Nexo evolves into a premier digital assets wealth platform

Nexo's transformation highlights the growing convergence of traditional finance and digital assets, setting a new standard for wealth management.

In a strategic move that mirrors the broader maturation of the digital assets industry, Nexo has grown beyond its 2018 origins to become a comprehensive digital assets wealth platform.

This evolution comes at a crucial time when traditional finance and digital assets are increasingly converging, placing Nexo at the intersection of two powerful financial currents.

With over $8 billion in credit issued, $1+ billion in interest paid, and zero security breaches since inception, Nexo’s track record speaks for itself.

The crypto market’s evolution beyond pure speculation has created a sophisticated investor base seeking institutional-grade services. Nexo’s transformation directly addresses this shift, with a service suite that rivals traditional private banking while maintaining the edge in crypto.

Redefining digital asset wealth

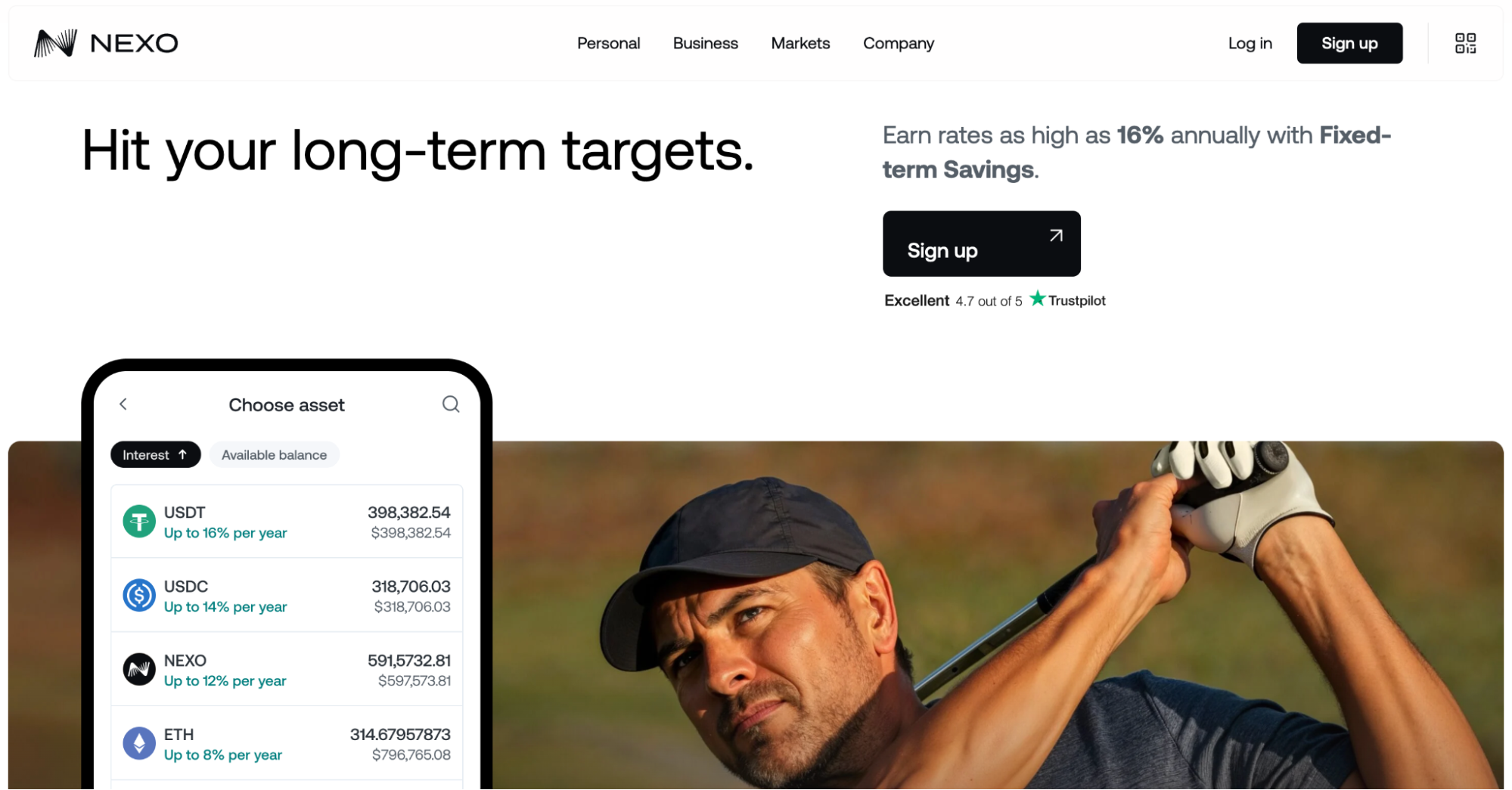

At the core of Nexo’s offering is a yield generation system that delivers up to 14% annual interest through Flexible Savings and up to 16% for Fixed-term Savings.

