Ethereum’s price under pressure as short positions reach record highs

Record short interest clashes with volatility, raising concerns about Ethereum's future stability.

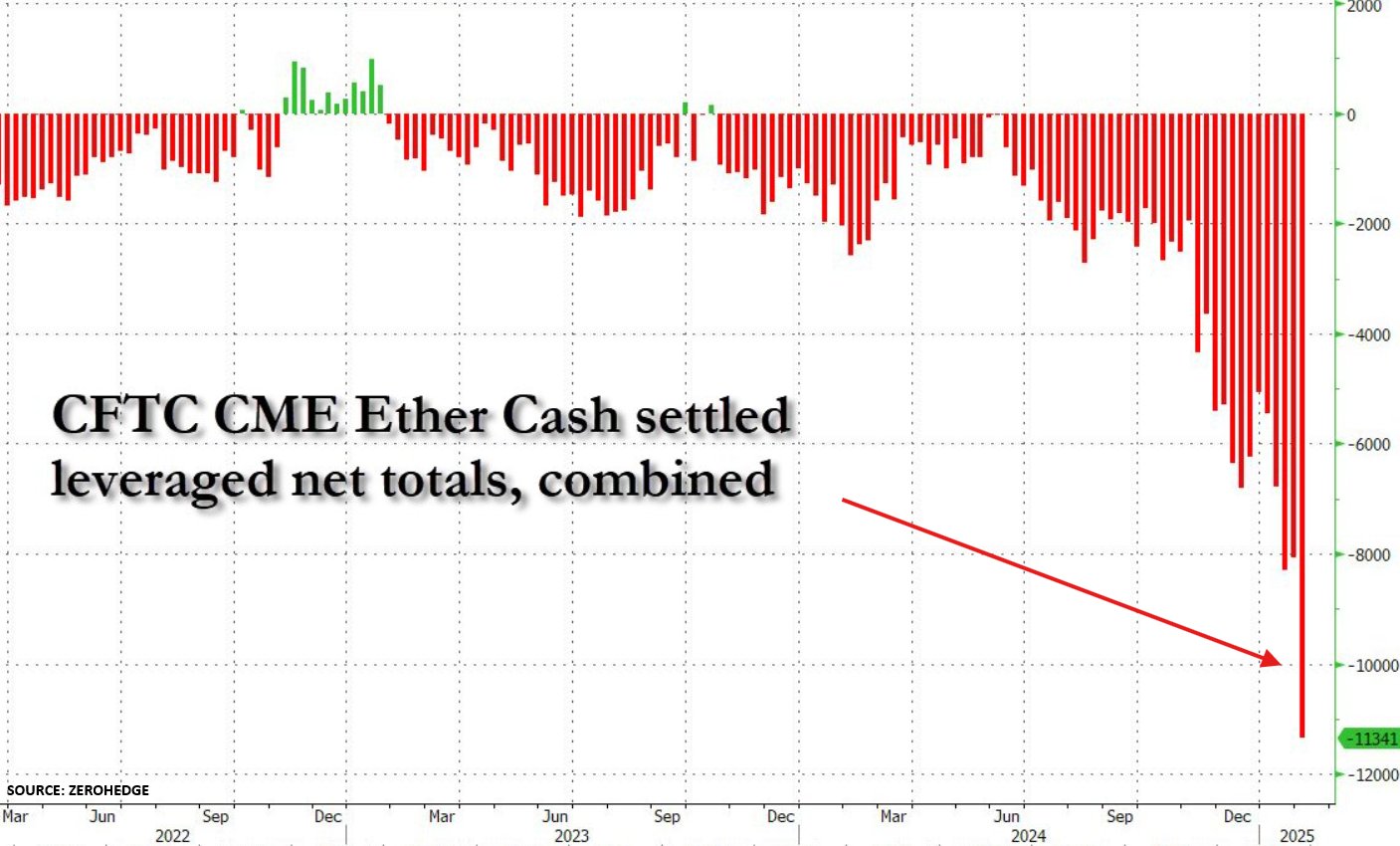

Ethereum is facing a record level of short selling from hedge funds, with futures contracts on the CME reaching a new peak of 11,341, ZeroHedge’s new chart shows.

Bearish bets have surged over 40% in a week and 500% since last November, as analyzed by The Kobeissi Letter. The aggressive shorting raises red flags about Ethereum’s near-term prospects.

The Kobeissi Letter’s analysis notes that Ethereum’s history shows a clear correlation between large short positions and subsequent price crashes. On Feb. 2, ETH experienced a major decline, plummeting as much as 37% in 60 hours following President Trump’s tariff announcement.

“It felt almost like the flash crash seen in stocks in 2010, but with no headlines,” said the analyst, adding that the selloff contributed to over $1 trillion being erased from the broader crypto market within hours.

The surge in short positions comes despite apparent support from the Trump administration, with Eric Trump recently stating “it’s a great time to add ETH,” which temporarily boosted prices.

As of the latest CoinGecko data, ETH is hovering around $2,500, down 2% in the last 24 hours. The digital asset currently trades approximately 45% below its November 2021 record high.

Bitcoin has left Ethereum in the dust since the start of 2024, soaring over 100% while ETH eked out a mere 3.5% gain. This disparity has ballooned Bitcoin’s market cap to six times the size of Ethereum’s—a dominance not seen since 2020, according to The Kobeissi Letter.

Ethereum’s underperformance amid a recovering crypto market raises concerns about the factors driving negative sentiment. Potential explanations include anxieties about Ethereum’s underlying technology, regulatory uncertainty, and macroeconomic headwinds.

The record short position amplifies the potential for price volatility. A sustained decline would validate the bearish outlook, but the sheer size of the short position also increases the likelihood of a short squeeze if positive developments materialize.