Kelp DAO unveils ‘Gain Vault’ to maximize L2 airdrop rewards

The Airdrop Gain Vault provides a hands-off approach to investing in multiple crypto opportunities.

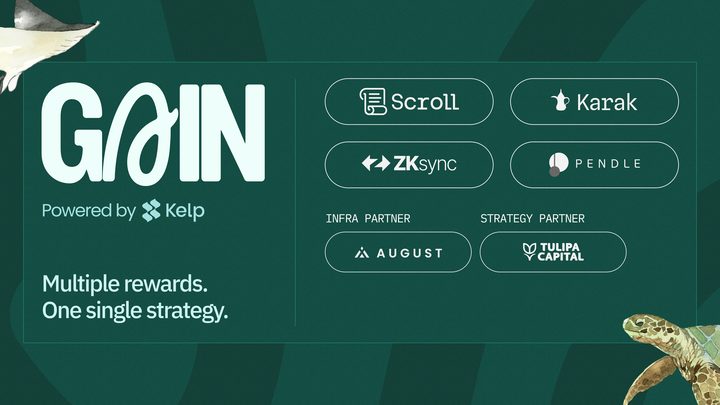

Liquid restaking platform Kelp DAO announced today the launch of ‘Kelp Gain Vaults,’ a new program designed to increase the chances of receiving airdrops and rewards. The program is the first to offer access to multiple Layer 2 (L2) airdrops, enabling users to maximize their crypto rewards and earnings through a single, diversified strategy.

“The Kelp Gain Vault is a leap forward in user experience, reward optimization and leveraging DeFi composability,” said Amitej G, Co-founder of Kelp DAO, in a press release.

The program’s initial offering will include the Airdrop Gain Vault, a specialized vault that makes it easier to engage in airdrop opportunities across various L2 protocols. Users can deposit assets into the Airdrop Gain Vault and receive a synthetic token, representing their share in the vault.

Instead of investors managing their investments in each project separately, Kelp Gain Vaults handles everything. The vaults use smart contracts to optimize airdrop and manage reward allocations, with periodic strategy adjustments to maximize returns and mitigate risks.

For instance, when a user deposits assets like Ether (ETH) or liquid staked Ethereum (rsETH) into the vault, these assets will be transferred to partner L2 networks to increase his chances of receiving airdrops from these networks. Beyond airdrops, the deposited assets are also used to participate in various DeFi strategies.

The user receive the synthetic token agETH in exchange for his deposit and can use the agETH token to participate in other earning opportunities across different DeFi platforms.

The initiative includes partnerships with platforms like August and Tulipa Capital, alongside various L2 and DeFi collaborations with projects like Linea, Karak, Scroll, Pendle, Across, LZ, Pendle, Spectra, and Lyra.

These partnerships allow Kelp Gain Vaults to offer a diverse range of investment opportunities and employ sophisticated strategies to boost returns, the team said.

“By focusing on targeted strategies and integrating with both L2 protocols and mainnet DeFi yields, we are providing users with a comprehensive, automated solution to maximize rewards potential,” Amitej G noted, ensuring that users will benefit from streamlined access to L2 airdrops and DeFi yields with minimal effort.

Earlier in May, Kelp DAO successfully raised $9 million in a private funding round led by SCB Limited and Laser Digital, with several prominent participants included Bankless Ventures, Hypersphere, Draper Dragon, and angel investors.

Kelp DAO plans to extend its liquid restaking services to other blockchain ecosystems, including Solana and Bitcoin, in addition to its existing offerings on Ethereum and various L2 networks.