Operating within real market dynamics and proven risk management frameworks, the platform takes a different approach from failed services that depended on unsustainable tokenomics.

The platform’s credit solution represents perhaps its most significant innovation in capital efficiency. With rates starting at just 2.9% annual interest, Nexo has solved one of the biggest challenges facing long-term crypto holders: accessing liquidity without triggering taxable events.

Revolutionary payment infrastructure

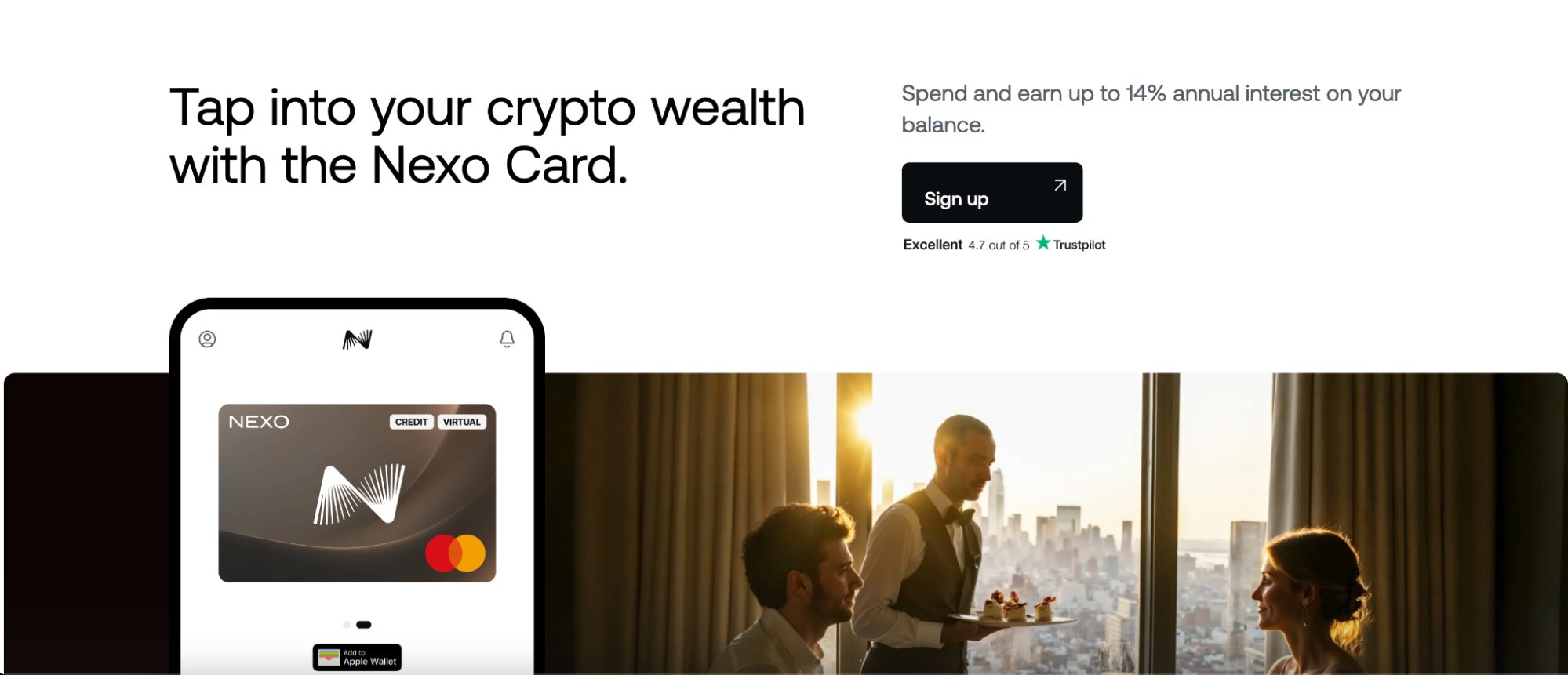

Nexo’s hybrid card system allows users to seamlessly switch between debit and credit, meaning users can maintain their crypto exposure while accessing spending power, a feature that has proven particularly attractive to sophisticated investors managing complex digital portfolios.

Sophisticated client segmentation

Nexo has implemented a comprehensive loyalty program that creates a sustainable ecosystem of engagement. The four-tier system doesn’t just rely on token incentives – a common pitfall in the industry – but integrates benefits across their entire product suite, from enhanced yield rates to preferential borrowing terms.

