Data Indicates Chainlink and Band Protocol Are Due for a Correction

Decentraliezd oracles tokens LINK and BAND have hit new all-time highs, but their uptrends may soon reach exhaustion.

Investors are overwhelmingly bullish on Chainlink’s LINK and Band Protocol’s BAND tokens. Still, different on-chain metrics suggest these competing oracle tokens are bound for a wild downward ride.

LINK Whales Offload Their Bags

Those who dared to short Chainlink over the past few weeks have been left in the dust.

The decentralized oracles token continues trending upwards, having surged by a whopping 127.5% since the beginning of the month. The swift price action allowed LINK to steal the crypto spotlight as prices recently hit a new all-time high of over $17.7.

Chainlink was able to take a 4% share of the overall cryptocurrency market capitalization, earning the number five spot on the top ten cryptocurrencies’ list.

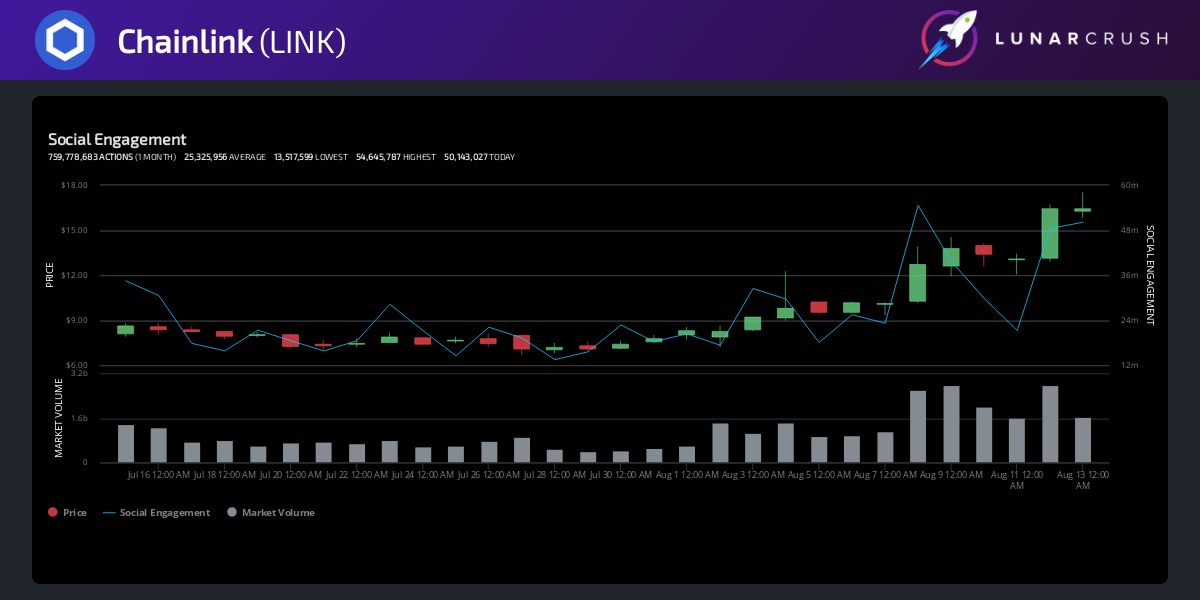

Data from LunarCRUSH reveals that the number of LINK-related mentions on social media skyrocketed in August, too. The community insights provider has registered over 410 million social engagements thus far this month. More importantly, roughly 68% of all the social interactions have been bullish about Chainlink.

These include favorites, likes, comments, replies, retweets, quotes, and shares, to name a few.

The rising chatter around LINK across different social media networks is nonetheless concerning.

Usually, when market participants pay increased attention to a given cryptocurrency due to an ongoing pump, it tends to lead to steep corrections.

