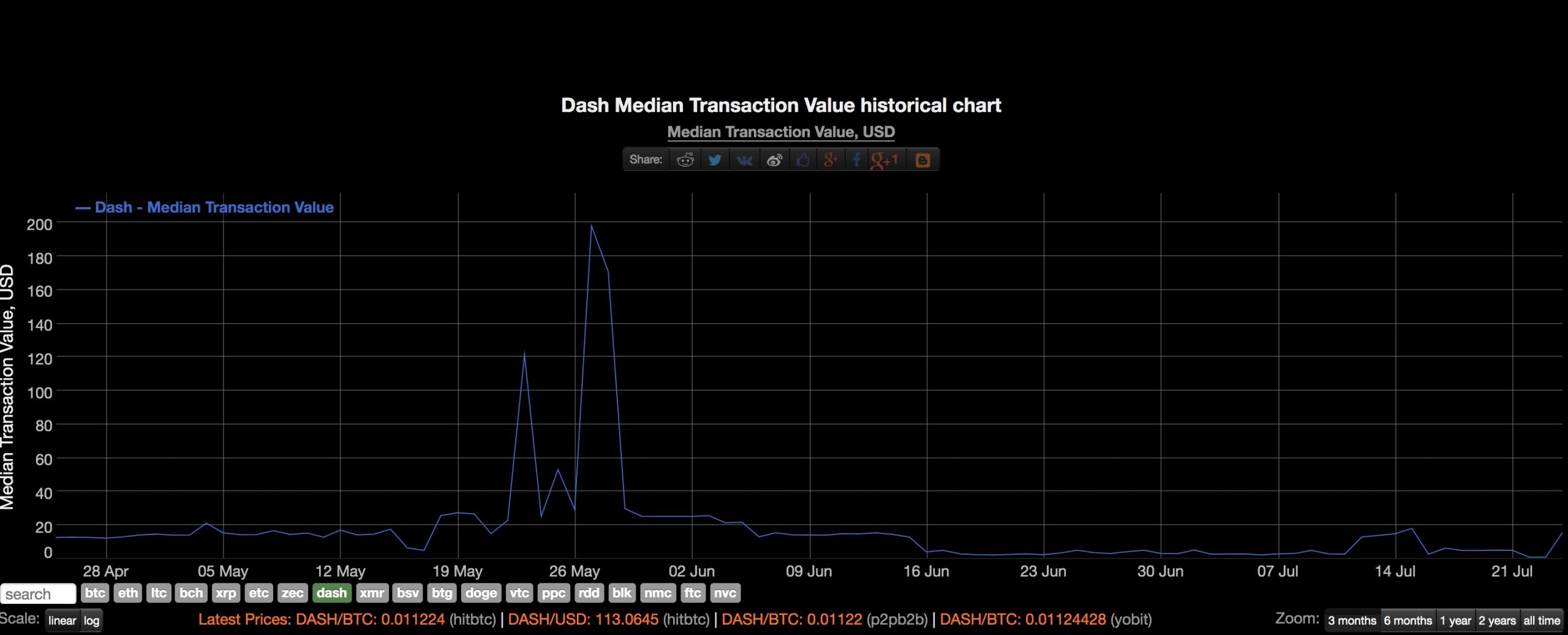

The average size of a Dash (DASH) payment has dropped considerably over the past year, and supporters say that’s good news. Based on data from BitInfoCharts, Dash’s median transaction value has dropped by more than 99% since over the past eighteen months.

From more than $1,600 back in January 2018, the median value for a Dash transaction fell quickly to the narrow range between $15 and $30. Having started June 2019 at roughly $25, Dash payments have dropped to a much lower range around the $5 mark. Just yesterday, the median value came in at just $1.

While partly due to the 90% drop in the token price over the same time period, a Dash Core report suggests that the decline in median transaction values indicates that larger speculative trades are giving way to “more repetitive transactions, reminiscent of transactions that are used for everyday purchases.”

Additional data support this conclusion. Since January 2018, the number of active wallets increased from 5,000 to well over 30,000, while daily transaction volume now exceeds 20,000, an 86% increase from eighteen months ago.

Where’s adoption coming from?

Venezuela has been a key driver for growth, explained Ernesto Contreras, Dash Core’s regional manager for Latin America. From no active wallets at all back in January 2018, there are now more than 10,000 in the country alone, comprising a third of the Dash network.

Crypto-enabled smartphones that come pre-loaded with Dash have proven popular in Venezuela. Kriptomobile reported in its first quarterly sales back in December that it had sold more than 66,000 phones to LATAM merchants, with 53,000 going straight to Venezuela, as Crypto Briefing reported at the time.

“This is not just happening in Venezuela,” said Fernando Gutierrez, Dash Core CMO. There are other Dash communities popping up all across the LATAM region, including in Brazil, Peru and neighbouring Columbia. There is also a growing user base in Spain.

“And those are just the ones we know about”, added Contreras. Dash Core frequently comes across cases of people using Dash who aren’t necessarily in an official community or have any communication with the broader user network.

Contreras believes Dash is succeeding because backers quickly identified who would benefit most from their cryptocurrency. People living within a fully-functioning economy don’t have much need for Dash, says Contreras, but there are vast swathes of the world’s population who have been left behind and gain little benefit from legacy systems.

As a vertical, Dash has become a remittance solution for migrant workers looking to send a portion of their wages back to their home countries. While legacy remittance solutions like Western Union charge fees up to 9.5%, value can be transferred quickly and easily using the Dash network, with negligible fees.

Dash is also becoming a popular choice for America’s cannabis industry. While marijuana is legal for medicinal use in thirty-three states, and recreationally legal in eleven, many merchants struggle to access financial services because banks are regulated at a federal level, where cannabis remains completely illegal.

“Many [cannabis] merchants have little choice than to hold funds in cash,” said Gutierrez. Dash provides access to a global financial network and protects them against the risk of theft or burglary.

Dash adoption

By having a clear understanding of the target market, Dash has quickly gained traction across a variety of sectors, where the only common thread is a lack of access to the traditional financial sector.

“An increase in the number of non-speculative transactions on a blockchain is always good for the health of that network,” explained Akbar Thobhani, CEO and co-founder of SFOX. Speculation is not intrinsically bad, but “any useful asset ought to have a healthy balance of utility, speculation, and accumulation.”

Dash set out to be a payments solution for anyone. The latest data show the project is well on its way towards fulfilling that objective.