Shutterstock cover by Al Medwedsky

Ethereum Booms in Anticipation of CME’s ETH Futures Launch

Market participants are growing overwhelmingly bullish as one key player in the derivatives markets is about to launch a new Ethereum financial product.

Ethereum is going through an impressive bull rally fueled by mounting buy orders from retail and institutional investors.

ETH Futures on CME Incoming

Interest in Ethereum mounts as the world’s largest financial derivatives exchange, CME Group, is scheduled to launch ETH futures on Feb. 8.

The new cash-settled contracts will offer institutional investors exposure to the digital asset on a 50:1 ratio, based on CME’s CF Ether-Dollar Reference Rate. According to the official announcement, the derivative product will be open to trade between 18:00 to 17:00 ET from Sunday to Friday.

Given the importance of the event, Grayscale is preparing for a spike in volatility.

The cryptocurrency asset management firm reopened its Ethereum Trust to accredited investors and closed a deal to buy more than $76 million worth of ETH. Grayscale now holds more than 3 million Ether, which is worth roughly $4.60 billion.

The significant spike in buying pressure appears to have had an important impact on Ethereum’s price, pushing it to new all-time highs.

Ethereum Targets $2,000

Even though Ether was able to rise to a record high of $1,767 on Feb. 5, its uptrend seems far from over.

The second-largest cryptocurrency by market capitalization recently broke out of an ascending triangle where it had been contained over the past three weeks. Based on the height of the triangle’s y-axis, Ethereum could surge another 13% to hit a target of nearly $2,000.

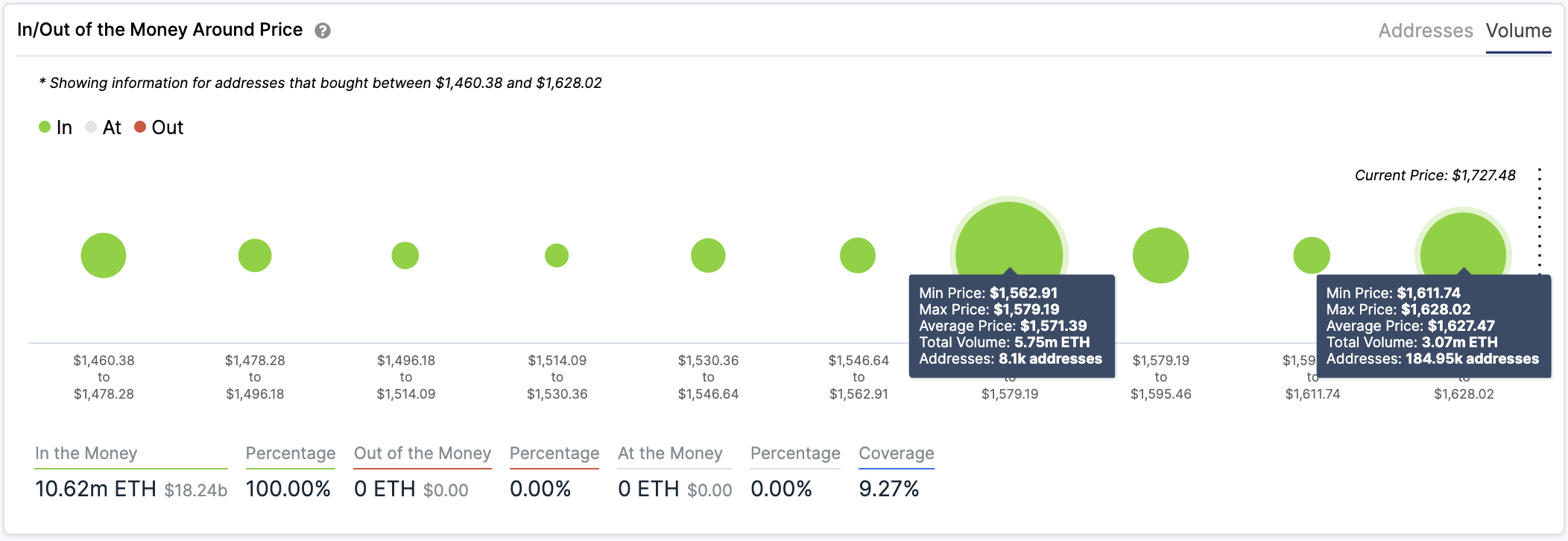

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model suggests that the bullish outlook will prevail as long as Ethereum continues to trade above the $1,560-$1,630 demand barrier.

Failing to do so could trigger a spike in selling pressure as more than 200,000 addresses will be forced to sell their holdings to avoid incurring significant losses.

If a “buy the rumor, sell the news” phenomenon was to occur, a sell-off may push Ethereum to look for support around the ascending triangle’s x-axis at $1,440.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.