Shutterstock cover by Hi my name is Jacco

Ethereum Looks Ready to Return to $4,000

Ethereum has kicked off September with a bang, as all major indicators suggest it is heading to $4,000.

Ethereum is back in the green after slicing through a crucial resistance barrier. Now, the technicals and fundamentals suggest that ETH has resumed its uptrend.

Ethereum Targets $4,000

Ethereum is back above $3,500, but the price point wasn’t easy to reach.

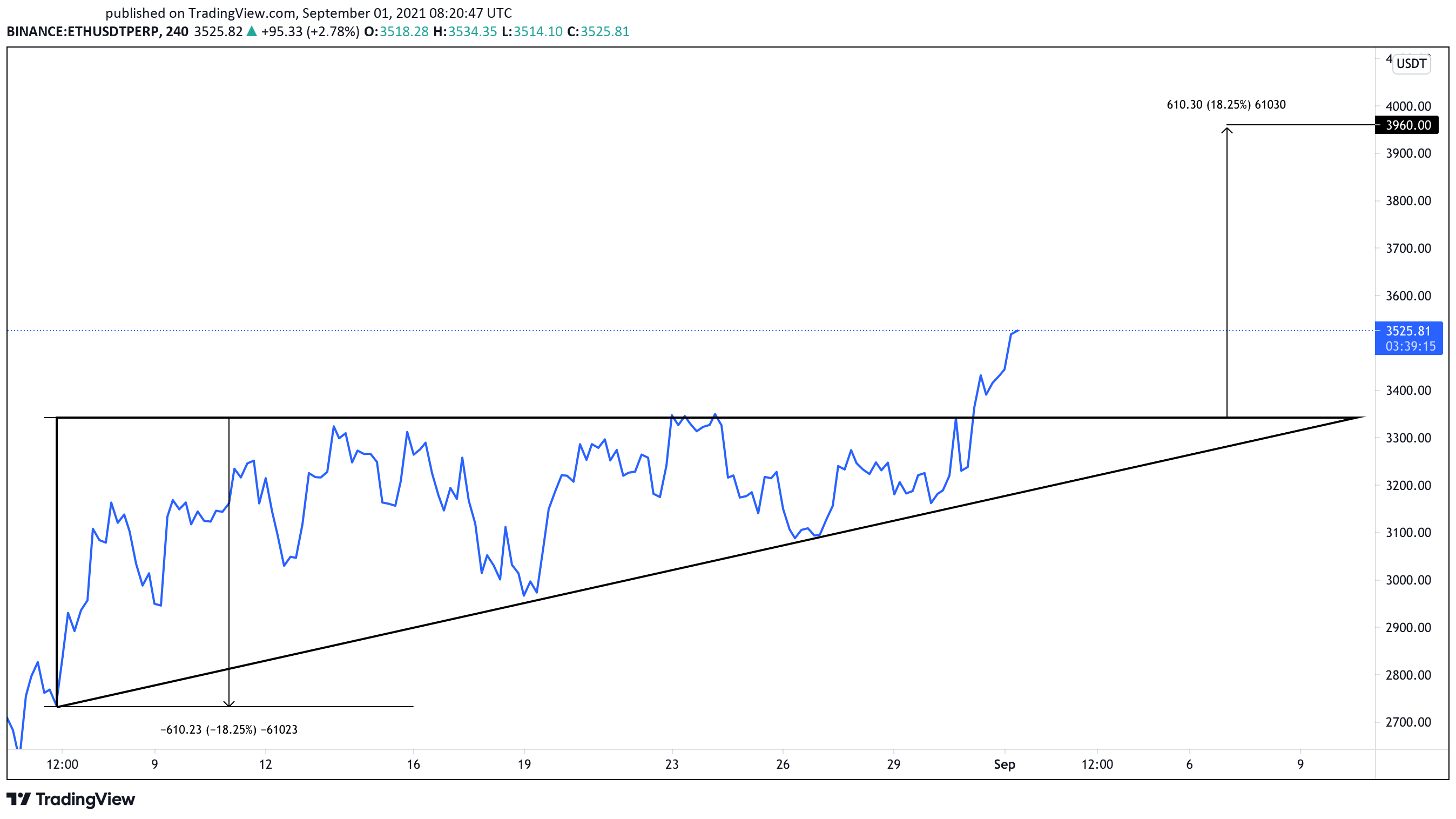

Indeed, the second-largest cryptocurrency by market cap endured a lengthy consolidation period that began on Aug. 6. As Ethereum’s price made a series of higher lows, the $3,350 resistance level rejected it from advancing further. Consequently, this formed an ascending triangle on ETH’s 4-hour chart.

