Polygon Rallies as Whales Go Into Buying Spree

MATIC looks primed for further upside as buy orders pile up.

Key Takeaways

- MATIC is up more than 20% in the last 24 hours.

- Buying pressure continues rising despite the recent gains.

- Polygon may be targeting $1.83 as it faces no resistance ahead.

Share this article

Polygon’s native token MATIC appears to have entered a new uptrend fueled by whales that have been accumulating tokens at a discount.

MATIC Targets Higher Highs

Polygon’s MATIC token is soaring.

Behavior analytics platform Santiment reveals that demand for Polygon is accelerating quickly. Based on the token’s supply distribution, the number of addresses with 100,000 to 10,000,000 MATIC has surged by nearly 9.34% in the last few weeks.

Roughly 67 whales have joined the Polygon network since Jul. 20.

The growing number of large investors backing the distributed ledger startup may seem insignificant at first glance. Still, when considering these whales hold between $135,000 and $13.5 million in MATIC, the sudden spike in buying pressure is substantial.

Prices have shot up as buy orders increase. Over the last 24 hours alone, MATIC has risen by more than 20%, with plenty of room to go further up.

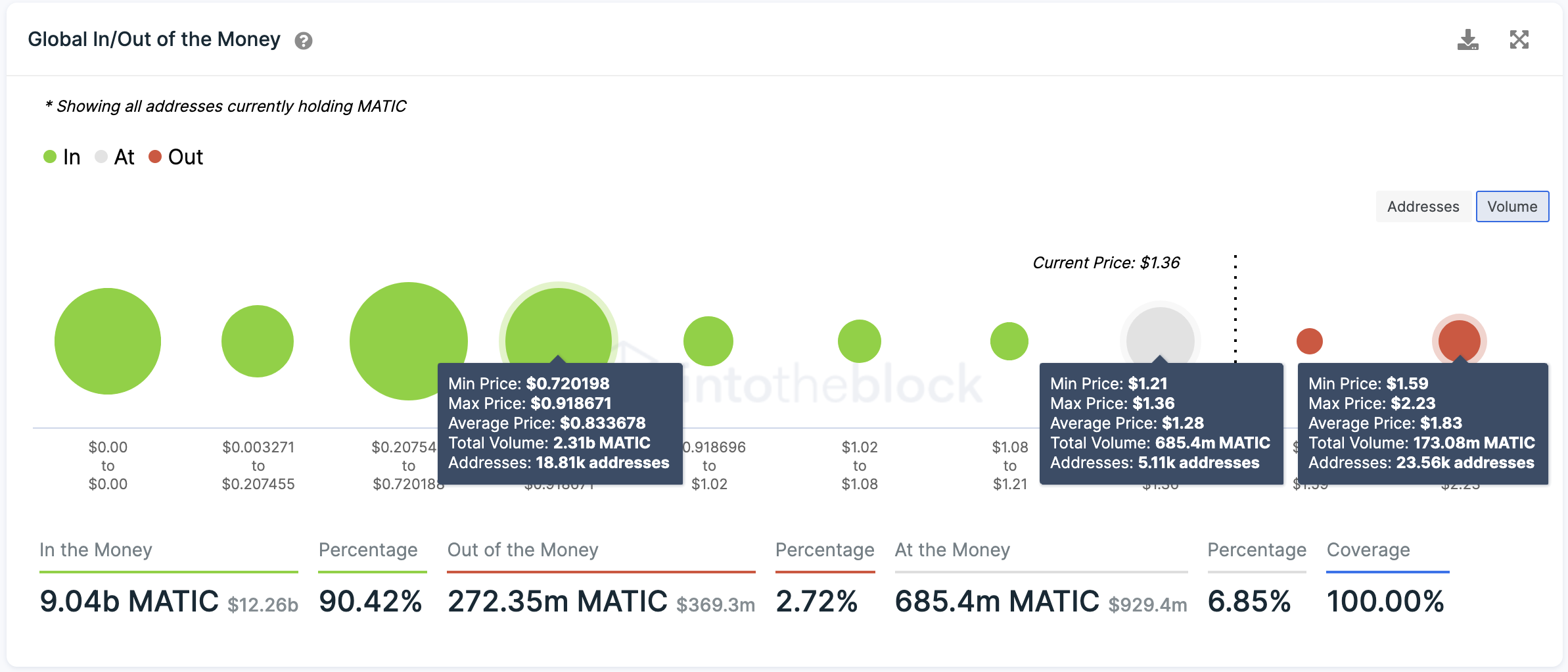

Transaction history shows that the only significant supply barrier ahead of Polygon sits at $1.83. Around this price level, more than 23,500 addresses have previously purchased 173 million MATIC.

IntoTheBlock’s Global In/Out of the Money (GIOM) model also reveals that Polygon sits on top of a vital demand barrier. More than 5,000 addresses bought over 685,000 MATIC between $1.21 and $1.36.

As long as this support wall holds, the eighteenth-largest cryptocurrency by market cap looks poised to continue its uptrend. However, in the event of a breach of the $1.21 to $1.36 barrier, investors should expect a downswing to the next critical demand zone at around $0.83.

Share this article