Ethereum Makes New All-Time Highs But Technicals Spell Trouble

Ethereum has enjoyed an impressive recovery over the past few days, but a particular technical indicator warns of a potential correction.

Key Takeaways

- Ethereum's price is up more than 42% as it reached a new all-time high of nearly $1,480.

- Despite the significant upswing, ETH could retrace if it fails to break decisively its recent peak.

- Closing above or below the $1,480-$1,380 range will determine where Ether is headed next.

Share this article

Ethereum has recovered and made new all-time highs following a steep correction earlier this month. Though ETH is in price discovery mode, multiple technical indicators suggest that its uptrend is approaching exhaustion.

Ethereum Primed for Another Downswing

Ethereum was able to rebound from the $1,000 support level after taking a 28% nosedive last week.

Bouncing off this critical demand barrier was seen as a positive signal by many market participants who rushed to exchanges to get a piece of ETH.

As buy orders piled up, Ether’s market value rose by more than 42% in the past three days to reach a new all-time high of nearly $1,480.

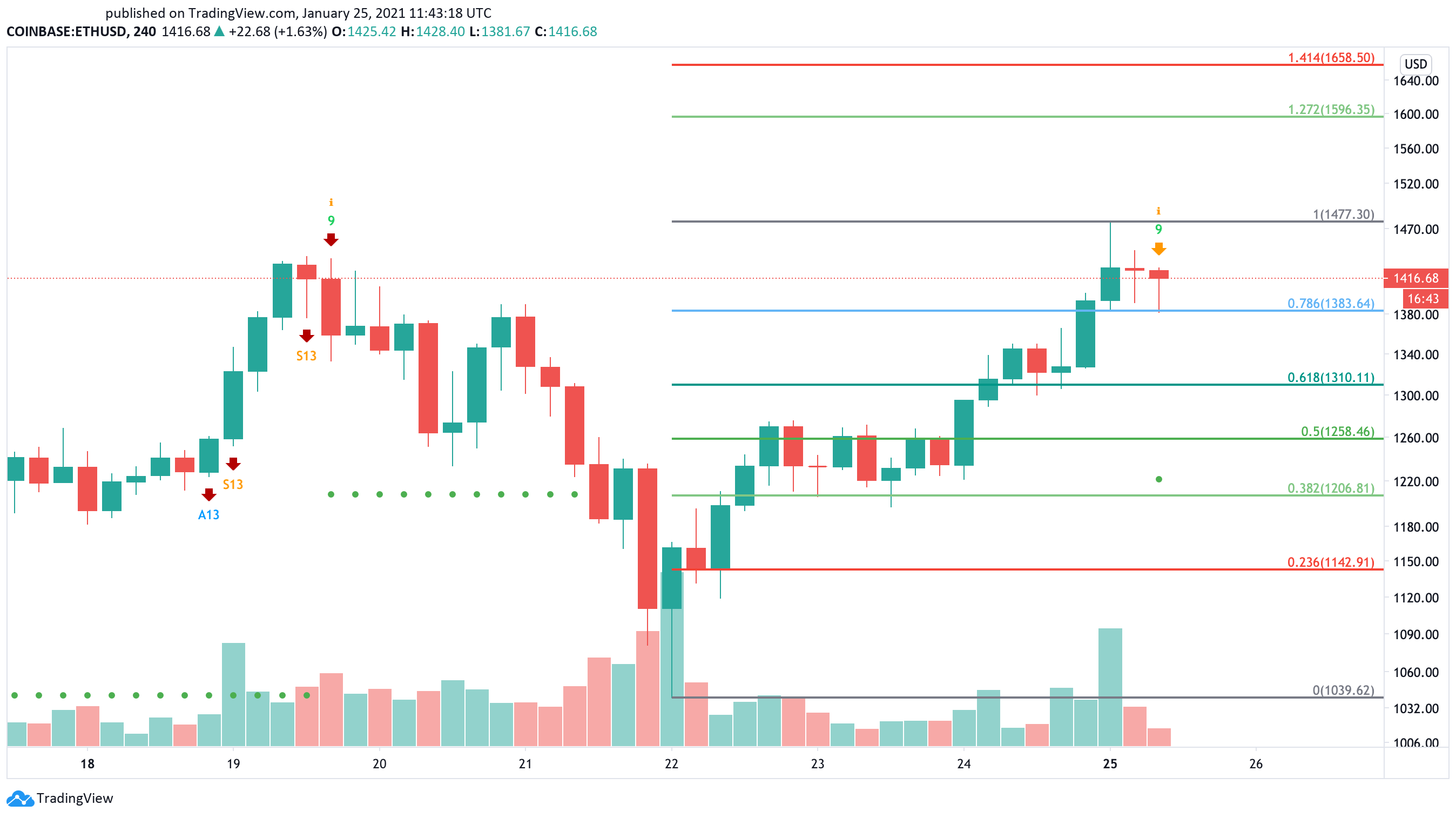

Despite the impressive run-up seen in such a short period, the Tom Demark (TD) Sequential indicator estimates Ethereum is approaching overbought territory. This technical index presented a sell signal in the form of a green nine candlestick on ETH’s 4-hour chart.

The bearish formation suggests this altcoin is primed to retrace for one to four 4-hour candlesticks before the uptrend resumes. Confirmation will occur when a red two candlestick trades below a preceding red one candlestick.

A spike in selling pressure could help validate the sell signal and push Ethereum towards the 61.80% or the 50% Fibonacci retracement levels. These support barriers sit at $1,300 and $1,260, respectively.

While another downswing could be catastrophic for overleveraged traders, it will help keep Ethereum’s uptrend healthy and offer sidelined investors an opportunity to re-enter the market.

It is worth noting that Ethereum recently saw the largest number of tokens withdrawn from cryptocurrency exchanges to date, which significantly reduces its downside potential. Therefore, the bullish outlook cannot be disregarded.

If ETH manages to break above the recent high of $1,480 decisively, the pessimistic thesis will be jeopardized. Under such circumstances, the second-largest cryptocurrency by market capitalization might rise towards a new all-time high of $1,600 or higher.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

Share this article