Shutterstock cover by Vladimir Kazakov

Polygon’s MATIC Token Breaks Out Targeting $2.60

Polygon’s MATIC token appears ready to resume its uptrend as it faces little to no opposition ahead.

Polygon’s MATIC token prepares to revisit previous all-time highs after breaking out of a bullish continuation pattern.

MATIC Retraces Before Skyrocketing

Polygon’s MATIC token has broken out of an inverse head-and-shoulders formation that has been developing since early July on its daily chart. After moving past the pattern’s neckline at $1.63, the altcoin surged by more than 10% to hit a high of $1.80.

A further increase in buying pressure around the current price levels could push MATIC’s price by another 46% towards $2.64. This target is determined by measuring the inverse head-and-shoulders’ widest range and adding that distance upward from the breakout point.

While the odds seem to favor the bulls, it is imperative to note that assets breaking out of inverse head-and-shoulders patterns tend to retest the neckline or breakout point before advancing further. Such downswings help shake out some of the so-called “weak hands” and provide an opportunity for side-lined investors to re-enter the market.

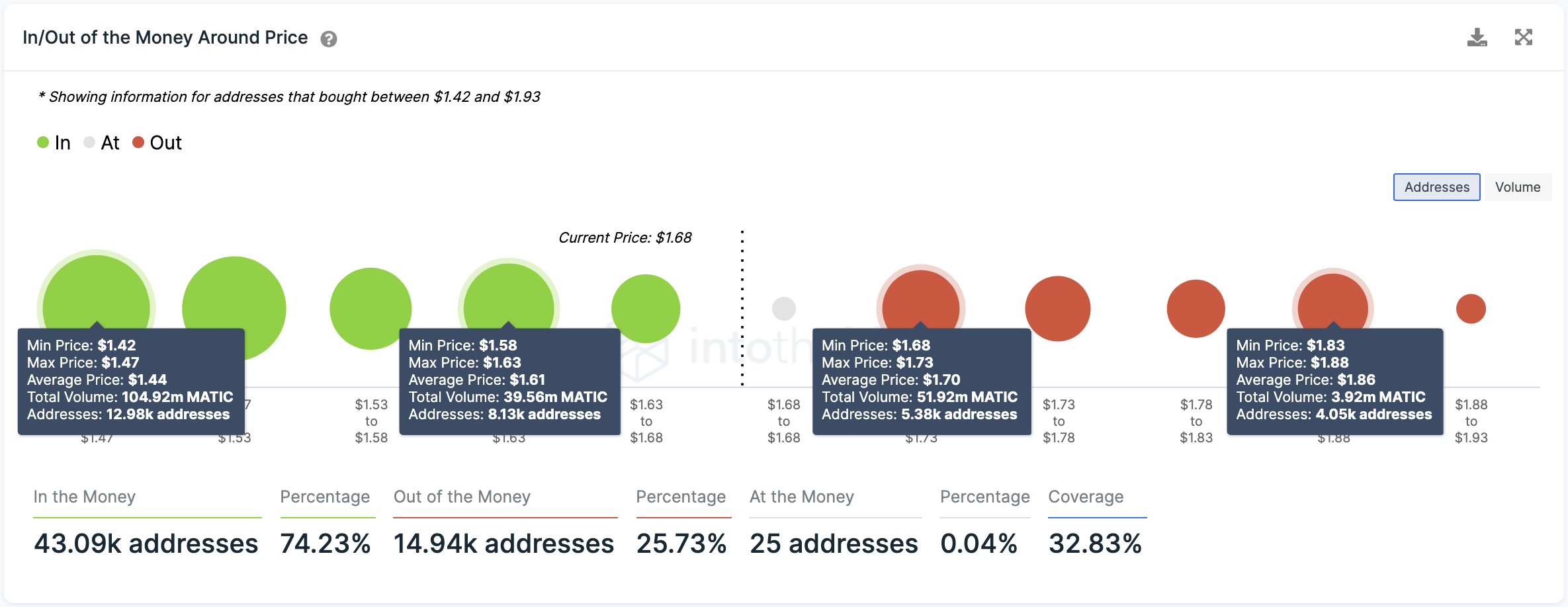

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that in the event of a downswing, the $1.58-$1.63 demand barrier would likely keep Polygon’s prices at bay. Here, more than 8,130 addresses had previously purchased nearly 40 million MATIC.

Given the significant interest around the $1.61 support level, token holders would likely do anything to prevent their investments from going out of the money. They may even buy more tokens allowing prices to rebound and reach the head-and-shoulders’ target of $2.63.

It is worth noting that there are a few obstacles that Polygon would have to overcome to achieve its upside potential. Based on the IOMAP cohorts, the most crucial supply barrier sits at $1.70, where 5,380 addresses hold roughly 52 million MATIC.

Once this resistance level is breached, the next critical wall lies between $1.83 and $1.88 as 4,000 addresses bought 3.90 million MATIC around this price point.