Digitex Announces Testnet Launch Date For Bitcoin Futures Exchange

I guess that's why it's called a 'futures' exchange.

One of the most anticipated projects of the year is finally inching closer to reality. After months of delays, the Digitex Futures Exchange has finally announced the date of its testnet launch, which is currently scheduled for November 30.

According to Digitex development partner SmartDec, the testnet will be the first step to creating “the world’s first zero-commission cryptocurrency futures trading platform.”

Instead of settling in cash or bitcoins, the Digitex platform takes the unique approach of settling in tokens. The DGTX token will be used to trade BTCUSD futures contracts, removing the need for any maker or taker fees. No percentage-based fee is taken on transactions, with operating costs instead being covered by the value of DGTX. The token will act as “the passport to using the exchange,” with all trades and account balances on the Digitex platform denominated in DGTX.

Theoretically, this arrangement should drive up the value of the token, due to demand from users who prefer to trade for free and enjoy the faster pace of commission-free short-term trading.

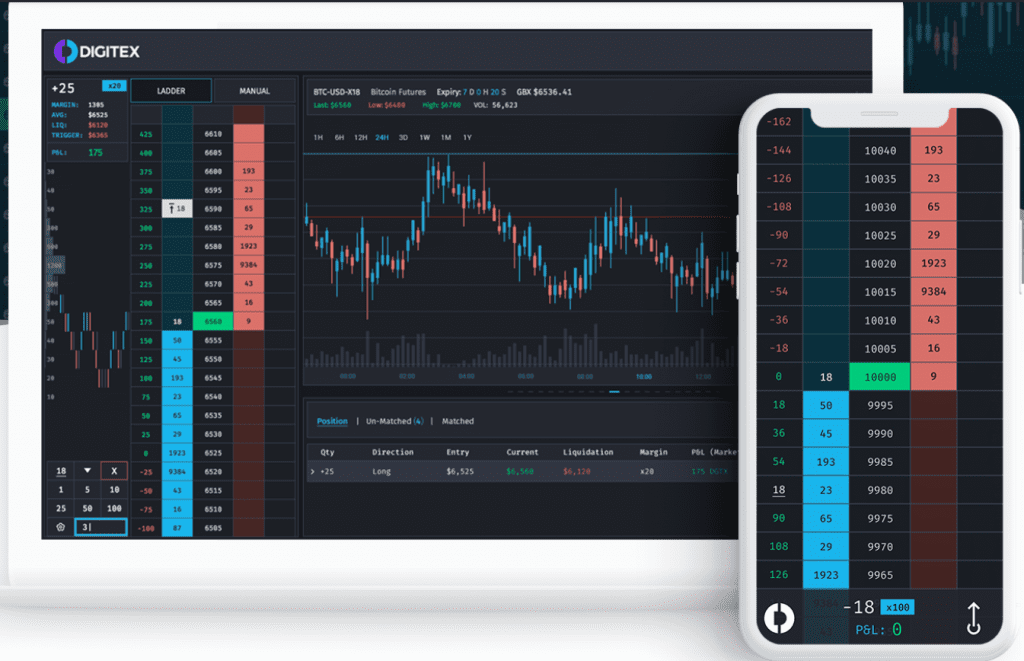

The Digitex website explains the distinct advantages of the new platform. “For the first time ever, traders get the real time trading benefits of a centralized exchange with the security benefits of a decentralized exchange.”

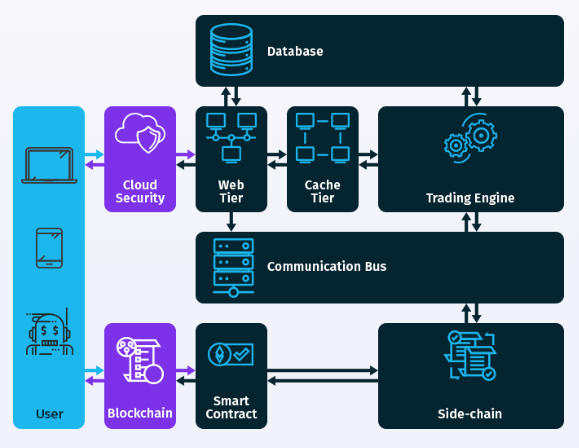

Using Plasma side-chains, traders will send DGTX to an independent smart contract, protecting users from tampering and ensuring trustless transactions. Using a sidechain, the platform offers much higher trading speeds, processing transactions “1500 times faster than the main Ethereum blockchain.”

The new platform also comes with much larger gains — or losses — with 100x leveraging.

The beta is slated to launch by November 30, 2019. Digitex will begin as a centralized platform, but will later offer non-custodial leveraged Bitcoin futures trading, using on-chain settlements to ensure speed and security.

Following a period of closed testing with a limited number of participants, the testnet will later open to the public, eventually supporting “at least 10,000 concurrent users, who will engage in virtual trades of BTCUSD futures contracts with speeds of up to 50,000 transactions per second” once the Plasma side-chain is up and running.

The testnet will undergo at least two-months of testing and auditing before a full launch to live trading. If all goes according to plan, the exchange could open trading by February of next year.

The announcement follows months of anguish among the DGTX community, after a last-minute postponement on April 30th. Token prices have also suffered, with DGTX falling from $0.13 in April to less than $0.039 at the time of writing.

To get things on track, Digitex contracted SmartDec, a Moscow-based Ethereum development and smart contract auditing firm. With the help of SmartDec, the Digitex team has released regular updates on its launch.

“Zero-fee futures trading has been a dream of mine for years,” said Founder and CEO Adam Todd, “and it’s finally becoming a reality.” Seeking to make commission-free futures trading available to the masses, Todd explained the greatest challenge has been “finding talent capable of actually developing that idea.”

Adam Todd will be hosting an AMA about the public testnet launch date on the Digitex YouTube Channel. The AMA will take place on Tuesday, August 27th at 9:00 EST (1300 UTC).