Grayscale Effect Pumps Filecoin, But for How Long?

Filecoin is going through a significant influx of institutional capital, pushing FIL to new all-time highs.

Filecoin has been on a roll lately, surging more than 550% since the beginning of March. While institutional capital continues to flow in, the technicals point to a brief correction before further gains.

Institutional Demand Picks Up

Institutional capital seems to be flowing en masse into Filecoin. Data from Bybt shows that Grayscale has gone into a buying spree, adding more upward pressure to the decentralized storage network token.

The world’s largest cryptocurrency asset management firm started increasing its holdings in mid-March and raked another 29,550 FIL in the past 24 hours.

Grayscale’s latest purchase comes only a few days after online game operator The9 signed a $2 million deal to purchase Filecoin mining machines.

The Shanghai-based company now owns an independent node on the FIL blockchain, and it is expected to have more than 80 Pebibytes of effective storage mining power in the network.

Filecoin in Extreme Overbought Conditions

As institutional demand picks up, Filecoin has done nothing but shoot up. Since the beginning of March, FIL’s market value has risen by nearly 550%, gaining more than 200 points.

Filecoin went from a low of $36.90 to recently hit a new all-time high of $238.50.

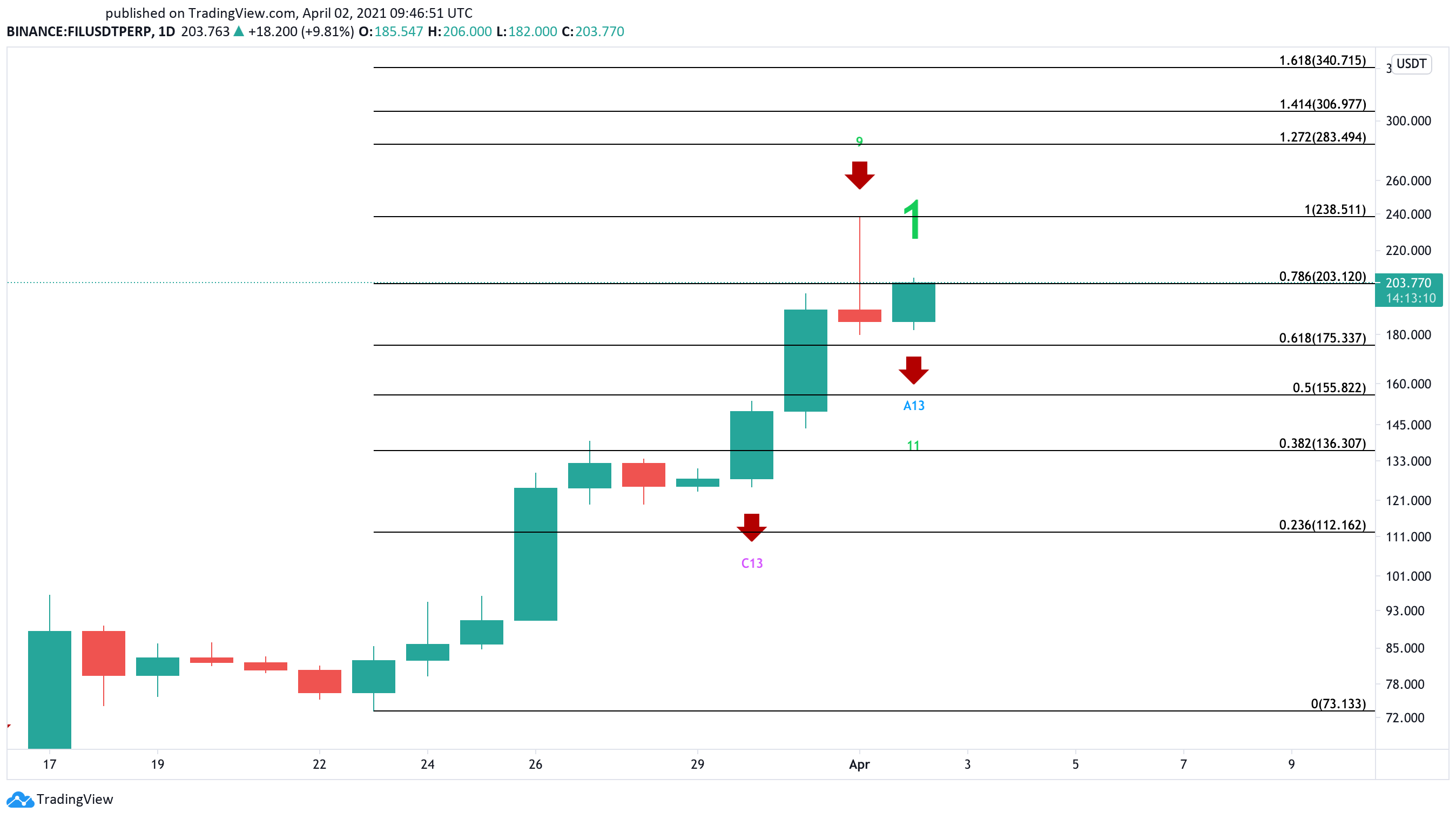

While market participants grow overwhelmingly bullish, this altcoin is trading at extremely overbought conditions. Not only is the daily Relative Strength Index (RSI) hovering at a value of 88, but the Tom DeMark (TD) Sequential indicator has flashed multiple sell signals.

The bearish formations developed in the form of a green nine candlestick and an aggressive 13 candle. These sell signals are indicative of a one to four daily candlesticks correction before the uptrend resumes.

A spike in profit-taking around the current price levels could be significant enough to validate the pessimistic outlook. Filecoin could then drop towards the 50% or 38.2% Fibonacci retracement levels to look for support.

These interest areas sit at $156 and $136, respectively.

Given the significant bullish momentum that Filecoin is going through, the optimistic scenario cannot be disregarded. A green two candlestick trading above the current green one candle would invalidate the sell signals and lead to higher highs.

By slicing through the recent peak of $238.50, the odds will substantially increase for an upswing towards $300.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Earn with Nexo

Earn with Nexo