Shutterstock cover by Joshua Resnick

DeFi Protocol Stake Steak Suffers Exploit, Token Plummets 93%

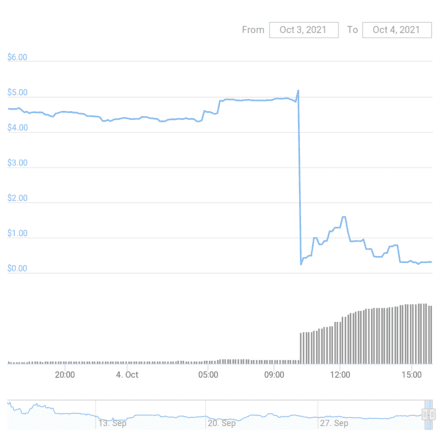

The STEAK token has crashed from $5.18 to $0.26

Fantom DeFi protocol Stake Steak has suffered an exploit allowing a hacker to mint massive amounts of the protocol’s STEAK token, causing the price to crash over 93%.

Stake Steak Protocol Attacked

Another DeFi protocol has been hacked, this time on Fantom.

Stake Steak, a DeFi protocol that aims to keep the fUSD and USDC stablecoins pegged, has suffered an exploit, crashing the protocol’s STEAK reward token by 93%.

It appears that a hacker has managed to mint a massive amount of STEAK tokens while also devaluing liquidity provider tokens for the STEAK-FTM liquidity pool, and has drained funds from several developer wallets. After minting the STEAK tokens, the hacker dumped them onto the market, crashing the price in a matter of minutes.

In response to the incident, the Stake Steak developers took to Twitter, warning users not to try and “buy the dip” by purchasing STEAK tokens. In recent months, several hacks and exploits have caused protocol tokens to crash in value, only for them to swiftly go back up after the exploit is fixed, as was the case with THORChain and Popsicle Finance.

This time, price recovery is not likely. Onlookers on Twitter have pointed out that if the private keys of the smart contracts have been compromised, the token will not be able to recover until a new contract is deployed.

Don't buy Steak tokens guys. If the PKs are out in the wild then this token can't be resurrected unless a new one is deployed.

FYI. Buying the dip in this particular case isn't the move. https://t.co/cmUBj14b40

— Austin Rampt (@blockbytescom) October 4, 2021

Currently, the exact cause of the exploit is unknown. However, the Stake Steak team has reassured users that funds deposited into the protocol’s SCREAM-FTM and USDC-FUSD pools are safe. Additionally, the team has stated that a full post-mortem of the incident will follow once they understand how the exploit occurred.

Disclaimer: At the time of writing this feature, the author owned BTC, ETH, and several other cryptocurrencies.

Earn with Nexo

Earn with Nexo