Photo: Brendan Smialowski/AFP/Getty Images

Dogecoin Up as Musk Says Tesla Is Accepting Payments

Dogecoin has rallied after Elon Musk revealed that Tesla is now accepting the meme coin for merchandise payments.

Dogecoin has enjoyed an upward jolt fueled by news of mainstream adoption. Although prices have reached critical resistance, a breakout could be on the horizon.

Tesla Now Accepting Dogecoin

Dogecoin is back in the spotlight thanks to Elon Musk.

The Tesla and SpaceX CEO posted a tweet Friday confirming that his electric car company had started accepting Dogecoin for merchandise payments. The announcement appears to have helped DOGE rally, adding to a winning streak the meme coin has enjoyed throughout this week. The asset spiked within minutes of Musk’s announcement and is currently trading at $0.19, up 35.7% in the last three days.

Despite the significant gains Dogecoin has posted over the last few days, the asset has some hurdles to overcome to maintain its bullish momentum.

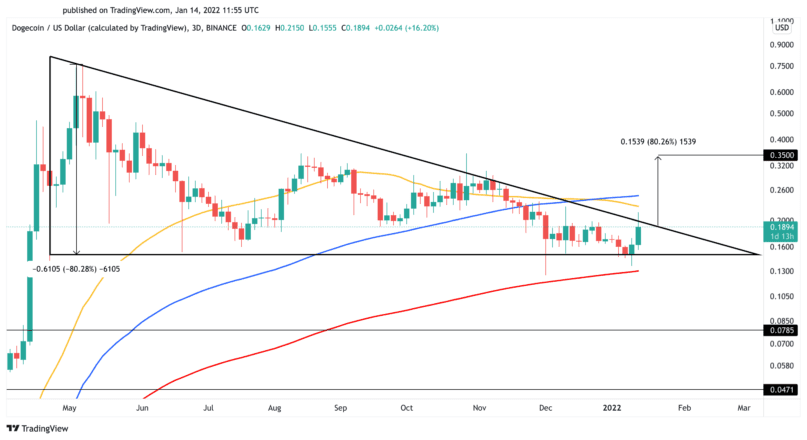

It has reached a critical area of resistance represented by the hypothenuse of a descending triangle. Its price action has been contained within the descending triangle since April 2021. Although the recent uptrend shows that DOGE is gaining pace, it has not yet decisively closed above $0.20. Moreover, it must breach the 50-three-day moving average at $0.23 to confirm a potential breakout from the consolidation pattern.

If Dogecoin breaches the 50-three-day moving average, sidelined investors could be encouraged to re-enter the market. That could potentially help Dogecoin surge toward $0.35. Still, it remains to be seen whether the buzz surrounding Tesla’s announcement will endure.

It is worth noting that any signs of weakness around the current price levels could lead to a rejection that pushes Dogecoin back to $0.15. Breaching the critical area of demand could signal a break of the 200-three-day moving average, likely resulting in further losses. It could then try to find support around $0.08 or even $0.05.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.