Ethereum and XRP Follow Bitcoin’s Steps After Its Breakout to New Yearly Highs

Bitcoin is leading the recent upswing in the crypto market. But as buying pressure mounts behind Ethereum and XRP, these cryptocurrencies may soon catch up.

While Bitcoin looks poised for further gains after slicing through $12,500, Ethereum and XRP are approaching crucial resistance suggesting an imminent breakout.

Bitcoin Aims for New Yearly Highs

Bitcoin appears to have broken out of an ascending parallel channel containing its price action since the market crash in early September. After slicing through the upper boundary of this technical formation, market participants seem to have rushed to exchanges to get a piece of it. The spike in buying pressure was significant enough to push the flagship cryptocurrency to a high of $12,000.

Now that the overhead resistance has been cleared, prices could be about to shoot up by more than 3.5% towards the next area of interest, $13,350. This target is determined by drawing a parallel line equal to the channel’s width.

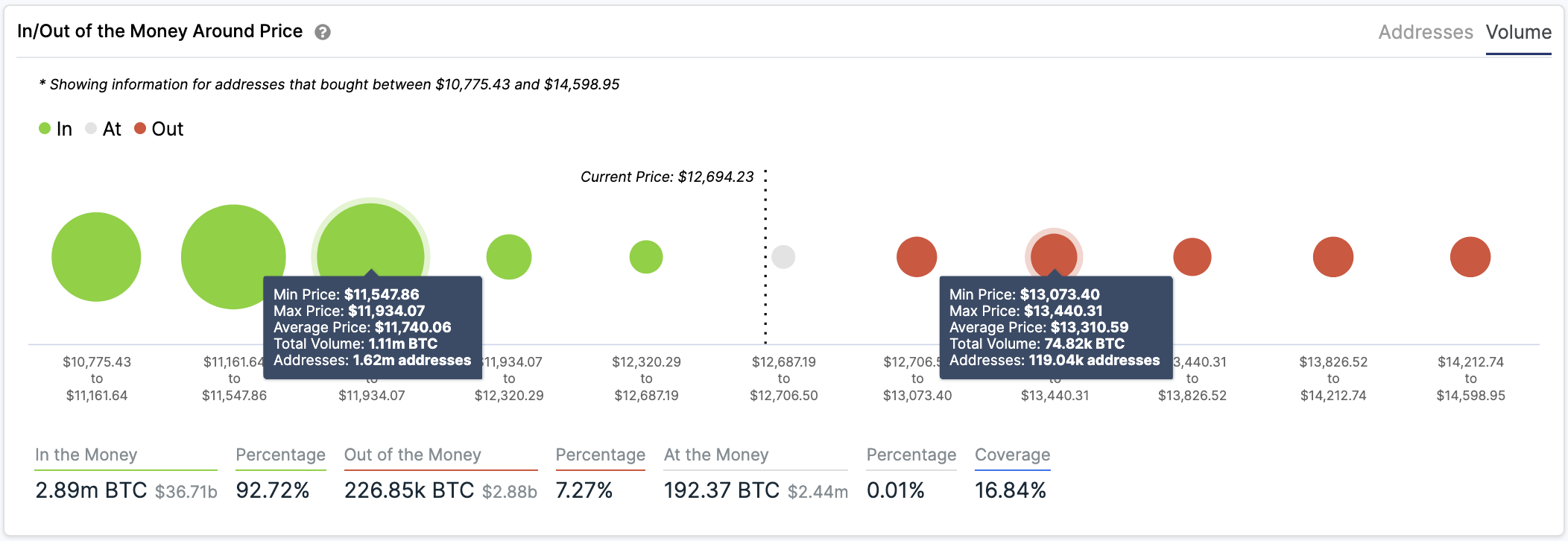

Such an optimistic thesis holds when looking at IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model.

Based on this on-chain metric, Bitcoin currently sits on top of a massive supply barrier that may have the strength to keep falling prices at bay in the event of a sell-off. Roughly 1.6 million addresses had previously purchased over 1 million BTC between $11,550 and $11,930.

On the flip side, the IOMAP cohorts show little to no resistance ahead of the pioneer cryptocurrency that will prevent it from achieving its upside potential.

The only crucial hurdle to pay attention to lies at $13,310, right next to the target presented by the parallel channel previously mentioned. Here, less than 120,000 addresses are holding approximately 75,000 BTC.

Nathan Batchelor, the lead Bitcoin analyst for SIMETRI, said:

“Today’s breakout in BTC does not come as a surprise, given the bullish fundamentals over recent weeks. A major bout of USD weakness only served to accelerate the technicals which have been pointing to a run towards $12,500. Looking at the where BTC heads to next; continued gains above the $12,500 level could encourage bulls to test towards the $13,500 or $13,900 area in the near-term.”

Ethereum Awaits for Volatility

Ethereum has endured a consolidation period over the past month. Its price action led to the formation of an ascending triangle within the 4-hour chart. A horizontal resistance formed along with the swing highs, while a rising trendline was created along with the swing lows.