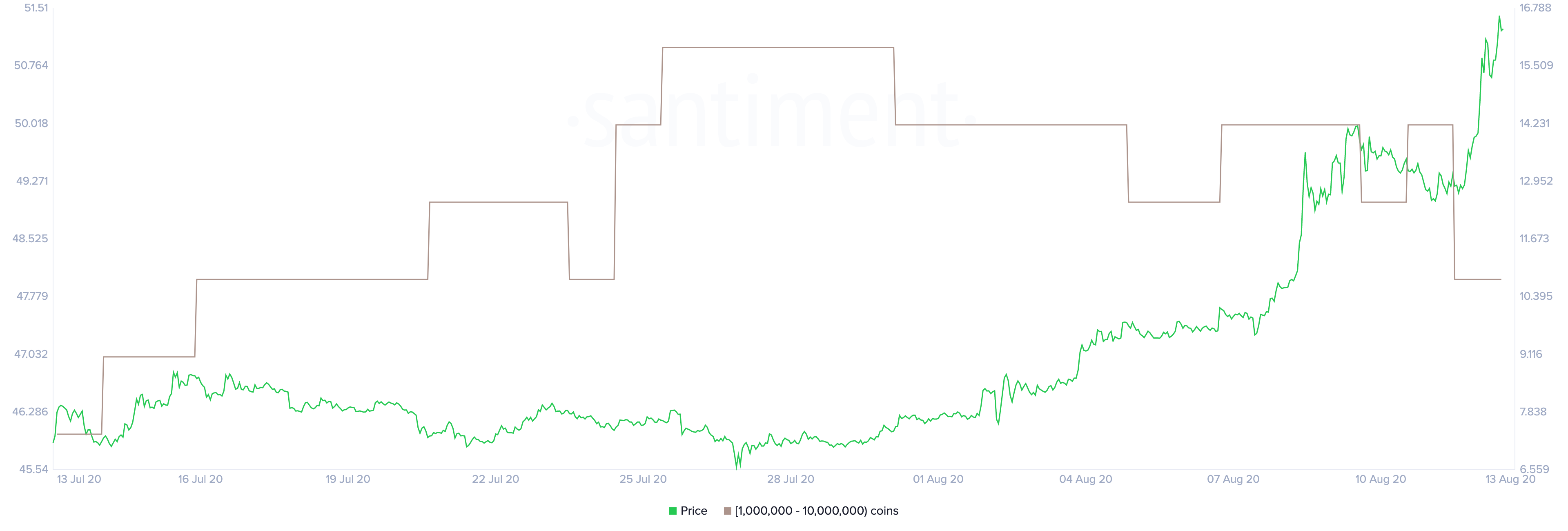

Big investors with millions of dollars in Chainlink, colloquially known as “whales,” seem aware of the high probability of a significant downturn. Santiment’s holder distribution chart shows that some of the biggest whales on the network have been offloading a massive number of tokens over the past few weeks.

Since Jul. 30, the number of addresses holding 1 million to 10 million LINK has decreased dramatically. Roughly three whales have left the network, representing a 5.9% decline in a short period.

The recent decline in the number of large investors behind Chainlink may seem insignificant at first glance. Still, when considering that these whales hold between $17 million and $170 million in this token, the sudden spike in selling pressure can translate into millions of dollars.