A recent spike in the buying pressure behind Ethereum has allowed it to slice through the overhead resistance, confirming a bullish breakout from the consolidation pattern. Now that ETH has made a new higher high, the triangle formation suggests prices could surge by another 12% to hit a target of nearly $4,000.

The optimistic outlook is determined by measuring the distance between the two highest points of the triangle and adding it to the breakout point.

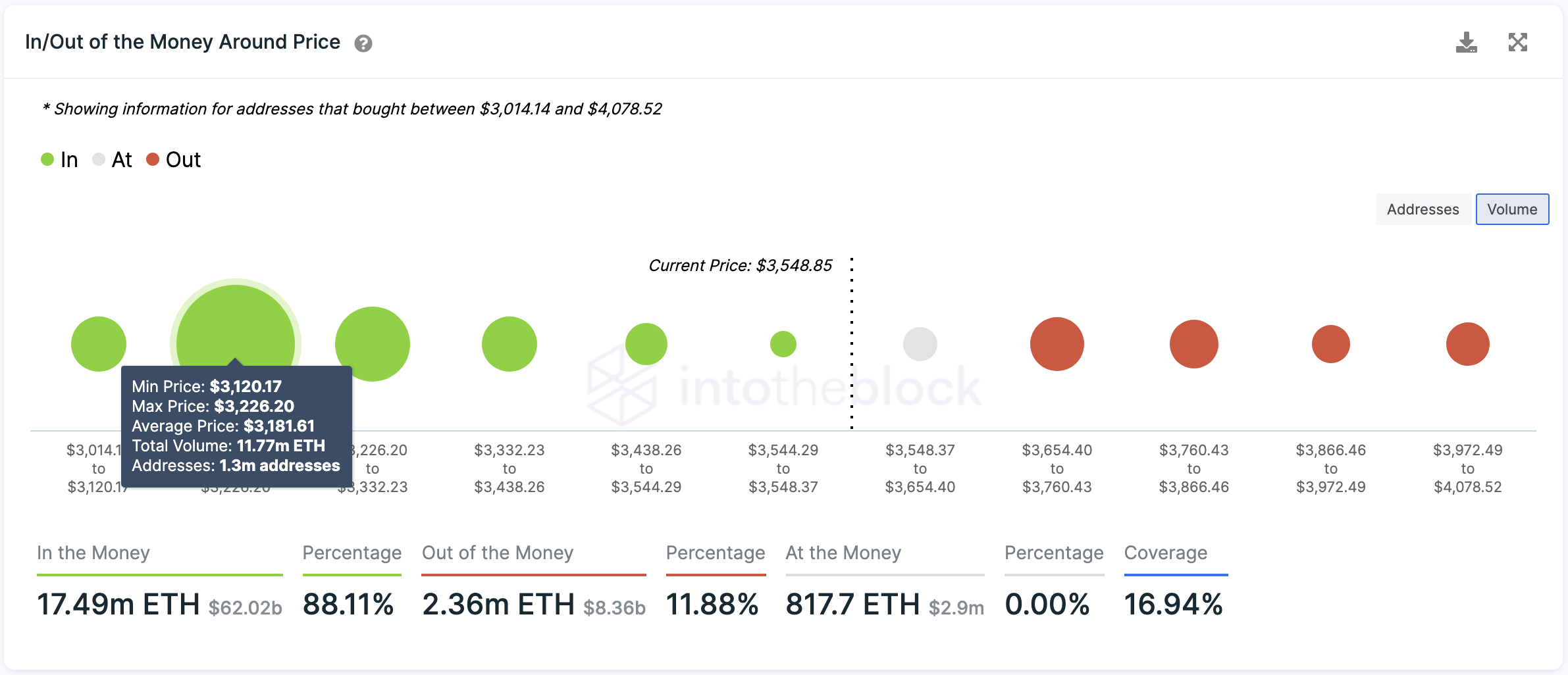

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model adds credence to the bullish outlook. Based on this on-chain metric, Ethereum sits on top of a massive supply barrier that may allow the uptrend to continue.

Approximately 1.3 million addresses have previously purchased nearly 11.77 million ETH between $3,120 and $3,230.

This critical area of interest may have the ability to absorb any downward pressure. Holders within this price range would likely do anything to remain profitable, including buying more tokens to push prices to higher highs.

Given the lack of significant resistance barriers ahead of Ethereum, it is reasonable to assume that the odds favor the bulls.

The probability of increased profit-taking at the current price levels seems minuscule as long as the $3,200 demand barrier holds. Only a macro event that encourages investors to sell their holdings pushing ETH below this support level could invalidate the optimistic outlook and lead to a correction to $2,700.