No No No No No Stop Saying Ripple Is Bigger Than Bitcoin

Our top 3 crazy theories: the Moon landing was fake, the Oscars are rigged, and CMC routinely understates XRP's market cap.

If you spend enough time lurking on the internet, you run into a lot of crazy theories. Cryptocurrency is a bit of a magnet for eccentricity, so it’s no coincidence that we have plenty of Moon Landing theorists and SEC Truthers in our midst.

There are cryptonauts who earnestly believe that McAfee is the LSD-fueled reincarnation of Abbie Hoffman (wait, that one’s kind of credible), that crypto prices are completely free from manipulation (that one’s harder to swallow), and our new favorite: the theory that the metrics for XRP are being consistently understated on CoinMarketCap and other sites in order to hide the token’s true value.

This theory tends to resurface every few months, especially when XRP is doing particularly well:

https://twitter.com/MyXrp589/status/1067934272542130177

Here’s the reasoning. There are 100 billion XRP, created in Ripple’s Genesis block, each of which has a market price of $0.3513, for a combined value of $35bn and change. CoinMarketCap only counts the XRP which are currently circulated among the public, for a reported market cap of only $14bn.

On the other hand, each of the 17.4 million bitcoins is worth $3,881, for a combined value of $67.5bn.

What makes this really interesting is that, at the height of last year’s dizzying bubble, XRP would have actually had a higher market capitalization than Bitcoin, at least under the more generous metric.

This in turn has sprouted a whole series of offshoot theories, to the effect that leading crypto trackers—like CoinMarketCap— are conspiring to keep the XRP token down, either by miscalculating the true value or excluding South Korean Markets, where XRP has a larger slice of the pie.

RippleCoinNews (which must have missed the memo about calling it XRP) recently revived the non-story, with the headline: “XRP Fans Think CoinMarketCap Is Manipulating The Market, Demand Fair Calculations.”

Regardless of what you think of Ripple, it’s hard not to smile at the thought of poor bankers and corporate financiers being oppressed by The Man.

The fallacy, as you’ve probably figured out, is that most of those tokens are locked in escrow and are considered unusable. If these tokens were publicly available, they could not be easily sold without tanking the price.

It’s not the only legitimate way to calculate market capitalization. Yahoo! Finance, for example, does include escrowed tokens in its calculations, giving XRP a cumulative value of $34.8 billion. And here it is from the Ripple’s Mouth:

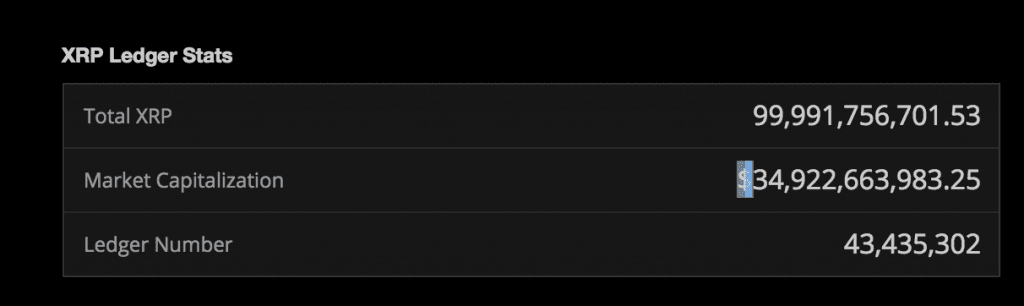

XRP Charts, a live dashboard of the XRP Ledger, shows the token’s market capitalization at a stately $34.9 billion, with a few points lost from coin burns.

They have a few good points there—CMC doesn’t include the XRP which Ripple has locked in escrow (around 60 billion) but it does include up to 3.8 million lost Bitcoins, as well as the 1.1 million reportedly held in escrow by Craig Wright. Taking these into account would trim Bitcoin’s market capitalization down to around $45bn.

But the bigger lesson—one that we’ve repeatedly harped on—is that market capitalization is an inadequate metric for the value of cryptocurrencies, whether they are calculated generously or not. These calculations assume that each token can be sold at the most recent public price, ignoring the fact that crypto markets lack meaningful depth. Any large trade, if public, could trigger a sell-off –as may have been the case last month.

Moreover, unlike stocks, the value of a currency depends on its use: HODLing might be better for the price in the short term, but it doesn’t facilitate adoption and circulation in the same way that spending and using them does.

The truth is that value, like beauty, is more than skin deep.

Arguments may now be started in our Telegram group.

The author owns both XRP and Bitcoin, which are mentioned in this article.

Earn with Nexo

Earn with Nexo