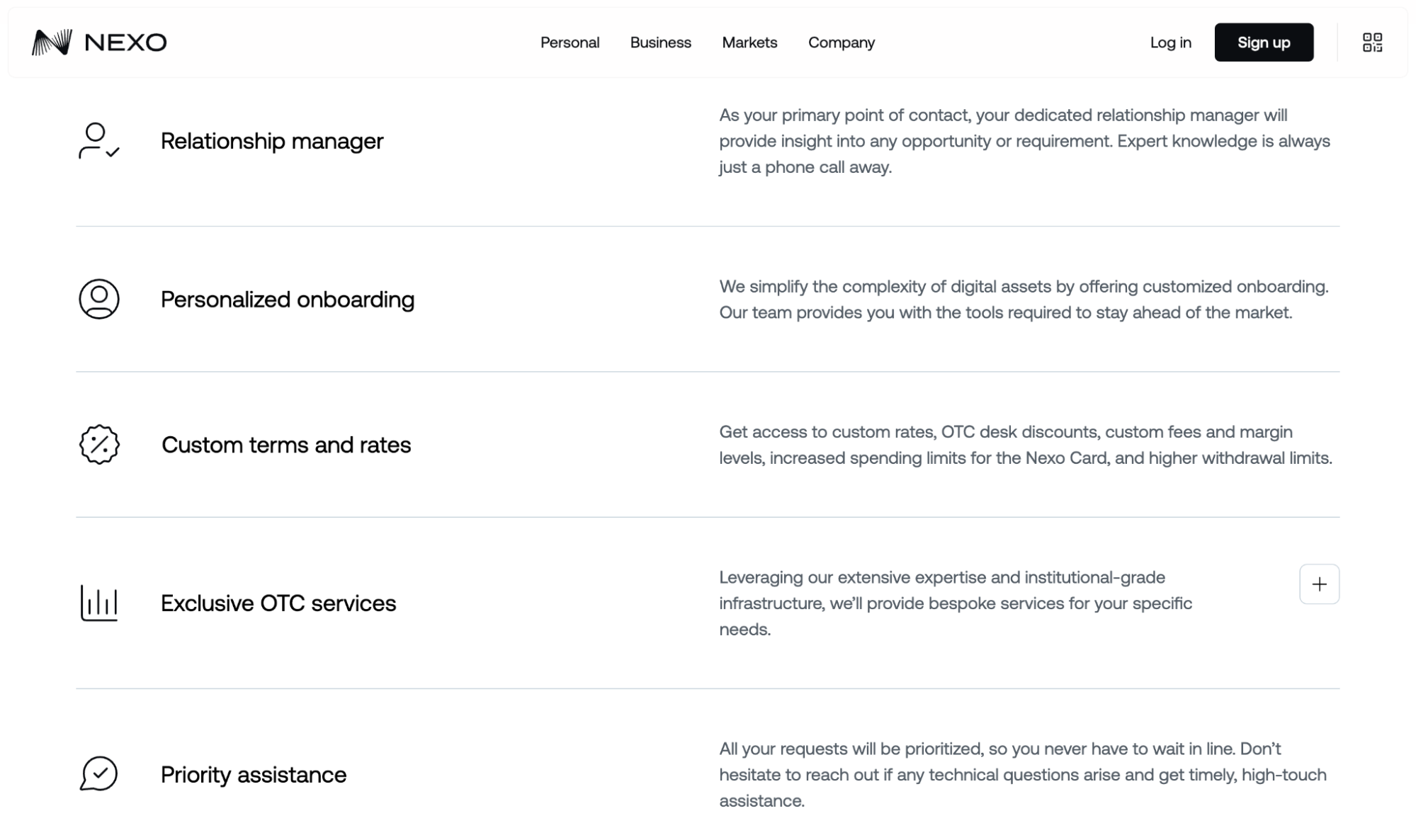

For high-net-worth clients investing over $100,000, Nexo offers a premium service tier that brings institutional-grade support to the digital asset space. This includes dedicated relationship managers, custom rates, and exclusive OTC services.

Market-leading risk management

Perhaps most impressive is Nexo’s track record through market volatility. Launching just before the 2018 crypto winter and maintaining operations through multiple market cycles, including the turbulent events of 2022, speaks to exceptional risk management.

Their Trustpilot rating of 4.7/5 further validates their operational excellence, particularly notable in an industry often marked by customer service challenges.

The future of digital assets wealth

This evolution positions Nexo as more than just another crypto platform – it sets a new standard for comprehensive digital assets solutions. By bridging traditional financial services with digital assets, they’ve created a model that could well define the next generation of wealth.

Earn with Nexo

Earn with Nexo