ICON / USD Technical Analysis: Signs Of Exhaustion

Share this article

- ICON retains a bullish short-term outlook, with the cryptocurrency still trading above its 200-period moving average on the four-hour time frame

- The four-hour time frame also shows price pressing towards the neckline of bullish inverted head and shoulders pattern

- The medium-term time frame is neutral, with the ICX / USD pair trading at the top of its price range on the daily time frame.

ICON / USD Short-term price analysis

ICON retains its bullish outlook over the short-term, with the ICX / USD pair trading close to the neckline of a bullish inverted head and shoulders pattern on the four-hour time frame.

The cryptocurrency has been consistently well supported on any dips lower since it started to push higher in early February. Technical indicators on the four-hour time frame are also attempting to push higher.

If the buyers once again fail to break above neckline resistance, we will likely see the ICX / USD pair testing towards its 200-period moving average on the four-hour time frame.

ICX / USD H4 Chart (Source: TradingView)

Pattern Watch

If the bullish pattern is triggered, the ICX / USD pair will likely rally towards the November 19th swing high from last year, as it offers the foremost technical resistance above the neckline of the pattern.

MACD Indicator

The MACD indicator on the four-hour time frame is currently generating a bullish trading signal, with the signal line and MACD histogram both turning higher.

Relative Strength Index

The RSI indicator is also attempting to turn bullish on the four-hour time frame.

Fundamental Analysis

The short-term uptrend movement was triggered by the announcement that Samsung’s newest flagship smartphone, the Galaxy S10, will have a built-in hardware cryptocurrency wallet.

ICON has direct connections with Samsung with a signed MoU where Samsung pledges to use Chain ID for Samsung Pass. Moreover, since ICON and Samsung both are from Korea, further development of Samsung in the blockchain space could potentially be supported by ICON and benefit its ecosystem, which is kept in mind by investors as they speculate on the coin.

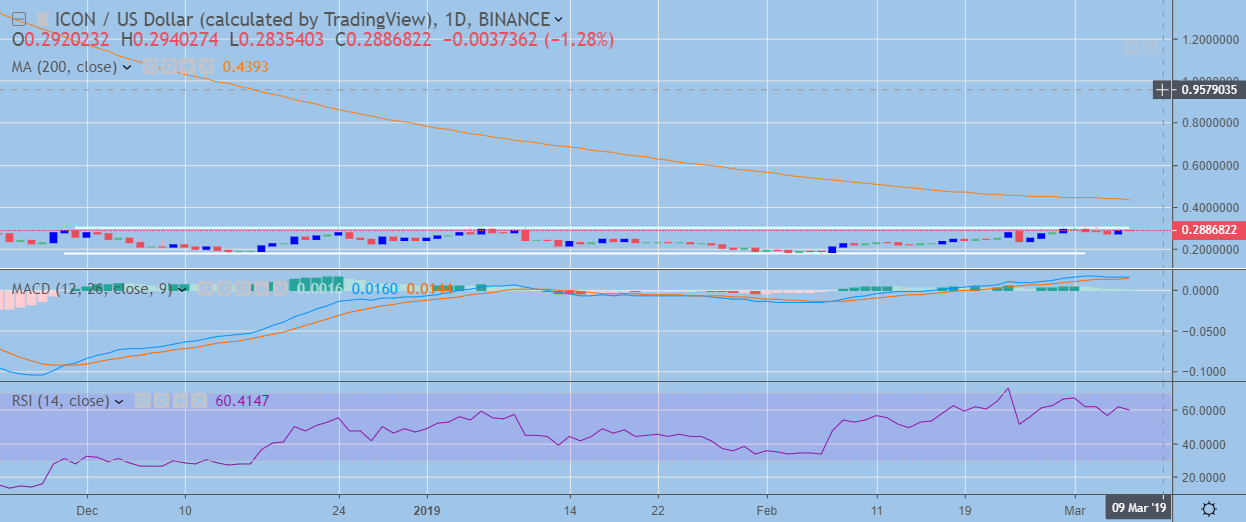

ICON / USD Medium-term price analysis

ICON has a neutral trading bias in the medium-term, with the cryptocurrency trading at the top-end of its recent range, but below its key 200-day moving average.

The ICX / USD pair has been trapped in a sideways price channel since November last year. Any sustained breakout above the price channel on the daily time frame will likely launch the cryptocurrency towards its 200-day moving average.

Traders should note that some signs of upside exhaustion are starting to appear, with the RSI indicator on the daily time frame pointing to a potential triple-top.

ICX / USD Daily Chart (Source: TradingView)

Pattern Watch

Ultimately, traders should expect sideways trading action until we see a sustained breakout above or below the price channel on the daily time frame.

MACD Indicator

The MACD histogram is attempting to move lower on the mentioned time frame, while the signal line is currently in overbought territory.

Relative Strength Indicator

The RSI indicator on the daily time frame is bullish, although it is starting to exhibit signs of a bearish triple top.

Fundamental Analysis

In the medium-term, the price still remains within its existing bounds. Currently, investors are buying into the Samsung story, and further positive news on the topic could potentially trigger a bull run for the coin, with the price likely to remain in the current range otherwise.

Conclusion

ICON continues to press against the best trading levels of the year so far, with both the four-hour and daily time frame showing that an upside breakout towards the ICX / USD pair’s 200-day moving could soon be upon us.

If a sustained upward move to fresh 2019 trading highs fails to occur, we may see a potential downward reversal in the cryptocurrency, as signs of possible upside price exhaustion are starting to appear on the daily RSI indicator.

For a refresher course on the project check out our coin guide for ICON here.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.