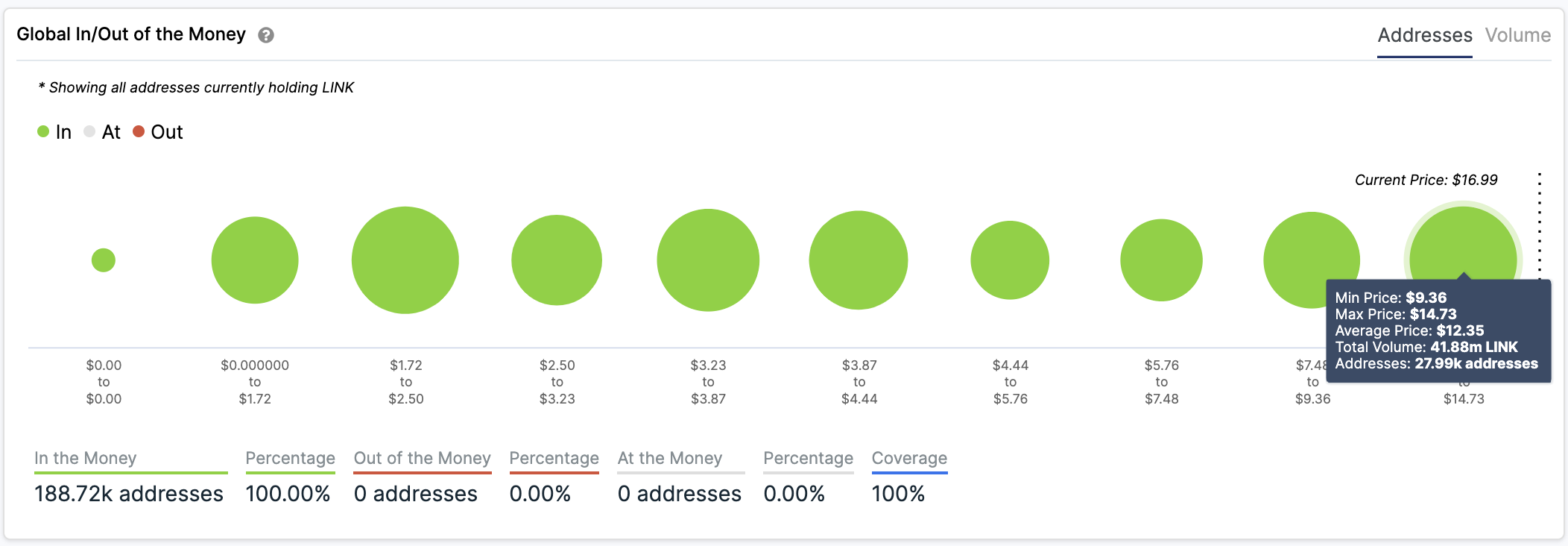

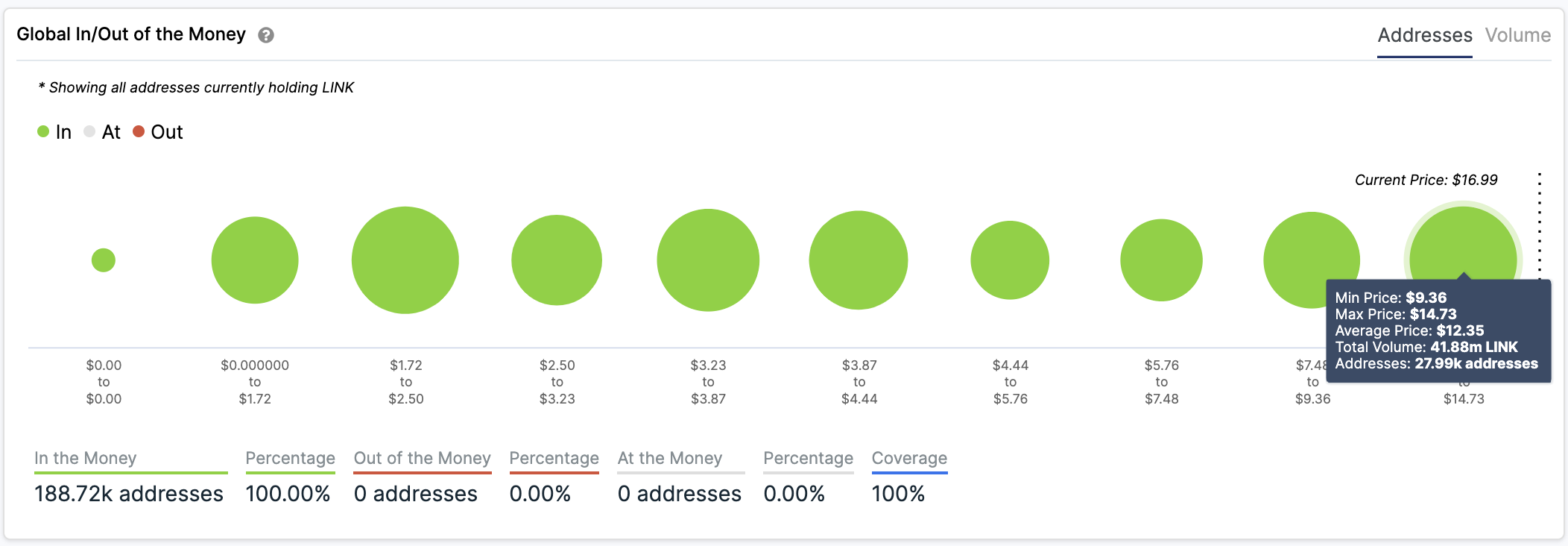

In the event of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals there is a crucial supply wall underneath Chainlink that could hold. Based on this on-chain metric, roughly 28,000 addresses had previously purchased nearly 42 million LINK around $12.35.

Such a considerable area of interest may have the ability to absorb some of the selling pressure. Holders within this price range would likely try to remain profitable in their long positions.

They may even buy more tokens to avoid seeing their profitable investments go into the red.

It is worth mentioning that Chainlink is currently in price discovery mode. Thus, the probability of a further advance cannot be taken out of the question.

The Fibonacci retracement indicator estimates that this cryptocurrency may rise towards $22 if buy orders continue piling up.

Millions of BAND Tokens Hit Exchanges

Like Chainlink, Band Protocol has also been on a rampage.

Its native token, BAND, saw its price increase more than 330% since the beginning of August. As of today, the token has a year-to-date return of over 8,870%.

