What is FIT21?

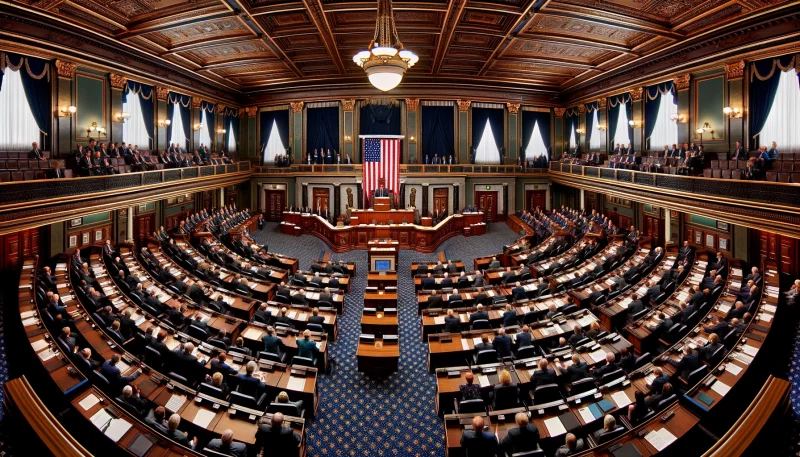

House vote on FIT21 reflects changing attitudes towards crypto regulation.

FIT21, or the “Financial Innovation and Technology for the 21st Century Act,” is a bill that aims to establish a regulatory framework for digital assets in the US.

If passed into law, FIT21 would mark a significant milestone in creating clear rules for the crypto industry.

The bill involves both the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in regulating the crypto market.

Key provisions of FIT21 include:

-

Delineating jurisdiction between the SEC and CFTC.

-

Providing consumer protections through transparency and disclosure requirements.

-

Prohibiting agencies from preventing the use of crypto.

-

Requesting the Treasury to study stablecoins.

-

Defining when decentralized networks are no longer considered securities.

-

Establishing a process to certify decentralized assets as commodities.

Why Does FIT21 Matter?

FIT21 represents a step forward in providing clear rules for the crypto industry. The SEC must review applications and respond within 90 days, and if an asset is determined to operate without a controlling entity, it falls under CFTC jurisdiction as a commodity.

While not perfect, FIT21 brings the crypto industry closer to a structured and transparent regulatory environment. It demonstrates progress in legislation and the ability to put points on the board, even if in spurts.

The FIT21 vote showcases shifting attitudes towards crypto, with both parties and the President signaling a move towards clearer regulations and broader acceptance of digital assets.

Although FIT21 does not have a corresponding Senate bill and won’t become law yet, the historic vote in the House of Representatives is a significant performance that showcases the changing tides in favor of crypto regulation.

This vote sets the stage for potential future legislation that could further shape the regulatory landscape for digital assets in the US.