MicroStrategy Buys More Bitcoin

Despite recent market trepidation, the institutional heavyweight has added thousands of Bitcoin to its balance sheets.

Key Takeaways

- MicroStrategy purchased 7,002 Bitcoin between Oct. 1 and Nov. 29.

- The announcement coincides with a rebound in BTC price.

- Still, the flagship cryptocurrency has many hurdles ahead to overcome.

Share this article

MicroStrategy continues adding more Bitcoin to its holdings after the pioneer cryptocurrency saw its price plummet from a record high of about $69,000 to as low as $54,000.

MicroStrategy Increases Holdings

Michael Saylor’s MicroStrategy has added another 7,002 Bitcoin to its already substantial holdings.

In a regulatory filing, the Virginia-based data analytics firm disclosed it bought roughly 7,002 BTC at an average price of $59,187 per token between Oct. 1 and Nov. 29. MicroStrategy allocated approximately $414.4 million to its recent Bitcoin purchase. The funds were raised through the sale of 571,000 MSTR shares previously disclosed in June.

To date, the company has acquired 121,044 Bitcoin at an average price of $29,534. MicroStrategy has spent $3.6 billion to grow its holdings, becoming the largest corporate holder of BTC in the world.

The announcement comes at a crucial time as the pioneer cryptocurrency is down nearly 18% from an all-time high of about $69,000 set earlier this month. The downward price action has created a state of “fear” among market participants.

Still, MicroStrategy could bring confidence into the crypto markets as it joins El Salvador and SkyBridge Capital in buying the dip.

Bitcoin Finds Stable Support

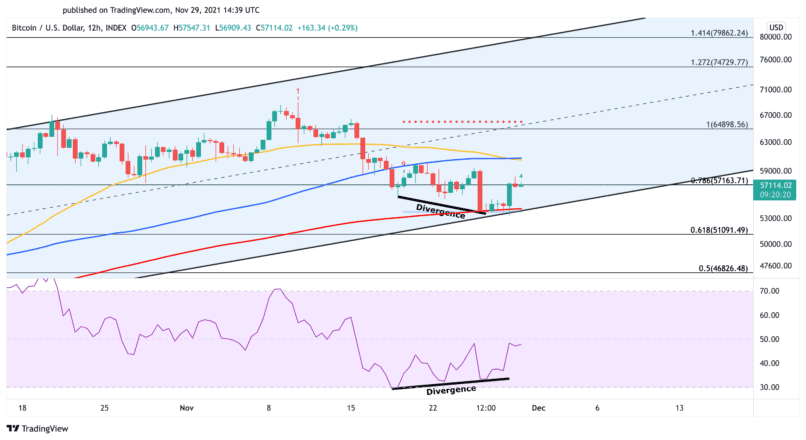

From a technical perspective, it appears that Bitcoin found a strong foothold around the 200-twelve-hour moving average at $54,000 and the lower boundary of a parallel channel where prices have been contained since mid-June. Such a significant demand barrier alongside the formation of bullish divergence on the 12-hour chart might have helped BTC partially recover.

As the pioneer cryptocurrency attempts to reclaim $57,000 as support, it must overcome a few hurdles to advance higher. Bitcoin would need to break through the 50-twelve-hour moving average at $60,000 to march towards $65,000. Only a 12-hour candlestick close above this resistance level can propel BTC towards a new all-time high at $75,000.

It is worth noting that Bitcoin must hold above $54,000 to be able to validate the optimistic outlook. Any signs of weakness around such a critical support level could encourage traders to exit their long positions. If this were to happen, BTC could drop to $51,000 or even $47,000.

Disclosure: At the time of writing, the author of this feature owned BTC and ETH.

Share this article