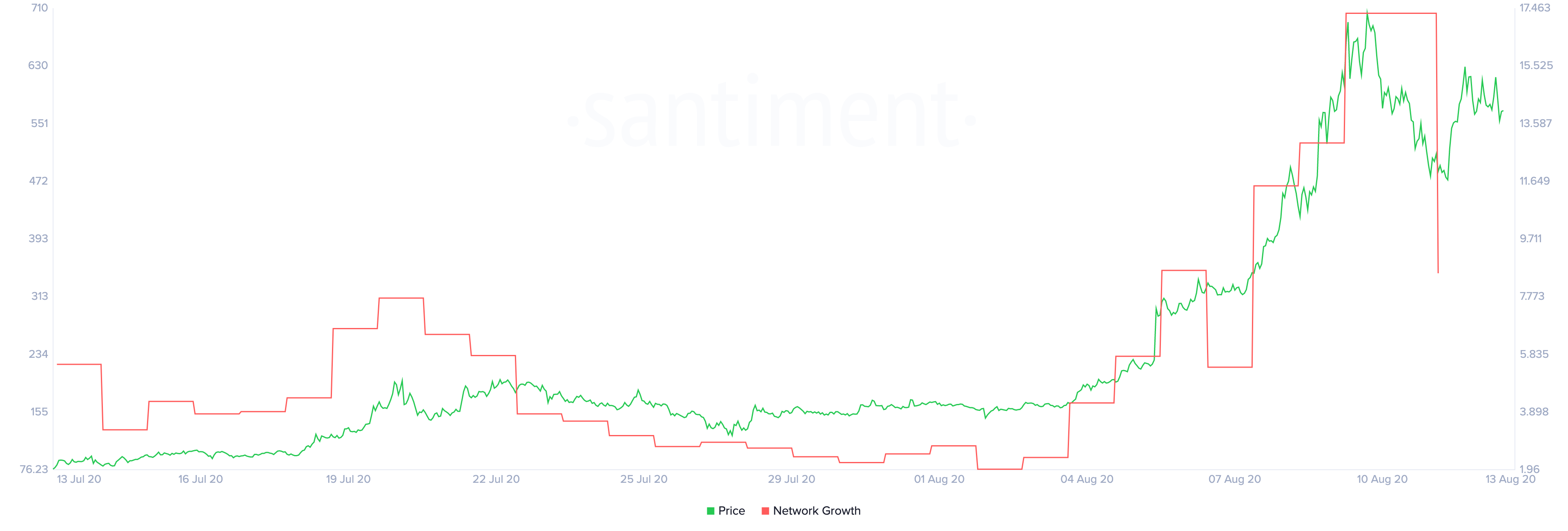

Despite the massive gains that this cryptocurrency has posted, the number of new daily addresses joining its network has declined. Such divergence between prices and network growth is something to worry about, according to Brian Quinlivan, marketing and social media director at Santiment.

Quinlivan maintains that network growth is “one of the most accurate price foreshadowers.”

The increase in user adoption over time can help analysts understand the health and well being of any given cryptocurrency.

“Generally, rising network growth leads to a rising price of any project over time, in most cases. On the flip side, declining network growth for a long enough stretch can usually indicate a future slumping price with the lack of newly created addresses constantly in-flowing the coin or token,” said Quinlivan.

Given the rate at which Band Protocol’s network growth is declining, investors must remain cautious.

If the selling pressure behind BAND increases, it would likely be bound for a wild downward ride. This thesis holds when looking at activity across top cryptocurrency exchanges.