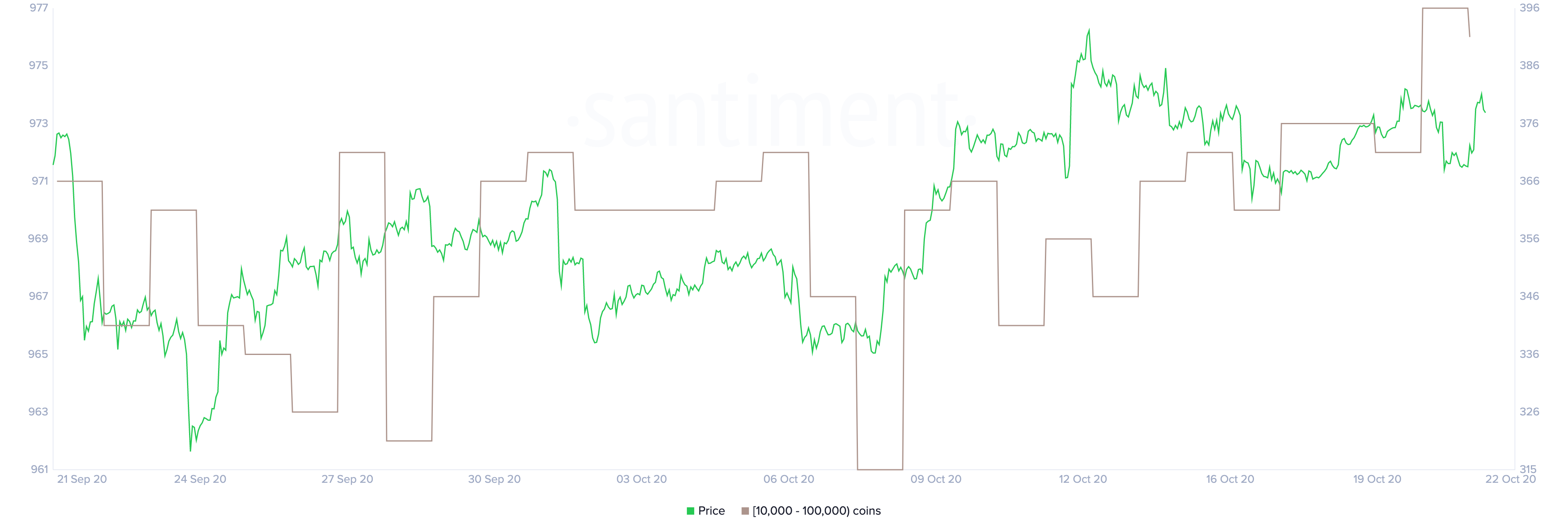

Although Bitcoin seems to have decoupled from the rest of the market, the smart contracts giant may soon follow its steps. Santiment’s holder distribution chart reveals that the buying pressure behind Ethereum is rapidly increasing.

The number of addresses holding 10,000 to 100,000 ETH rose by nearly 1.7% over the past two weeks. Roughly 16 new whales have joined the network over this short period. The upswing is quite significant when considering these investors hold between $3.8 million and $38 million worth of Ether.

If demand for Ethereum continues accelerating, prices will likely break through the x-axis of the triangle previously mentioned and aim for $470.

IntoTheBlock’s IOMAP shows that the $380-$390 range is the only hurdle that could prevent Ether from breaking out. Approximately 1.4 million addresses are holding nearly 1.8 million ETH around this level.

While holders within this price pocket may try to break even on their underwatered positions, slicing through it will drastically increase the odds of a significant upswing.

It is worth mentioning that the second-largest cryptocurrency by market cap sits on top of a large supply wall. More than 1.3 million addresses bought 14 million ETH between $367 and $377.

Therefore, only a break below this critical support barrier may jeopardize the bullish outlook.

XRP Prepares to Break Out

Like Ethereum, XRP’s price action is also contained within an ascending triangle over the past month. While whales have been loading up on this token since Oct. 13, the demand increase has yet to be reflected on prices. Until then, the $0.24 support and the $0.26 resistance will play a key role in determining where this cryptocurrency is headed next.

Moving past resistance may trigger FOMO among market participants. The increase in buy orders will likely see the cross-border remittances token surge towards $0.30.

This target is determined by measuring the distance between the widest point of the triangle and adding it to the breakout point.

Meanwhile, an increase in selling pressure around the current price levels could push prices below the triangle’s hypotenuse. Slicing through this area can be considered a breakdown of this pattern. Under such circumstances, investors would have to prepare for XRP to drop towards $0.21.

Despite the ambiguity that XRP presents, the Market Value to Realized Value (MVRV) index favors the bulls. Each time the MVRV drops below -8%, a buying opportunity presents. Conversely, when this indicator rises above 18%, it signals that a correction is underway.

Since late September, the MVRV moved out of the “buy zone” and is currently hovering around 2.6%. Such levels indicate that XRP has a lot of room to go up before it enters the “sell zone.” Thus, it is imperative to pay close attention to the $0.26 resistance barrier since breaking through it will confirm the optimistic outlook.

The Crypto Market Moves Forward

The HODL strategy has never looked better than today despite the opportunities to profit previously presented. More than 15 publicly traded companies are holding Bitcoin on their balance sheets, and now PayPal has decided to join the party.

The online payments firm announced that it would enable U.S. customers to buy, sell, and hold cryptocurrencies. The initial list of digital assets available includes Bitcoin, Ethereum, Bitcoin Cash, and Litecoin. The firm will also subsidize all trading or storage fees.

The move is set to enable over 26 million merchants connected to PayPal to trade goods for cryptos globally. This is a significant step towards mass adoption that will likely help the crypto market enter a new bullish cycle.