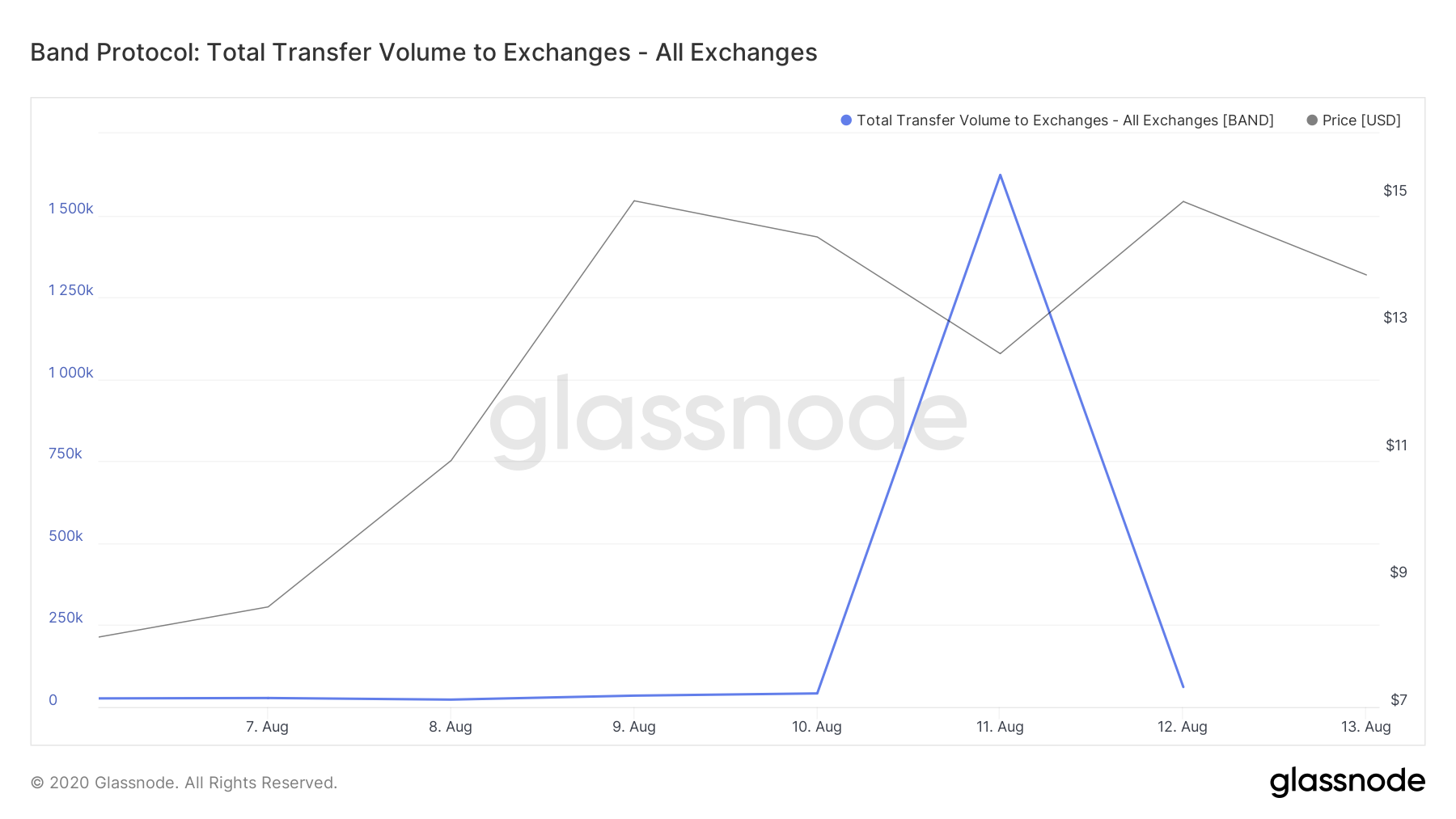

Glassnode, an on-chain data and intelligence platform, reveals that over 1.6 million BAND were transferred to different exchanges on Aug. 11. The considerable spike in exchange deposits can be considered a sign of mounting selling pressure behind this altcoin.

IntoTheBlock’s GIOM model shows that the $11.8 support level may have the ability to hold in the event of a sell-off.

Roughly 730 addresses had previously purchased nearly 210,000 BAND around this price level. Such a considerable supply wall could prevent Band Protocol from a steeper decline because those who bought within this price range may do anything to try to remain profitable.

On the flip side, the GIOM cohorts show that the most crucial resistance barrier ahead of this altcoin lies around $14.3. Here, approximately 540 addresses are holding over 253,000 BAND. Moving past this hurdle will likely invalidate the bearish outlook and lead to new all-time highs.

LINK and BAND Market Participants Are Greedy

The bullish price action that Chainlink and Band Protocol have experienced over the past month has investors overwhelmingly optimistic about further gains.

Indeed, the Crypto Fear and Greed Index (CFGI) has been sensing “extreme greed” among market participants since late July. Historical data reveals that greed is not a good sign.

Each time the CFGI has moved into “extreme greed” in the past, the market tends to enter a corrective period. With all the bearish signals previously mentioned, LINK and BAND, as well as the entire market, could be bound for a downswing.

If history repeats itself, trades must take into consideration the different support levels mentioned before. These critical areas of interest may be an excellent opportunity for sidelined investors to get back into the market and propel prices further.

Earn with Nexo

Earn with Nexo